Ah, the sweet sound of market stagnation – nothing like a little volatility compression to keep traders on their toes. Despite some minor blips in the short-term, the asset has managed to keep its cool with a lovely consolidative structure, showing us the narrowing bands of volatility. Clearly, the stage is set for something dramatic – a breakout? A breakdown? Who knows, but we can feel the tension building. 😏

Dogwifhat Price Analysis Highlights Critical Breakout Level at $0.52

Oh, and here’s our friendly analyst CW (@CW8900) dropping wisdom on X, pointing out that the $0.52 level is the key, where a beautiful, dense sell wall is standing tall like a fortress. CW suggests that if we get a solid breakout above this wall, we could see Dogwifhat flying toward $0.61. A return to glory! 🚀

The chart CW shared gives us some hope with a pattern of accumulation followed by an upward trend, respecting those higher lows. But hold on, it’s not all sunshine and rainbows-if we can’t break that $0.52 resistance, we’re probably looking at a rejection back to the $0.45-$0.47 support region. So, it’s either ascend to the heavens or back to the abyss, folks. And let’s not forget the steady volume coming from both spot and derivatives markets, keeping the hope alive. 📉📈

Moderate Volatility as Market Awaits Direction

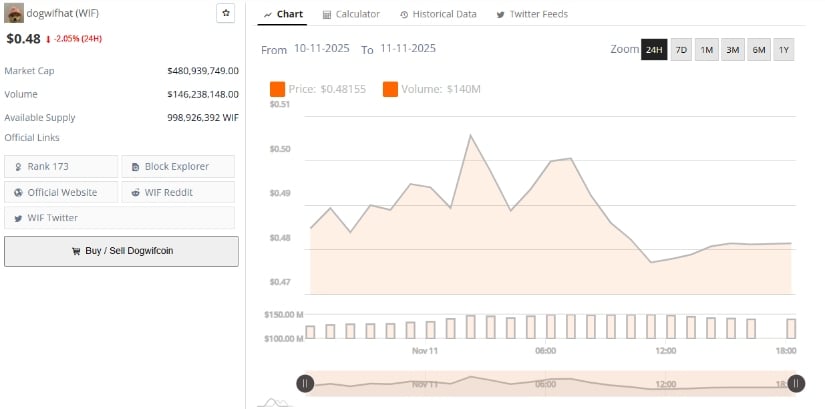

BraveNewCoin puts Dogwifhat at $0.48, down 2.05% in the last 24 hours-hey, at least it’s not a complete disaster. With a market cap of $480.9 million and daily trading volume of $146.2 million, it holds a rank of #173. Not exactly a star in the crypto sky, but hey, it’s still in the game. 🚶♀️

The data clearly shows that while sentiment is a bit underwhelming in the short term, liquidity is holding steady. Traders are playing it safe, stuck in a waiting game as they nervously glance at the charts. Will they make a move? Or will they stay glued to the sidelines, unsure of which way the wind is blowing? ⚖️

And, of course, the real magic happens when volume spikes. One big move could send this thing soaring or crashing, and either outcome will validate or destroy the current consolidation. The suspense is killing us. 🙃

Consolidation Below Mid-Band Resistance

According to TradingView, the WIF/USDT pair is hanging out around $0.481, just below the Bollinger Band basis at $0.501. It’s in that delightful zone of bearish-to-neutral momentum. The upper and lower Bollinger Bands are at $0.593 and $0.409, respectively-so, yeah, not much room to dance. It’s all very tight, very cozy, almost too comfortable. 😌

The Relative Strength Index (RSI) sits at 44.28, with its moving average hanging around 40.48. So, we’re neither too hot nor too cold-just a nice, lukewarm range. Historically, RSI has stayed below 60 since midyear, which means not much bullish heat to get excited about. Still, it’s not oversold, so we’re not diving off a cliff either. The analysts say if we break above $0.50 and the RSI starts ticking up, we might just get some bullish energy. But a slip below $0.41? Oh boy, get ready for some downward pressure and a potential return to the bears’ lair. 🐻

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-11-12 03:06