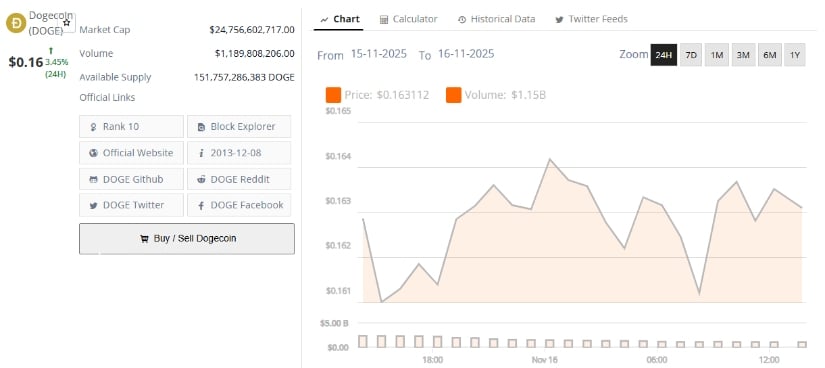

And thus, on the 16th of November, 2025, the digital coin Dogecoin, that most enigmatic of assets, hovers at the paltry sum of 0.16 dollars, its daily volume ascending as if in some desperate attempt to grasp the fleeting specter of prosperity. Yet, amidst the clamor of speculation, whispers of a $3.60 surge echo like the hollow promises of a beggar, while the cold, unyielding gaze of technical indicators and historical patterns stares back, unimpressed. Investors, those weary souls navigating the tempest of cryptocurrency, now fixate on the veritable pillars of trend, support, and resistance, seeking solace in the chaos, their hearts heavy with the burden of responsibility. 🐕💸🧠

The Dogecoin Price, That Most Fickle of Companions, Finds Temporary Refuge Above the Crucial Support Levels

Recent market charts, those cryptic scrolls of financial prophecy, reveal Dogecoin has clung to support above $0.164, reclaiming a previously descending trendline that may hint at the nascent stages of a bullish reversal. A miracle? Or merely the trick of the light? 🤔

Shan Specter, that sage of the crypto realm, proclaims: “DOGE could ascend to $1 if the winds of sustained interest and community fervor continue to blow. Yet, the specter of short-term fluctuations looms, and the critical support levels around $0.16 remain the lifeline of stability.” How quaint, that a mere 16 cents could be the fulcrum upon which the fate of a digital empire balances. 🐕🧠

Technical tools, those steadfast sentinels of analysis, corroborate this cautious outlook. A bullish Relative Strength Index (RSI) divergence-where DOGE price forms lower lows while RSI forms higher lows-signals reduced selling pressure and potential accumulation. The Gaussian Channel (3-day) whispers that dips below the lower band historically herald recoveries, though a confirmed upward surge demands a breakout above $0.168. To fail in this endeavor would invite a swift descent toward the abyss of liquidity zones. 📉

The Dogecoin Community, That Ever-Chaotic Congregation of Optimists and Skeptics, Remains Divided

The Dogecoin community, that ever-chaotic congregation of optimists and skeptics, remains divided. The optimists, those blessed with an almost divine faith, cite historical endorsements and platform integrations as omens of bullish triumph. The skeptics, those grim realists, caution that the $3.60 target is a mirage, a fleeting illusion conjured by the fevered minds of the desperate. 🤯

Retail activity, that fickle force of short-term volatility, continues to drive the market’s pendulum. Data from CoinGecko, that arbiter of truth, reveals trading volume often spikes in tandem with social media trends, illustrating how sentiment can generate rapid but transient price swings. Analysts, those weary prophets of the market, emphasize that recognizing this interplay between social engagement and technical fundamentals is crucial for responsible trading. 🕵️♂️

The Risks, That Ever-Looming Shadow, Remain Looming

Despite the faint glimmer of hope, the specter of risk looms large. Ali Charts, that arbiter of crypto wisdom, warns that support below $0.16 is as thin as a beggar’s cloak, with a liquidity gap stretching toward $0.073. To lose this fragile thread would invite a swift and merciless descent. Moreover, Dogecoin’s price, that fickle companion, often mirrors the broader cryptocurrency tides, especially Bitcoin‘s performance, for the masses of retail traders, those humble servants of the market, dictate its course. 🐕📉

Investors must consider macro factors-such as BTC price movements, global market sentiment, and potential regulatory shifts-when evaluating DOGE risk. Technical signals are conditional and cannot guarantee outcomes; all projections should be treated as probabilistic, not definitive. A reminder, perhaps, that in the realm of finance, as in life, certainty is a myth. 🧠

The Outlook for Dogecoin Price in 2025, That Most Speculative of Years

For the remainder of 2025, the analysts, those wise sages of the financial realm, counsel focusing on the tangible, the technical, and the market fundamentals, rather than the sensationalized price targets that dance like phantoms in the night. Short-term resistance near $0.18, that fragile line of hope, aligns with recovery trends, while the $3.60 dream remains a distant star, visible only to the most delusional of dreamers. 🌟

Key factors to monitor in the next 1-2 weeks include:

Support levels: Holding $0.16 is crucial to prevent sharp corrections. A test of faith, perhaps?

Trading volume: Sustained buying interest can validate recovery patterns. Or it could be a mirage.

Community sentiment: Positive engagement may influence short-term momentum but remains volatile. As fickle as a politician’s promise. 🐕

Final Thoughts: A Reflection on the Human Condition and the Market

Dogecoin continues to generate market attention, but its trajectory is best understood through a combination of technical analysis, trading activity, and market fundamentals. Informed strategies and risk management remain essential when navigating this highly speculative, sentiment-driven cryptocurrency. May the reader, in their quest for fortune, remember that in the world of finance, as in life, the path is fraught with peril, and the only certainty is uncertainty itself. 🐕💸🧠

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- World Eternal Online promo codes and how to use them (September 2025)

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-11-17 00:12