Welcome to today’s episode of “Bitcoin: Can You Not?” starring yet another crypto analyst muttering sweet nothings about support levels. Apparently, Bitcoin is in a mood. Again.

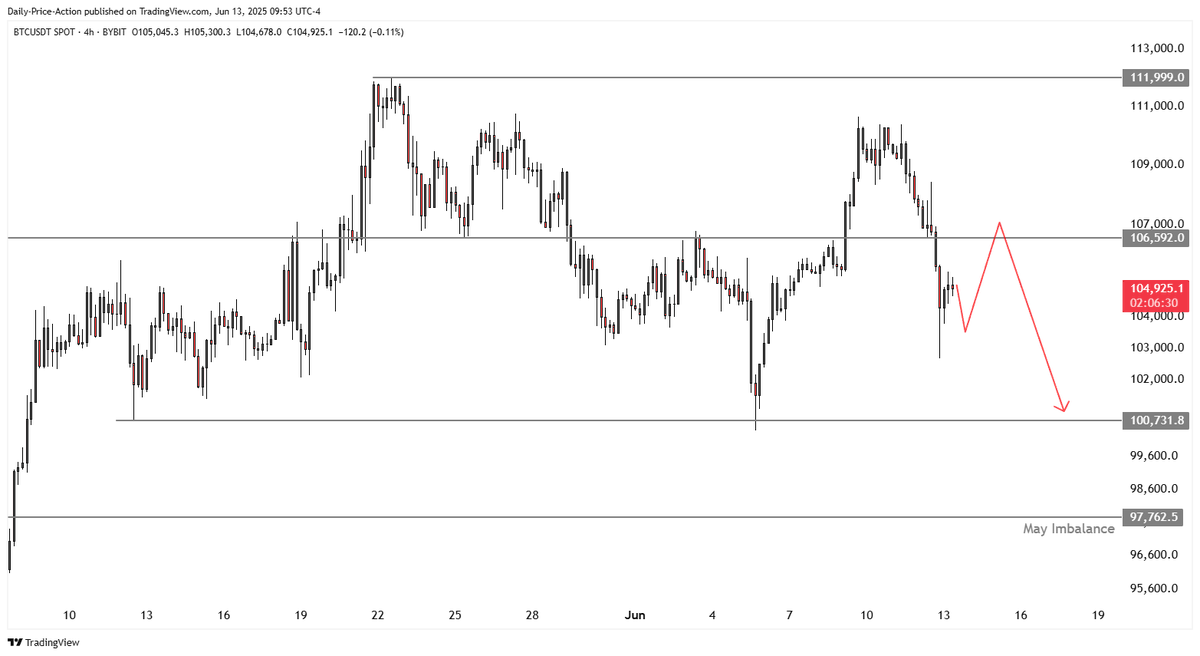

Justin Bennett, who has the kind of Twitter following that would absolutely get him free drinks in certain London bars, has announced to 116,000 expectant souls that BTC may “revisit the lower end of its range” a.k.a. flop embarrassingly in front of the whole playground. $100,000. Yes, that one. Not a typo. 🙃

“Here’s your Friday night entertainment: BTC whiffs at $106,600, does some emotionally-fraught consolidating (we’ve all been there), then lets weekend retailers talk themselves back into it around $106k–$107k, before slipping on a banana peel down to $100k. The only time I’d buy is if I desperately needed adrenaline. Short or nothing, darling.”

And just when you thought you were safe, enter: the Whales. They’re dumping longs like last season’s fast fashion and betting on shorts. Retail is getting played harder than my gran at bingo.

“Thursday was basically Whales Gone Wild. Retail tried to start a trend, Whales said ‘LOL, nice try’ and dumped. Scam city.”

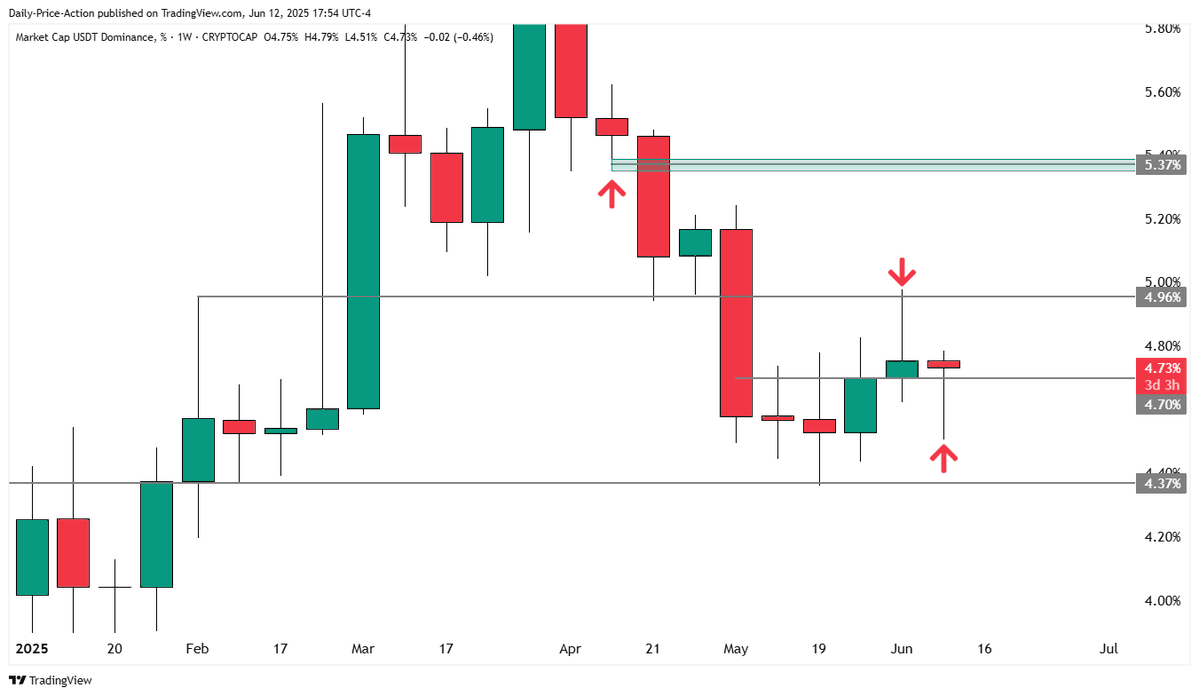

But wait—someone mentioned USDT.D and now things are getting spicier! This chart allegedly signals a Bitcoin mood swing every time traders get cold feet and go hunting for the trusty (read: extremely boring) stablecoin. More USDT.D means more side-eye for BTC.

“Look, I’m not saying it’s happening, but the weekly chart is giving that ‘I might start drama’ vibe. If USDT.D pops to 5%, expect BTC and ETH to imitate me after I check my bank account post-vacation: down, fast.”

BTC is currently at $105,658, down 1.6% in the past 24 hours—which is more or less how I feel at the end of a workweek. Meanwhile, USDT.D is bopping around at 4.79%, just loitering ominously. Watch this space, or don’t. BTC will do whatever it wants, anyway. 💅🪙

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-06-13 21:22