Oh, how the crypto market dances to the whims of central bankers! Bitcoin, ever the showman, leapt to multi-week highs, while altcoins, in their usual fashion, followed with the grace of a well-dressed parrot 🦜. A spectacle of speculative glee, if ever there was one.

“We see a labor market that’s softening and wage growth that is moderating, so you’re really not going to see a lot of pressure coming on the cost side of labor. We don’t want to make the mistake of holding on too long for rates only to find out we’ve injured the economy.”

Her statement came as odds that the Federal Reserve will cut interest rates in December jumped to 73% on Polymarket. A number so precise, it’s almost as if they’ve calculated the exact moment to crash the party 🕺.

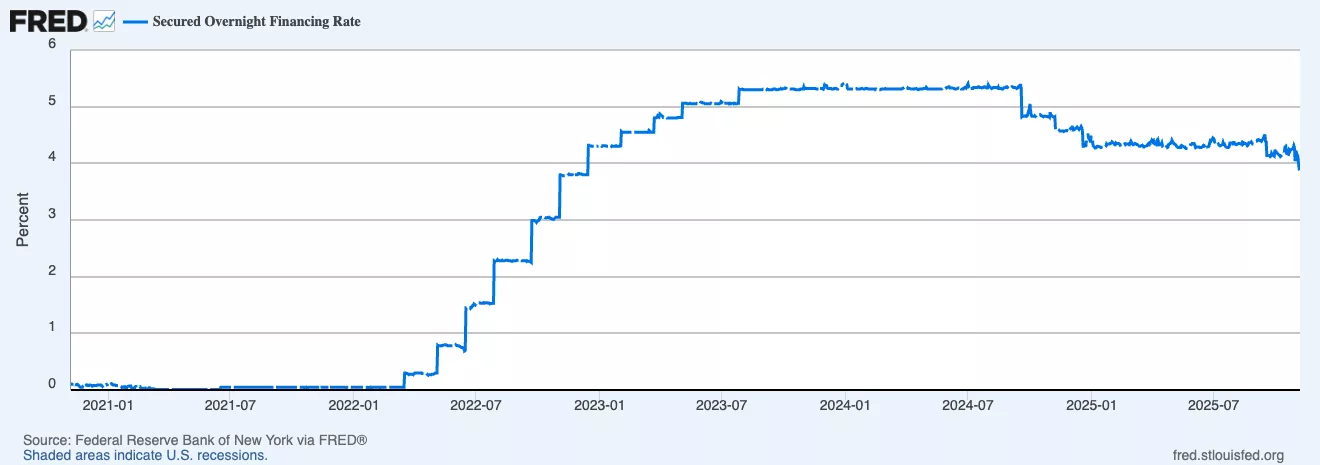

Most importantly, the closely-watched Secured Overnight Financing Rate, commonly known as SOFR tumbled to the lowest level since 2022. SOFR is a rate used by banks and other companies to access financing from the Federal Reserve in the overnight market. A rate so low, it’s practically a financial ghost story 👻.

The falling SOFR rate, coupled with the proposed $2,000 stimulus check, means that risky assets like cryptocurrencies and stocks may bounce back as liquidity rises. One can only hope the stimulus is as effective as a magician’s trick-sudden, surprising, and utterly unreliable 🎩🐇.

Beware of a dead-cat bounce

Still, there is an elevated risk that the ongoing crypto market recovery is part of a dead-cat bounce, a common scenario as of late. A dead-cat bounce, my dear reader, is when an asset in free fall briefly bounces back, only to resume its descent with the elegance of a drunk flamingo 🦩.

A dead-cat bounce is a situation where an asset in a free fall bounces back briefly and then resumes the downtrend. It is often called a bull trap because it usually attracts inexperienced retail investors. A trap so cunning, it makes a fox look like a novice 🐺.

One warning that this could be a dead-cat bounce is that the Crypto Fear and Greed Index remains in the fear zone of 29. A number so low, it’s practically a cry for help 😭.

Another is that Bitcoin and most altcoins remain below their short- and long-term moving averages and the Supertrend indicators, a sign that bears are still in control. A bear market, if you will, with a penchant for dramatic exits 🐻.

Therefore, a clear crypto bull run will likely be confirmed once the Fear and Greed Index moves into the greed zone and momentum pushes assets above the short- and long-term moving averages. Until then, we shall all remain in a state of hopeful suspense 🤞.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-11-10 21:59