Lido’s token (LDO) shot up 7% to $1.30 on Thursday, continuing a 20% rally that’s got traders high-fiving like they just invented fire. 🕺 The spike? Blame (or thank) asset manager VanEck, which dropped a *bombshell* filing for a stETH ETF in Delaware-the Delaware of ETFs, apparently. 🏛️💸

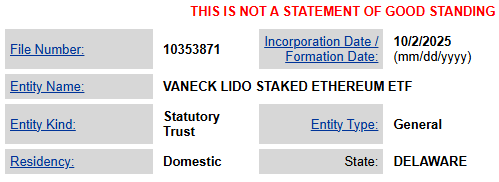

The October 2 filing? It’s basically VanEck shouting, “We’re not just crypto tourists! We’re here to *yield*!” 🗣️ While approval’s about as certain as a weather forecast in a hurricane, it’s enough to make staking enthusiasts scream, “Liquid staking’s back, baby!” (Even though it never left. ???)

Trading volume? Up 29% to $168.5M. Derivatives volume? +45% to $426.9M. Open interest? +6.6%. Traders are practically humping the legs of their desks in excitement. 📈😅

This ETF would let investors earn ~4% APY staking ETH without the hassle of… *actually doing anything*. Because who doesn’t want free money that’s not really free and probably taxable? 🧾 Lido already lords over 24% of ETH staking, so they’re basically the Zuck of decentralized finance. 👑

Buybacks? More Like Cry-Me-A-Riverbacks

Lido DAO, in a rare moment of decisiveness, approved a buyback program using stETH and stablecoins. Because nothing says “confidence” like burning tokens while crossing your fingers the rug doesn’t get pulled. 🤞 Long-term plans include “integrating with Layer-2 networks” (buzzword bingo!) and decentralizing validators. Groundbreaking.

Analysts at CoinCodex predict LDO could hit $1.34-$1.75 this month. By year-end? $2-$3! 🚀 Unless, y’know, regulators show up late to the party like they always do. Spoilers: They will.

Bottom line? VanEck’s filing is crypto’s latest plot twist in The Great Staking Bake-Off™. Lido’s the star, investors are the confused judges, and the prize is… tax evasion? 🏆

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

2025-10-03 11:05