What to know:

By Omkar Godbole, the chronicler of digital folly (All times ET, naturally)

Ah, Bitcoin, that fickle darling of the crypto ball, has rebounded to nearly $90,000, as if Sunday’s drop were but a fleeting indiscretion. The broader market, ever the wallflower, remains largely unchanged, save for the RAIN token, which has dared to add 6%-a scandalous flourish in this sea of mediocrity. 🌧️✨

BTC‘s recovery mirrors the 0.5% gains in futures tied to the S&P 500 and Nasdaq, while the dollar continues its sullen retreat. “Price action is compressed,” quoth Timothy Misir, head of research at BRN, in an email dripping with ennui. “Volatility is present, but conviction is not. This remains a market waiting for a catalyst-or perhaps a clown car to complete the spectacle.” 🤡🚗

Catalysts abound this week, like guests at a party no one truly wanted to attend: U.S. retail sales, jobs data, inflation reports, and a parade of Fed speakers. The Bank of Japan, ever the wallflower, is expected to raise rates by 25 basis points. “Any upside surprise risks reinforcing the ‘hawkish cut’ narrative,” Misir noted, “while softer data could reopen the door for risk assets. For crypto, macro sensitivity remains elevated-or, as I like to say, it’s still wearing its emotional support socks.” 🧦💔

Market sentiment has turned fearful, according to the Crypto Fear & Greed Index, a barometer of collective hysteria. Nearly $300 million in leveraged bets were wiped out over 24 hours, mostly longs-a massacre of optimism. Yet bears, those dour creatures, also feel emboldened. The MOVE index suggests renewed bullishness, but market swoons, like uninvited in-laws, usually accompany heightened volatility in Treasury notes. 📉🐻

In other news, BTC’s hash rate fell 8% to 1,200 EH/s, a decline Nano Labs’ founder, Kong Jianping, linked to the closure of mining farms in Xinjiang, China. The SEC, ever the party pooper, released a wallet and custody investor guide, warning against rehypothecation and commingling assets-because nothing says “fun” like regulatory caution. 📚⚖️

In traditional markets, gold extended its gains, while analysts warn the downside in the Dollar Index looks limited. Stay alert, or don’t-what’s another missed opportunity? 🌟💤

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead,” if you must. 🗓️🤓

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead,” if you must. 🗓️🤓

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead,” if you must. 🗓️🤓

- Nothing scheduled. How utterly Wilde. 🎭🍷

Market Movements

- BTC is down 0.46% from 4 p.m. ET Friday at $89,821.87 (24hrs: -0.07%) 🤑

- ETH is up 2.47% at $3,160.25 (24hrs: +1.65%) 🚀

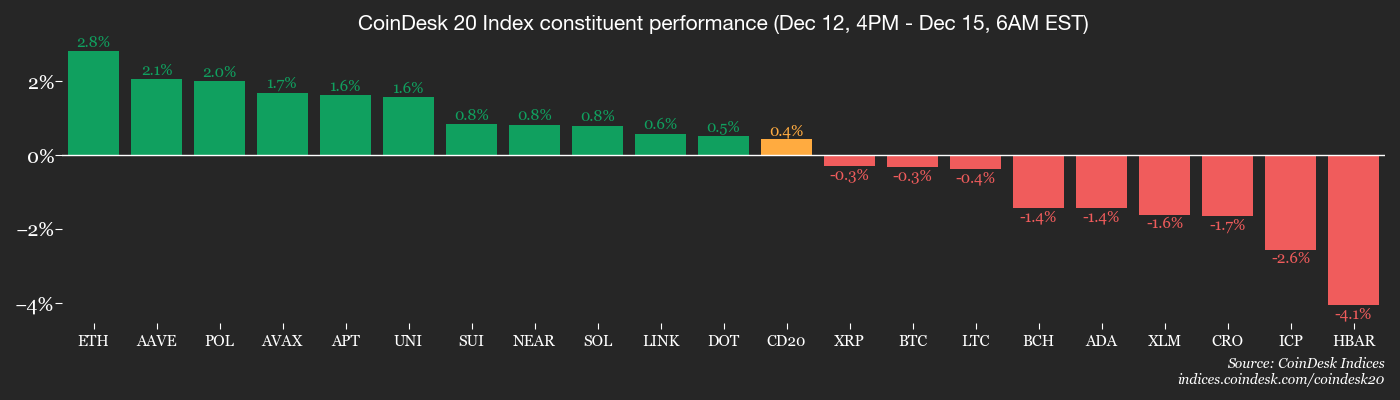

- CoinDesk 20 is up 0.3% at 2,853.05 (24hrs: +0.24%) 📈

- Ether CESR Composite Staking Rate is up 3 bps at 2.81% 📊

- BTC funding rate is at -0.0017% (-1.8407% annualized) on Binance 📉

- DXY is little changed at 98.32 🧮

- Gold futures are up 1.16% at $4,378.70 🏆

- Silver futures are up 2.78% at $63.73 ✨

- Nikkei 225 closed down 1.31% at 50,168.11 📉

- Hang Seng closed down 1.34% at 25,628.88 📉

- FTSE is up 0.83% at 9,729.49 📈

- Euro Stoxx 50 is up 0.6% at 5,754.91 📈

- DJIA closed on Friday down 0.50% at 48,458.05 📉

- S&P 500 closed down 1.07% at 6,827.41 📉

- Nasdaq Composite closed down 1.69% at 23,195.17 📉

- S&P/TSX Composite closed down 0.42% at 31,527.39 📉

- S&P 40 Latin America closed unchanged at 3,173.29 😐

- U.S. 10-Year Treasury rate is down 2.6 bps at 4.17% 📉

- E-mini S&P 500 futures are up 0.5% at 6,865.00 📈

- E-mini Nasdaq-100 futures are up 0.5% at 25,338.50 📈

- E-mini Dow Jones Industrial Average Index futures are up 0.47% at 49,090.00 📈

Bitcoin Stats

- BTC Dominance: 59.13% (+0.13%) 👑

- Ether-bitcoin ratio: 0.03516 (1.21%) ⚖️

- Hashrate (seven-day moving average): 1,064 EH/s 💻

- Hashprice (spot): $38.35 💸

- Total fees: 1.93 BTC / $172,697 💰

- CME Futures Open Interest: 124,275 BTC 📜

- BTC priced in gold: 20.6 oz. 🏅

- BTC vs gold market cap: 6.01% 📊

Technical Analysis

- The chart shows daily swings in stellar (XLM) token’s price in candlestick format-a dance of despair. 💃📉

- Prices have dived below a sideways consolidation pattern, signaling a broader downtrend represented by the descending trendline. How très tragic. 🎭

- The breakdown has shifted focus to the April low of 20 cents. Will it find a floor, or continue its plunge into the abyss? 🕳️

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $267.46 (-0.58%), +0.41% at $268.56 in pre-market 📉

- Circle (CRCL): closed at $83.47 (-5.76%), +0.97% at $84.28 📉

- Galaxy Digital (GLXY): closed at $26.75 (-10.42%), +1.23% at $27.08 📉

- Bullish (BLSH): closed at $43.54 (-4.05%), -0.18% at $43.46 📉

- MARA Holdings (MARA): closed at $11.52 (-2.7%), +0.52% at $11.58 📉

- Riot Platforms (RIOT): closed at $15.30 (-2.86%), +0.65% at $15.40 📉

- Core Scientific (CORZ): closed at $16.53 (-5%), +0.42% at $16.60 📉

- CleanSpark (CLSK): closed at $14.03 (-5.33%), unchanged in pre-market 😐

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $42.74 (-7.77%) 📉

- Exodus Movement (EXOD): closed at $15.23 (-8.2%), +1.31% at $15.43 📉

Crypto Treasury Companies

- Strategy (MSTR): closed at $176.45 (-3.74%), +0.32% at $177.02 📉

- Semler Scientific (SMLR): closed at $17.97 (-6.5%) 📉

- SharpLink Gaming (SBET): closed at $10.51 (-8.85%), +1.71% at $10.69 📉

- Upexi (UPXI): closed at $2.26 (-6.22%) 📉

- Lite Strategy (LITS): closed at $1.71 (-5.52%) 📉

ETF Flows

Spot BTC ETFs

- Daily net flows: $49.1 million 💼

- Cumulative net flows: $57.89 billion 💰

- Total BTC holdings ~1.31 million 🏦

Spot ETH ETFs

- Daily net flows: -$19.4 million 📉

- Cumulative net flows: $13.11 billion 📊

- Total ETH holdings ~6.32 million 🏦

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-12-15 16:08