On this fateful day, the fifth of February, in a manner befitting an opera of tragedy, bitcoin, that capricious creature of digital fortune, plummeted by an astonishing 7% within a single day, breaking through the once-fragrant threshold of $66,000 and landing at a rather dismal $65,253 on Bitstamp. This harrowing descent has ignited a delightful cocktail of anxiety amongst investors, who are now wringing their hands over the possibility of a retreat to the murky depths of $60,000-a fate previously dismissed as ludicrous, but now looming ominously ahead.

The Market’s Grim Dance and Liquidations

The bitcoin debacle reached new heights of absurdity on this very day, as the flagship of digital currencies dared to breach the delicate psychological barrier of $66,000, trapped in a tempest of frantic selling. The market data tells a tale of volatile calamity, with a plunge of 7%, sending prices spiraling downwards to the tragic low of $65,253 by midday. This precipitous drop has rekindled the bearish sentiment, with participants whispering sweet nothings of doom, now convinced that a fall to the $60,000 territory-a notion once laughed at-is indeed a very real possibility.

This latest leg of despair has pushed bitcoin’s weekly losses beyond a staggering 20%, representing a disheartening 30% correction since that glorious peak in mid-January when dreams flirted with $98,000. The carnage has dragged bitcoin’s market capitalization down to a mere $1.34 trillion, causing the entire crypto economy to tumble to a paltry $2.36 trillion.

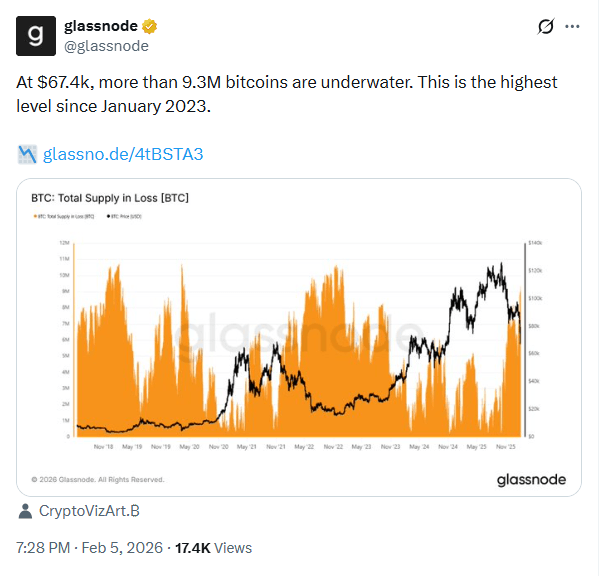

The swiftness of this market collapse incited a massive long squeeze, resulting in a veritable bonanza of over $1.4 billion in liquidations across leveraged positions, all occurring within the brief span of 24 hours. Bitcoin-specific liquidations alone exceeded $714 million, with overleveraged long bets accounting for a comically disproportionate $630 million of the wipeout. According to Glassnode, the breach of the $67,400 mark has plunged 9.3 million BTC into “underwater” status-meaning a significant portion of the circulating supply is now held at a loss-the highest concentration of unrealized losses since the market lows of January 2023.

While the initial downward spiral was instigated by the brewing geopolitical tensions and the nomination of Kevin Warsh as chair of the Federal Reserve, the malaise festering in the tech sector further exacerbated the sell-off. The Nasdaq, in a theatrical display of despair, surrendered 280 points, or 1.26%, during the session, following a prior rout of 500 points, as lackluster earnings from tech titans left investors with a sour taste reminiscent of stale bread.

Bitcoin’s tightening correlation with the Nasdaq Composite-juxtaposed against its curious decoupling from safe-haven assets like gold-suggests a grandiose capital rotation, as investors, like rabbits fleeing a fire, abandon speculative risk-on assets in favor of defensive postures that would make any sensible investor chuckle.

Although bitcoin’s previous sharp declines were often heralded as ‘buy-the-dip’ opportunities, that fervor is, alas, glaringly absent from today’s social media banter. In its stead, fear and panic have taken root, effectively erasing the gains inspired by Donald Trump’s recent presidential escapades.

The irony of the situation has not escaped the keen eyes of Mohamed A. El-Erian, a learned professor at the University of Pennsylvania’s Wharton School, who expressed his astonishment at the lack of institutional players ready to seize this “market of lemons.” El-Erian emphasized that the current climate presents a unique opportunity to acquire “good” assets-fundamentally sound projects being carelessly tossed aside by distressed sellers, eager merely to cover margin calls elsewhere.

In agreement, Deutsche Bank analysts Marion Laboure and Camilla Siazon opined that this slide, while painful, is a necessary recalibration. They argued that distancing ourselves from the speculative excesses of the past two years is essential for bitcoin’s maturation into a legitimate asset class-an evolution that resembles a caterpillar transforming into a butterfly, albeit one that occasionally forgets how to fly.

FAQ 💡

- What happened to bitcoin on Feb. 5? Bitcoin plunged 7% intraday, breaking $66K support and hitting $65,350.

- How much value was lost? Its market cap fell to $1.34T, dragging the global crypto economy to $2.36T.

- What triggered the sell-off? Geopolitical tensions, Fed chair news, and tech sector weakness fueled forced selling.

- Why does this matter globally? Bitcoin’s correlation with Nasdaq shows capital fleeing risk assets, reshaping markets worldwide.

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Brawl Stars February 2026 Brawl Talk: 100th Brawler, New Game Modes, Buffies, Trophy System, Skins, and more

- Gold Rate Forecast

- MLBB x KOF Encore 2026: List of bingo patterns

- eFootball 2026 Show Time Worldwide Selection Contract: Best player to choose and Tier List

- Free Fire Beat Carnival event goes live with DJ Alok collab, rewards, themed battlefield changes, and more

- Brent Oil Forecast

- Magic Chess: Go Go Season 5 introduces new GOGO MOBA and Go Go Plaza modes, a cooking mini-game, synergies, and more

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Overwatch Domina counters

2026-02-05 23:17