What to know:

- Bitcoin is hanging around in Asia like a sleepy cat, but it’s gained a weekly high-five thanks to U.S. investors with more cash than sense.

- The Ethereum ETF — think of it as crypto’s version of a trendy new sandwich — might just steal some Bitcoin’s thunder in the institutional snack bar.

- Decentralized exchanges are doubling their volume — because who needs Central Authority when you can have chaos served with a side of profit?

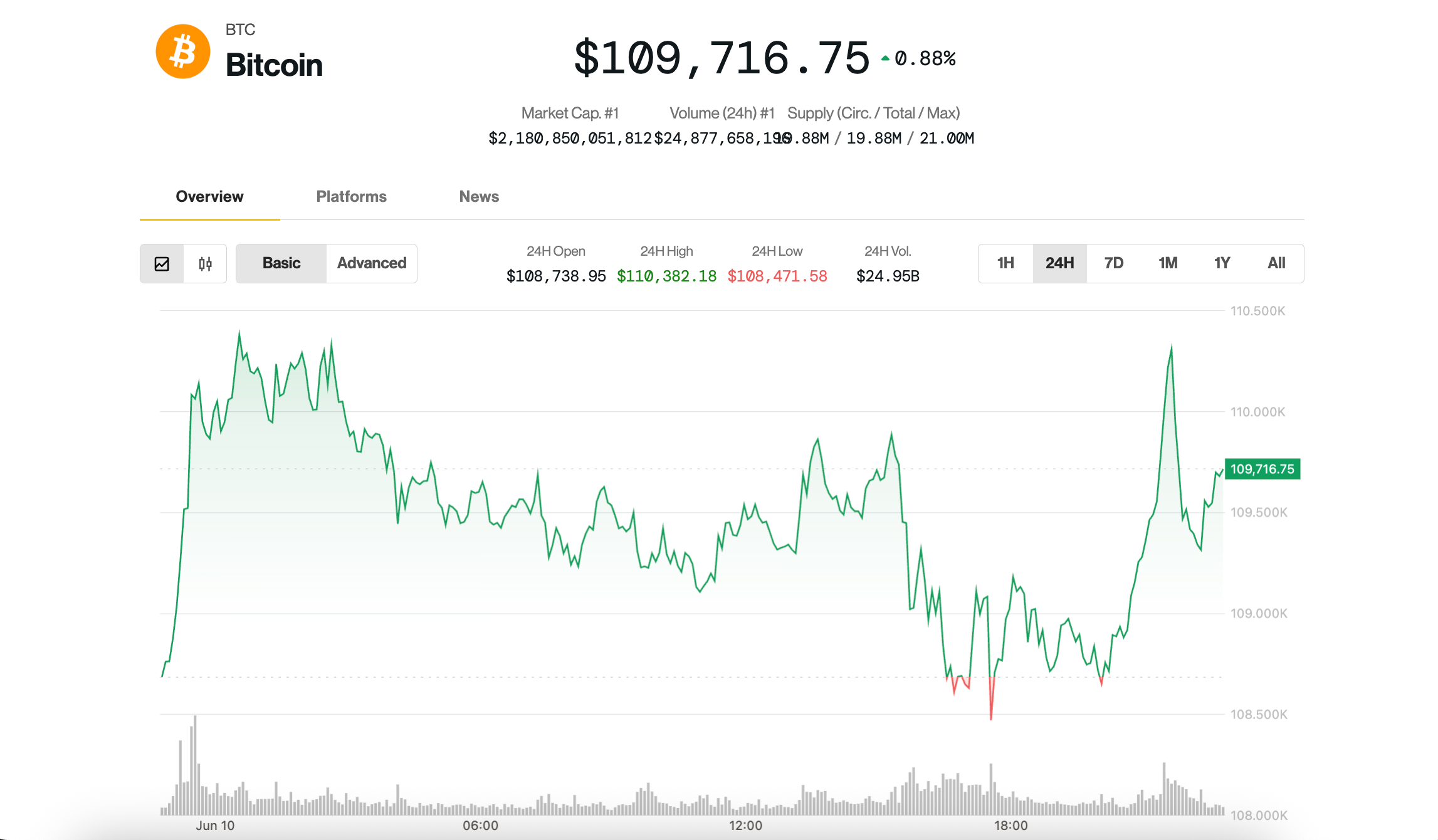

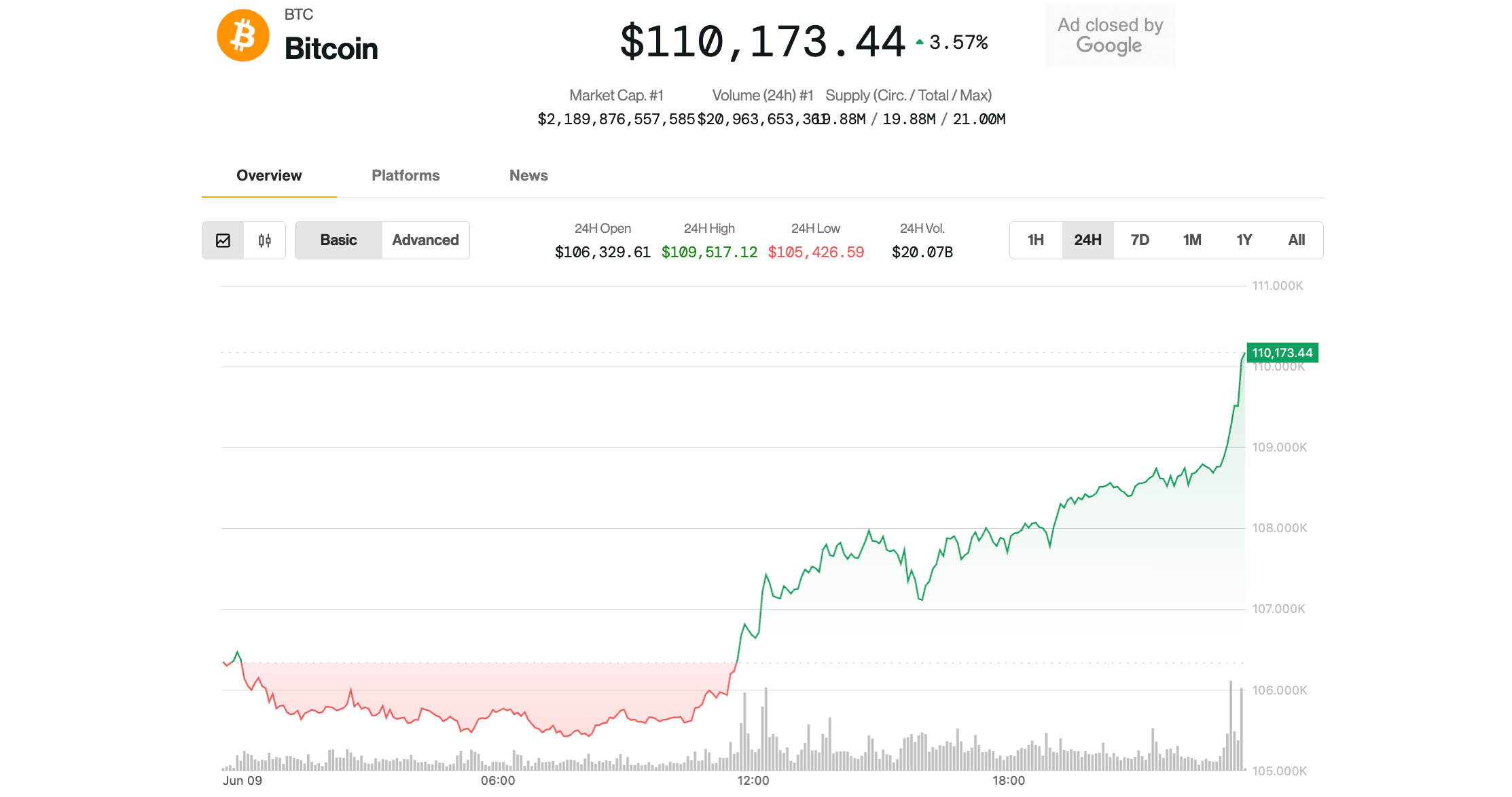

Bitcoin

is lurking at $109.7K as the big monkey in Asia’s digital jungle starts the day, according to CoinDesk.

While it’s not doing much but twiddling its virtual thumbs, it’s still up 4% for the week — proving that patience (and perhaps a dash of madness) pays off.

Meanwhile, the Bank of Japan’s rate cut is about as exciting as watching paint dry, despite low interest rates usually making risk-on traders excited enough to dance naked in the moonlight, which might explain why BTC isn’t yet moonbound.

Instead, keep your eyes on the ‘Coinbase Premium’ — basically the difference in Bitcoin price between Coinbase and Binance — because that’s where the real fun is. CryptoQuant tells us it’s creeping upward, hinting that U.S. dollar demand is giving Bitcoin a nice little push, like a caffeine jolt for sleepy traders.

“The Coinbase Premium is doing a slow climb — meaning U.S. investors are throwing more money at Bitcoin,” CryptoQuant analysts cheerfully report. “Whale activity is also subtly seducing the market.”

Adding to the drama, Bitcoin’s ETF inflows have hit a monstrous $386.27 million this week, which – let’s face it – is enough money to buy an island or at least a really nice sandwich.

But beware! Some market soothsayers warn that the upcoming Ether staking ETF might steal some of Bitcoin’s thunder and cause a mini tantrum in the institutional playground.

Yuan–yen economist Youwei Yang states that ETH staking ETFs are like that shiny new toy — more attractive than just holding the price balloon itself, and possibly drawing in the big money while Bitcoin watches wistfully.

“Everyone’s buzzing about it,” Yang notes. “Especially since Ether is the only other ‘real’ crypto ETF in the U.S., so institutions are waiting in the wings, probably petting a cat, ready to jump at the right moment.”

But for now, it’s a game of patience, or at least a good bluff. At least until the BoJ makes it official — or until Arthur Hayes screams “parabolic moonshot!” into the void.

DEX Volume Nearly Quadruples — Because Who Needs Central Bosses?

Centralized exchanges (CEXs) have long kept an eye on their rebellious younger sibling, decentralized exchanges (DEXs), since they popped onto the scene in 2018 with automated market magic (the tech kind, not the wizardry).

As the year progresses, and mergers sparkle like a bad disco, DEXs have seen their volume explode — because nothing says “trust me” like decentralized chaos with a splash of potential for profit.

Data from Messari reveals that DEX trading volume has jumped from 6% of all crypto action to a whopping 12%, cruising past 25% in May thanks to Hyperliquid, the platform with a name so aggressive it sounds like an energy drink.

Are DEXs rivals to CEXs? Not quite. Hong Fang—president of OKX—says they’re more like siblings with very different fashion tastes, working together to take over the world, one trade at a time.

“Crypto enthusiasts want the reliability of CEXs and the innovation of DEXs,” she asserts, because nobody likes one-trick ponies anymore.

Latest Buzz & Breaking News:

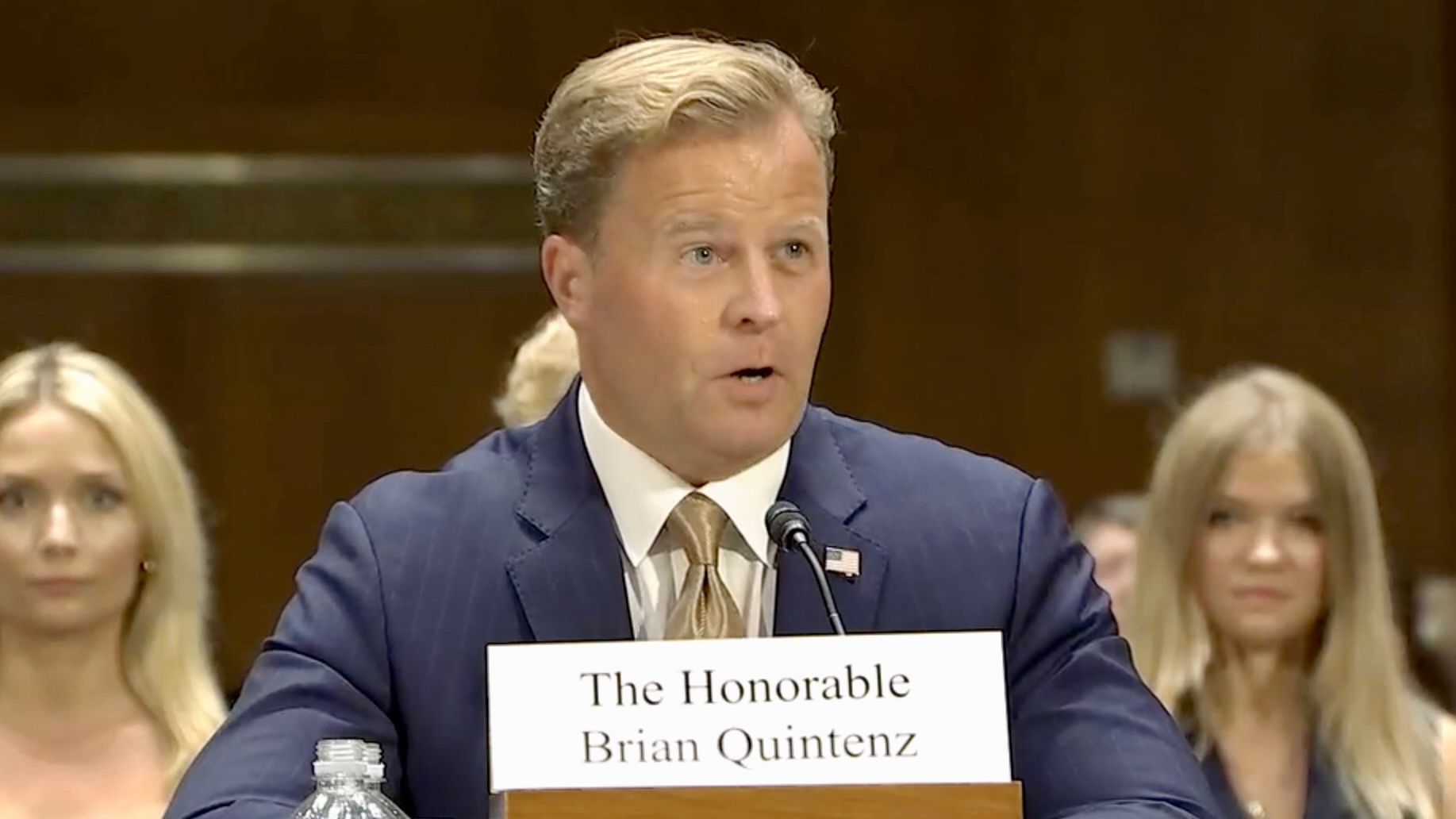

Trump’s CFTC Nominee Brian Quintenz Says Congress Holds the Key to Crypto’s Future (And Probably Coffee)

Quintenz, a former CFTC guy, told Congress that clear rules are like the fairy dust needed to make crypto innovation sparkle — but only if Congress gets off its collective rear and does something, preferably involving coffee and some serious legislation.

Members of Congress expressed concern about vacancies — because who doesn’t enjoy a game of political musical chairs? — but Quintenz wisely dodged the questions and talked about technology, regulation, and that thing called “predictive markets,” which is just fancy words for gambling with style.

Aave Joins Sony’s Soneium — Because Gaming Consoles Need DeFi Too

Yes, you read that right. Aave is now on Sony’s Soneium, a blockchain playground supported by the giant electronics conglomerate — because nothing says “trust” like a gaming company trying to do finance, right?

This move includes exploring Aave’s stablecoin GHO for payments, savings, and general digital chaos, with a shiny partnership and a $4 million piggy bank to incentivize adoption, or maybe just to buy more gadgets.

Soneium is already bustling with 7 million users enjoying platforms like Uniswap v4, Velodrome, and a whole suite of blockchain fiesta — proving that the future is now, or at least very confusing.

Market Movements and Mysterious Quantities

- BTC: Below $110K, but reserves are dropping faster than your willpower at a free pizza party — indicating strong accumulation and liquidations.

- ETH: Up 6.9% to $2,803, thanks to big ETF inflows and BlackRock’s big collection of ETH, making it the new hot ticket for institutional naysayers and hopefuls.

- Gold: Closer than ever to $3,350 despite US-China trade optimism and a dollar that’s doing its best impression of a rock.

- Nikkei 225: Roaring upward at 0.69%, because Asian markets are basically the class clowns of the financial circus.

- S&P 500: Approaching the magic 6,000 mark, thanks to Elon Musk’s robotaxi dreams and trade talks that are more soap opera than strategy.

Ripple’s Brad Garlinghouse Says Circle IPO Means U.S. Stablecoins are About to Get Their Act Together

Trump’s CFTC Pick Declares: US Crypto Rules Coming, Grab Your Popcorn 🍿

Bitcoin Hits $110K, Altcoins Join the Party — But Will They Stay for the Cake? 🎂

Aptos’ APT Rallies 4%, Because Even Coins Need a Little Sunshine ☀️

Solana’s SOL Jumps 5% — Spot ETF Rumors or Just Fancy Gossip? 🗞️

Ether Blazes Past $2,700 — The Beast Is Awake! 🐉

Bitcoin Nears $107K as Trump Sends the National Guard — Because Why Not?

Bitcoin Struggles Amid US-China Trade Drama & U.S. Inflation — The World Keeps Spinning

Shiba Inu Recovers, Whale Makes a Splash with $36M — Karma’s a Dog, or Is It?

Michael Saylor Dismisses BTC’s ‘Quantum Threat’ — Because It Only Matters if It’s Real

Bitcoin Crosses $110K — The ‘Crossroads’ of a Major Move, or Just a Nice Place to Pause?

Asia Morning Briefing: BTC Dips Below $110K—Signs of Fatigue or Just a Break?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-06-11 05:15