In the great Theater of Speculation, the price of Bitcoin has taken a brief intermission. The reason? A casual round of international squabbling in places with suspiciously more sand than water. But, as cryptocurrency enthusiasts clutch their mousepads with sweaty optimism, an ancient omen has emerged on the sacred Three-Day Chart: The Inverse Head and Shoulders. That’s right, it sounds like a wrestling move and, frankly, it behaves like one. Word on the digital cobblestone is that this neat little squiggle increases the odds of Bitcoin pirouetting to a new all-time high sometime soon. Possibly. Maybe. You know how it is.

Can Bitcoin Outrun Its Own Hype?

The chart-wielding oracle known only as Mister Crypto posted on X (once known as Twitter, then briefly as “that bird site”). His chart, bristling with technical doodles, foretells of a price stampede toward $150,000. Or, as some call it: “enough to finally buy a London shoebox.” 🎩

For those not raised in the arcane rites of Investment Chartomancy, an “inverse head and shoulders” pattern is a bullish thing. Imagine three potholes in the road: one deep one with a smaller one on each side. Add a “neckline” (fashionable!), and if the price leaps over it, the crowd goes wild. Or at least mildly interested.

Meanwhile, a market analyst named Jelle—who has mastered the ability to type with coffee in one hand—notes that Bitcoin is also waving a bullish pennant. This is at least as exciting as an ordinary pennant, but with more chance of outrage and euphoria.

Now, as exchanges see their Bitcoin piles dwindling (now less than two million, the lowest since 2017!), wise commentators like Master of Crypto declare that coins are vanishing into wallets, presumably for a long nap in cold storage. Less supply, same or more demand. It’s basic economics, or as basic as anything can be in crypto.

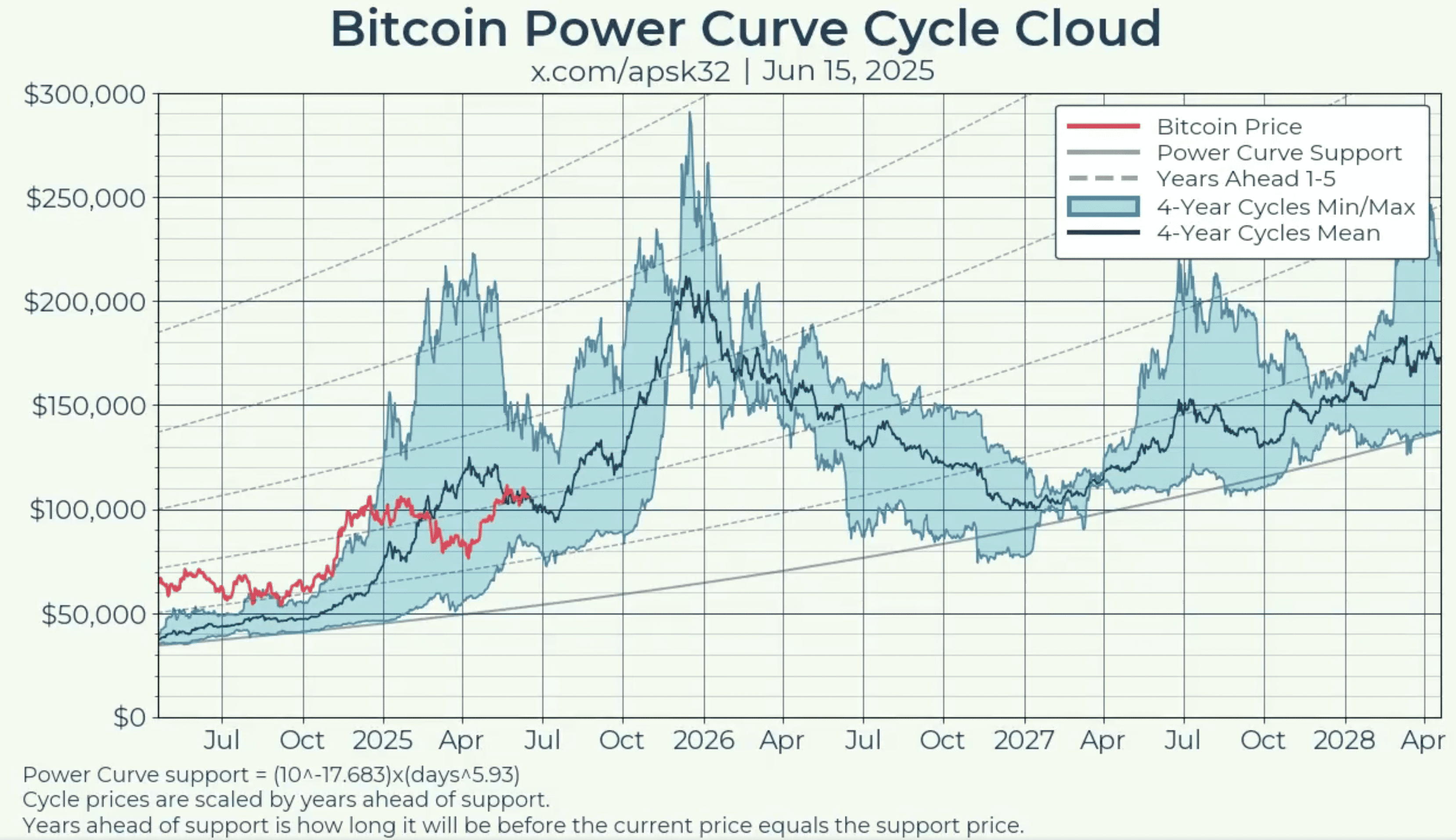

Yet another analyst, apsk32 (possibly a medieval automaton), waxes philosophical about Bitcoin’s legendary “power curve,” which has been bamboozling mathematicians for fifteen years. If the pattern endures, expect a top in November or December 2025, and afterwards, endless social media posts about how everyone “totally saw it coming.” 📈

How Many Satoshis Does It Take to Feel Rich?

Elsewhere, in this ongoing game of “Who Can Yell the Highest Number,” Robert Kiyosaki of “Rich Dad Poor Dad” fame is currently winning by predicting Bitcoin will one day soar to $1 million. He reminds the loyal throngs that “the number of coins you own” is what counts, surely to the delight of anyone with a calculator and very patient relatives.

Over in the slightly less fantastical realms, other number conjurors predict highs of $205,000 by 2025—still enough to make even a dragon jealous. Meanwhile, exchanges are running out of Bitcoin like shops after a Discworld fire sale, with whales vacuuming up what’s left while the price tiptoes around $104,359 (give or take a cup of coffee).

Will Bitcoin vault its own “neckline” and shower investors in digital riches? Or is this just the preliminary act before the next comedic market pratfall? As always, in the crypto bazaar, one thing remains true: the chart patterns may be confusing, but at least the comments sections are reliably hilarious. 🐉🙈

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-06-20 08:25