Crypto Stocks: When the Party Ends, the Hangover Begins 🤯

As the crypto economy has shrunk by a staggering $150 billion since Monday, the downturn has left an indelible mark on crypto stocks. The once-thriving shares are now reeling, with a significant portion experiencing double-digit declines across the board. It’s as if the party has ended, and the hangover has begun.

The Unbreakable Bond Between Crypto and Stock Markets

Crypto-related equities have been under intense pressure this week, mirroring the broader market downturn that unfolded during the same period. By Friday, all four benchmark U.S. indices concluded the trading day in the red, shedding considerable value. It’s a synchronized selloff, with no escape from the market’s wrath.

On March 24, the crypto economy was assessed at a whopping $2.82 trillion, but by March 29, it had dwindled to $2.67 trillion. This contraction has weighed heavily on crypto stocks, with many bearing the full force of the decline. It’s a stark reminder that when the crypto party ends, the stocks suffer too.

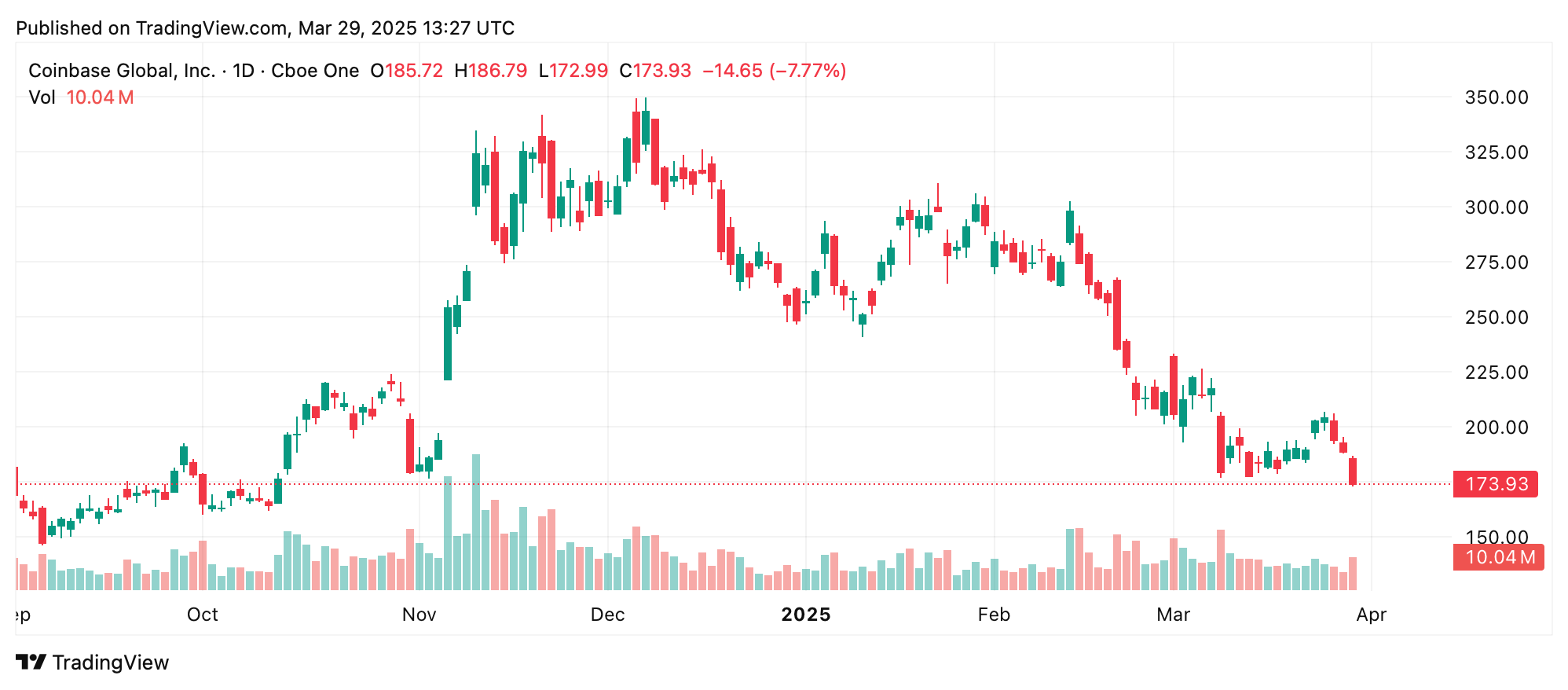

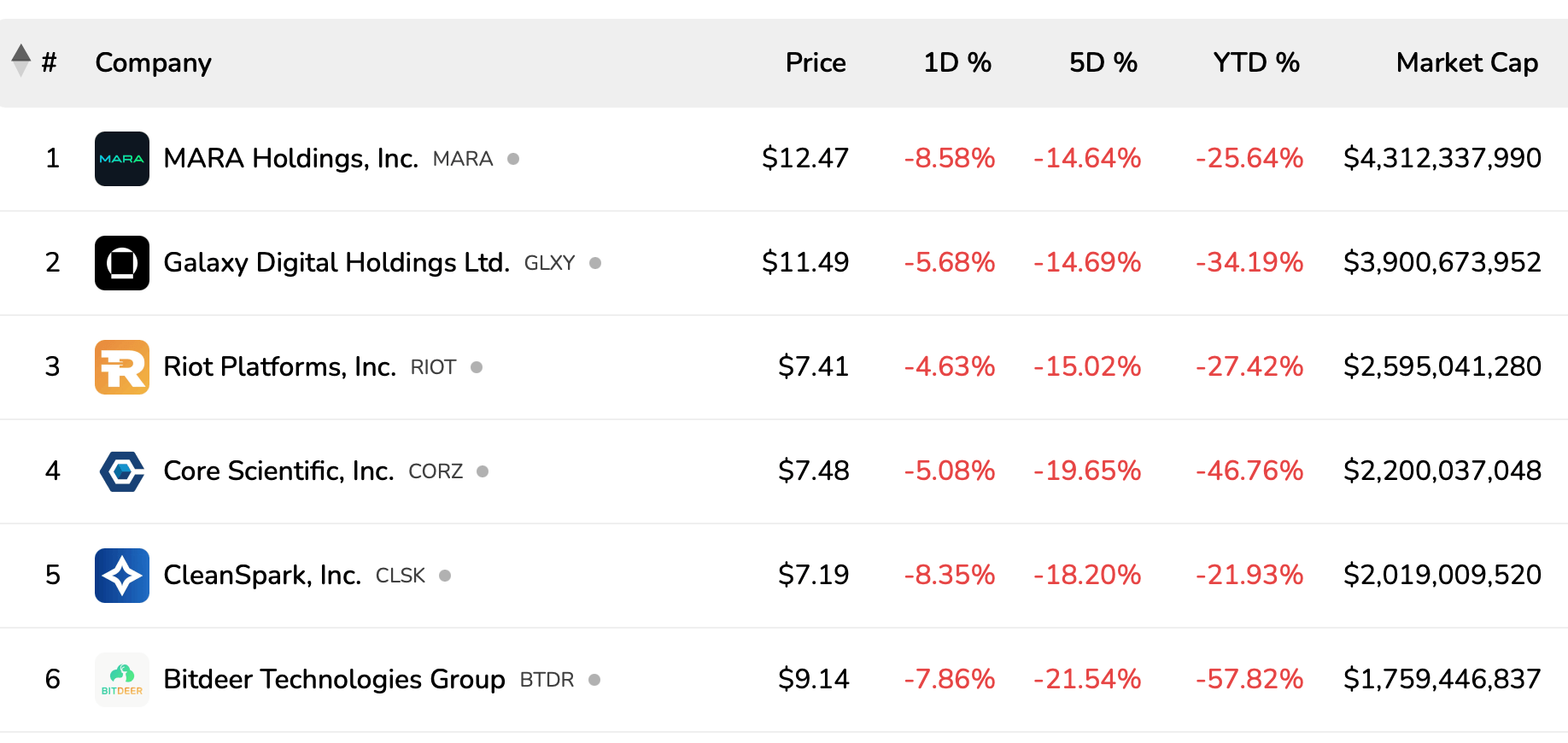

Take Coinbase’s COIN, for example, which has declined by 11.93% against the U.S. dollar since Monday. The current market capitalization of COIN rests at a paltry $44.16 billion. Meanwhile, Strategy’s MSTR experienced an 8.46% drop over the span of five consecutive trading sessions. Publicly traded mining firms have also borne significant losses, with MARA Holdings’ shares retreating by 14.64%. It’s a bloodbath out there, folks!

Galaxy Digital (GLXY) relinquished 14.69%, Riot Platforms (RIOT) fell by 15.02%, and Core Scientific (CORZ) dropped 19.65% during the previous week. Cleanspark (CLSK) saw its value diminish by 18.2% against the U.S. dollar, while Bitdeer (BTDR) plummeted by 21.54% across the same five-day stretch. Additionally, Iren Limited (IREN) and Applied Digital (APLD) witnessed declines ranging from 21.06% to 28.41%, respectively. It’s a veritable slaughterhouse out there!

Crypto-related stocks often mirror the spot crypto economy due to their intrinsic ties to digital asset performance. Like crypto assets, these equities are heavily influenced by market sentiment and macroeconomic factors affecting cryptocurrencies. When spot prices decline, investor confidence wavers, prompting sell-offs in both crypto assets and associated stocks.

Additionally, many publicly traded firms hold significant crypto reserves, amplifying their vulnerability to market downturns. This interconnectedness fosters synchronized losses across both domains. It’s a vicious cycle, and it’s not pretty.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

2025-03-29 21:00