Crypto Rollercoaster: Brace for Turbulence! 🚀⚠️

In the shadowed halls of Bitfinex, where numbers dance and hope flickers like a dying candle, analysts ring the alarm: the merciless beast of volatility stirs again. Bitcoin, that stubborn idol of speculation, has stagged, fallen nearly 8% from its latest high—an all-time peak of $111,880, after a 50% surge in less than two moons. The traders’ nightmare or dream, depending on your perspective, whispers of a correction—an inevitable return to earth after touching the sky.

Record Options, Big Boom, Then Boom Again

According to the wise oracle of Bitfinex, bitcoin’s recent tumble from its lofty perch signals a disturbance. The big beast, bitcoin (BTC), once soared to heights that made the gods jealous, only to tumble back—this time, descending from a wild peak, showing an 8% dip. These days, markets are playing with fire: options open interest hit a staggering $49.4 billion—your eyes do not deceive you—almost fifty billion dollars of bets, hedges, and wild guesses. Like a carnival game gone haywire, traders are positioning themselves for a spectacle of larger swings, while derivatives dance on the edge of chaos.

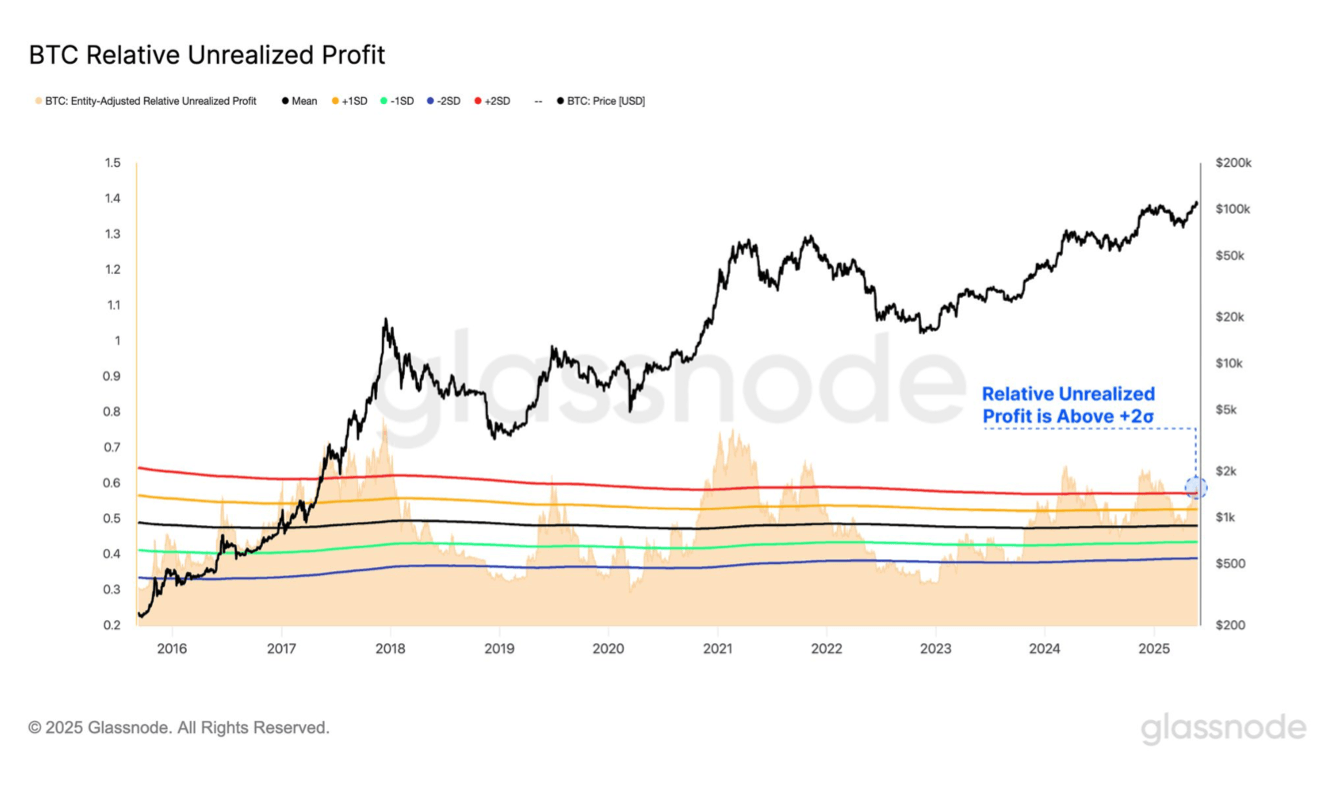

Meanwhile, the gamblers, greedy as ever, take profits like bandits in a siege. “A handy gauge is the Relative Unrealised Profit,” they say, which measures how much paper gold, or rather, digital gold, traders are sitting on. When this metric breaks above its +2 standard deviation—well, that’s a fancy way of saying “people are euphoric, and euphoria is a dangerous drug.” Historically, less than one out of six days sees such extremes—so buckle up.

These euphoric zones usually come with wild volatility and vanish faster than a politician’s promise. Only about 16% of Bitcoin’s trading days have seen such dizzying heights, so take a breath.

To add spice, macroeconomic pressure is tightening. The unexpected reintroduction of U.S. tariffs sends ripples, raising Treasury yields above 5% for the first time since dinosaurs roamed the Earth—or 2009, at least. Liquidity shrinks, markets tighten, and both Wall Street and crypto markets feel the pinch—like trying to run in a molasses bath.

But wait, there’s more—because the crypto circus never sleeps. GameStop, that relic of yesteryear, throws $513 million into bitcoin. The U.S. Labor Department, in a surprising act of rebellion, rescinds its old warnings about crypto in 401(k)s—probably tired of the constant chaos. And Russia, the eternal wildcard, authorizes crypto-linked instruments for favored investors. Yes, the game is changing—whether for better or worse, no one can say.

Despite the inevitable backslide, Bitfinex’s seers insist bitcoin is not broken but simply taking a “healthy reset”—like a tired boxer before the next round. Still, all signs point to a storm brewing on the horizon. So hold tight, fellow voyagers—this ride isn’t over yet. 🚀😏

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-06-03 06:57