Picture, if you will, the crypto market—usually a hive of vim, vigor, and people named Todd—down a minuscule (but apparently catastrophic) 0.48%. Why? Because the stock markets also woke up gloomy, and Bitcoin decided to throw a bit of a technical wobbly. 😑

On Tuesday, May 6 (a date now living in infamy, albeit only for people with too much Bitcoin in their portfolio), the market cap tottered off its $3 trillion perch and landed, gingerly, at $2.94 trillion. Not quite over a cliff, but enough for a hundred thousand “analysts” to clutch their pearls in exquisitely choreographed unison.

The primary force behind this (apparent) disaster? The same brand of grumpiness plaguing stocks. The Dow dropped a robust 400 points—give or take a decimal—accompanied by the other indices who, frankly, didn’t want to be left out of the sulk. 🥲 Apparently, when stocks sneeze, crypto catches the flu and promptly takes to its bed with a damp cloth.

But lo! Enter macroeconomic uncertainty, stage left, trailed by that old ham Donald Trump, now shaking a stick at pharmaceuticals and movies with yet another round of tariffs. Traders—always ready for a good panic—interpreted this as a sign of dark times, tighter trade winds, and possibly the end of HBO.

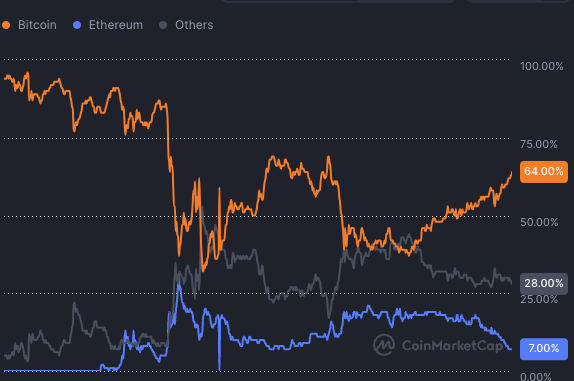

And yet, in the midst of this tepid hand-wringing, Bitcoin stood stalwart. Well, “stalwart” being relative; it managed not to topple over quite as dramatically as the altcoin rabble. Its dominance ticked up to 64.1%—a number not seen since January 2021, an era when people still thought NFTs were a sensible idea. Bitty’s price even took a daring dip to $93,400 before rallying limply, ending the day barely below where it started, down a spine-chilling 0.01% at $94,841. Astonishing restraint, really.

Beware the Technical Bogeymen

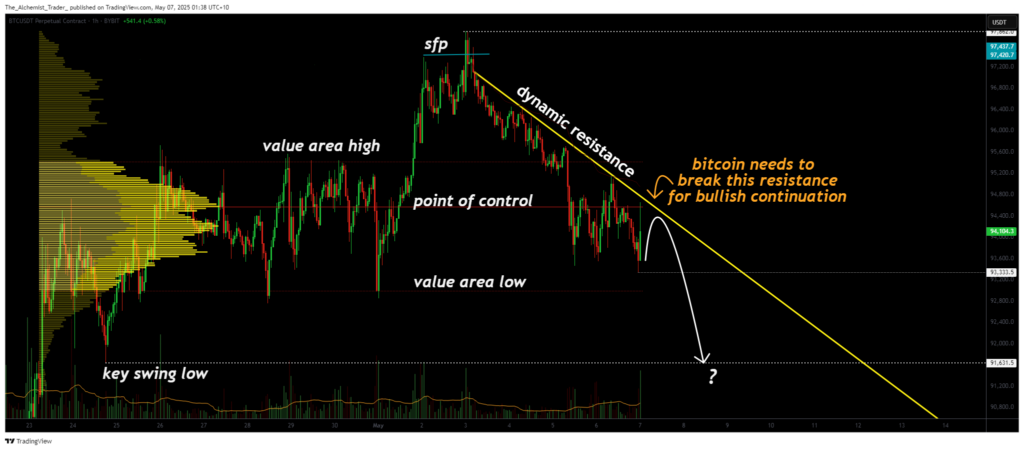

So, why isn’t Bitcoin breaking out and buying everyone a drink? Blame “technical factors”, the boogeymen of every crypto whisperer. Apparently, Bitcoin has become extremely fond of a “long-term dynamic resistance,” which started haunting it after its all-time high in January. Resistance, it seems, is not futile after all.

Since then, the venerable coin has grazed its head against this resistance ceiling repeatedly, like a particularly persistent goldfish. Last time it tried to break out was April 23; now, the consensus says it’ll need an honest-to-goodness “major catalyst” to come barging in if it hopes to crash through that ceiling. Until then, expect further polite declines, knowing nods, and at least seventeen more op-eds blaming everything on “market sentiment.” 🧐

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-05-06 23:31