In a dance as old as finance itself, Bitcoin ETFs leap back from their three-day lament, scooping up a hefty $378 million—like a gambler who finally hits the jackpot—mostly thanks to the charismatic ARKB and FBTC. Meanwhile, Ether ETFs keep their winning streak alive—tenth, eleventh, twelfth—like a stubborn cat that refuses to leave the sunbeam, amassing $109.43 million, proving they’re not just a pretty face.

Crypto ETFs Swell Like a Pufferfish Over $487 Million — Don’t Worry, No Fish Were Harmed

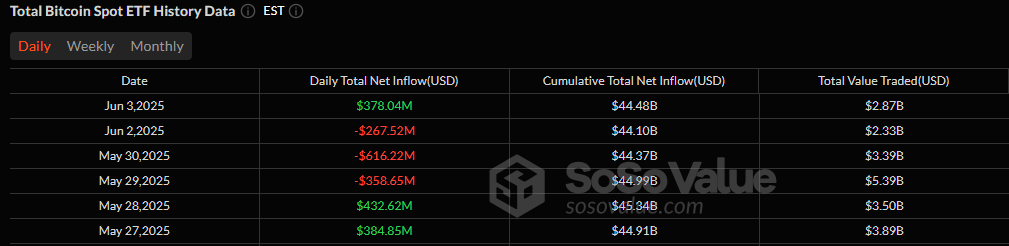

Investor enthusiasm returned faster than a boomerang after a few rough days; thus, the crypto funds—most notably, bitcoin ETFs—snagged a roaring $378.04 million entry, snapping out of their three-day sulk with flair on Tuesday, June 3. The venerable ARKB and Fidelity’s FBTC, with their charm and dollar signs, pulled in $139.93 million and $136.83 million respectively, making up over seventy percent of that day’s cash carnival.

Blackrock’s IBIT and Vaneck’s HODL also played their parts, grabbing $57.97 million and $18.79 million, respectively, because who doesn’t love a reliable magnet? Not to forget the quirky crowd—Bitwise’s BITB, Grayscale’s Bitcoin Mini Trust, and Valkyrie’s BRRR—adding their own bits and bobs to the green pile. Interestingly, not a single ETF decided to flee—an epic rarity in the tumultuous sea of crypto confidence, like a unicorn trying to stay invisible.

Trading was a carnival of chaos, with an astonishing $2.87 billion swapping hands—probably enough to buy a small country—and net assets bouncing back to a shiny $128.13 billion for bitcoin ETFs, because who doesn’t love a good comeback story?

Meanwhile, the bravest of the bunch—Ether ETFs—kept their streak alive, not caring about the skeptics or the market’s mood swings. Twelve days of continuous inflow, raking in a combined $109.43 million, like an unstoppable steamroller.

Blackrock’s ETHA once again led the parade, swallowing $77.06 million faster than a souffle in a hot oven, while Fidelity’s FETH toted in $20.97 million, proving they’re in it for the long haul—because who needs sleep? Grayscale’s Ether Mini Trust and Franklin’s EZET chipped in, adding $8.41 million and $2.99 million, respectively, with total trades reaching a dizzying $472.5 million. Ether ETFs now boast a majestic $9.81 billion in net assets, because size isn’t just a matter of ego—it’s a matter of fact.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-06-04 14:59