Why Your Crypto Wallet Might Just Be a Fancy Piggy Bank 🐷💰

What to know:

- Maple now offers stablecoin loans backed by stETH through a partnership with Lido Finance.

- Institutions can borrow without un-staking, keeping ETH rewards active. Because who wants to miss out on free money? 🙄

In a move that can only be described as “let’s make crypto lending a little less boring,” Maple Finance has decided to cozy up with Lido Finance. Together, they’re offering stablecoin credit lines backed by Lido’s liquid staking token (stETH). Yes, you heard that right—liquid staking! It’s like having your cake and eating it too, but with a side of blockchain. 🍰

Thanks to this partnership, institutions can now borrow stablecoins without the hassle of unwinding their staked ETH positions. It’s like borrowing your neighbor’s lawnmower while still pretending to care about your own yard. Borrowers can use stETH as collateral for credit lines, all while Maple’s in-house credit team watches over them like a hawk. 🦅

Restaking is the new buzzword in crypto, and Lido is at the forefront, forging partnerships like a kid trading Pokémon cards at recess. With over $1.8 billion in assets, Maple is on a roll, working with Wall Street’s Cantor Fitzgerald to do bitcoin-backed loans. Because why not add a little more chaos to the mix? 🎢

“This partnership formalizes a growing demand from institutions already using stETH in their capital strategies,” said Sid Powell, CEO and Co-Founder of Maple. “By enabling loans backed by stETH, we’re making it easier for institutions to access liquidity while keeping their core assets staked and productive.” Sounds fancy, doesn’t it? Like a corporate version of “I’m just here for the snacks.” 🍿

The offering serves a range of institutional use cases, including treasury runway extension, conservative leverage trading, and short-term working capital. In other words, it’s like a Swiss Army knife for financial institutions. 🛠️

Crypto Lending Platform Morpho V2 Brings DeFi Closer to Traditional Finance

Bittrue Hacker Funnels $30M Through Tornado Cash, Made $9.3M by Trading Ether

CoinDesk 20 Performance Update: Chainlink (LINK) Drops 6.2%, Leading Index Lower

Conduit, Braza Group Debut Stablecoin Forex Swaps for Cross-Border Payments in Brazil

Tether Takes Minority Stake in Gold-Focused Investment Company Elemental Altus

FBI Crypto Veteran Chris Wong Joins TRM Labs to Bolster Fight Against Illicit Finance

XRP Ledger’s Ethereum-Compatible Sidechain to Go Live in Q2

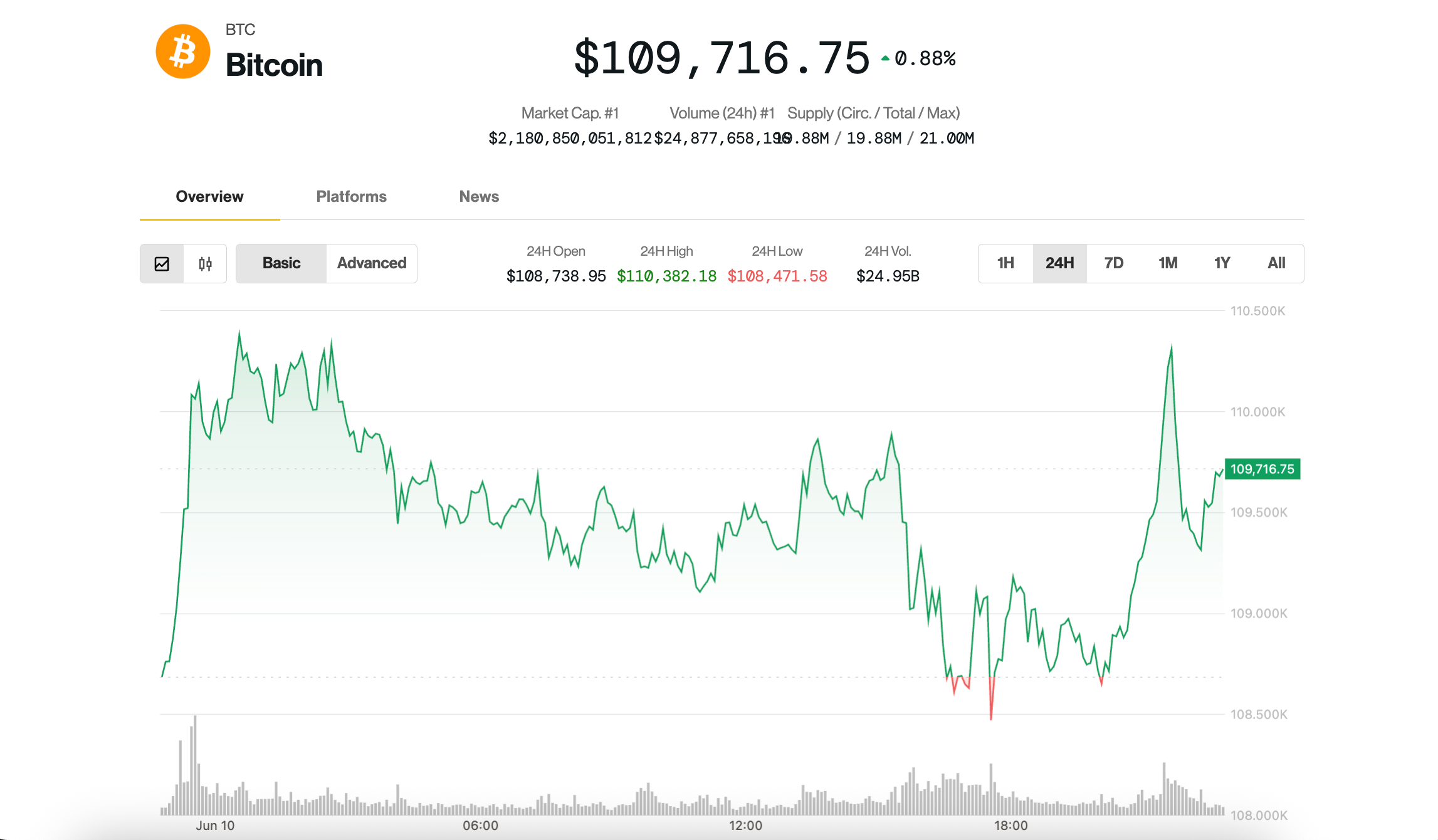

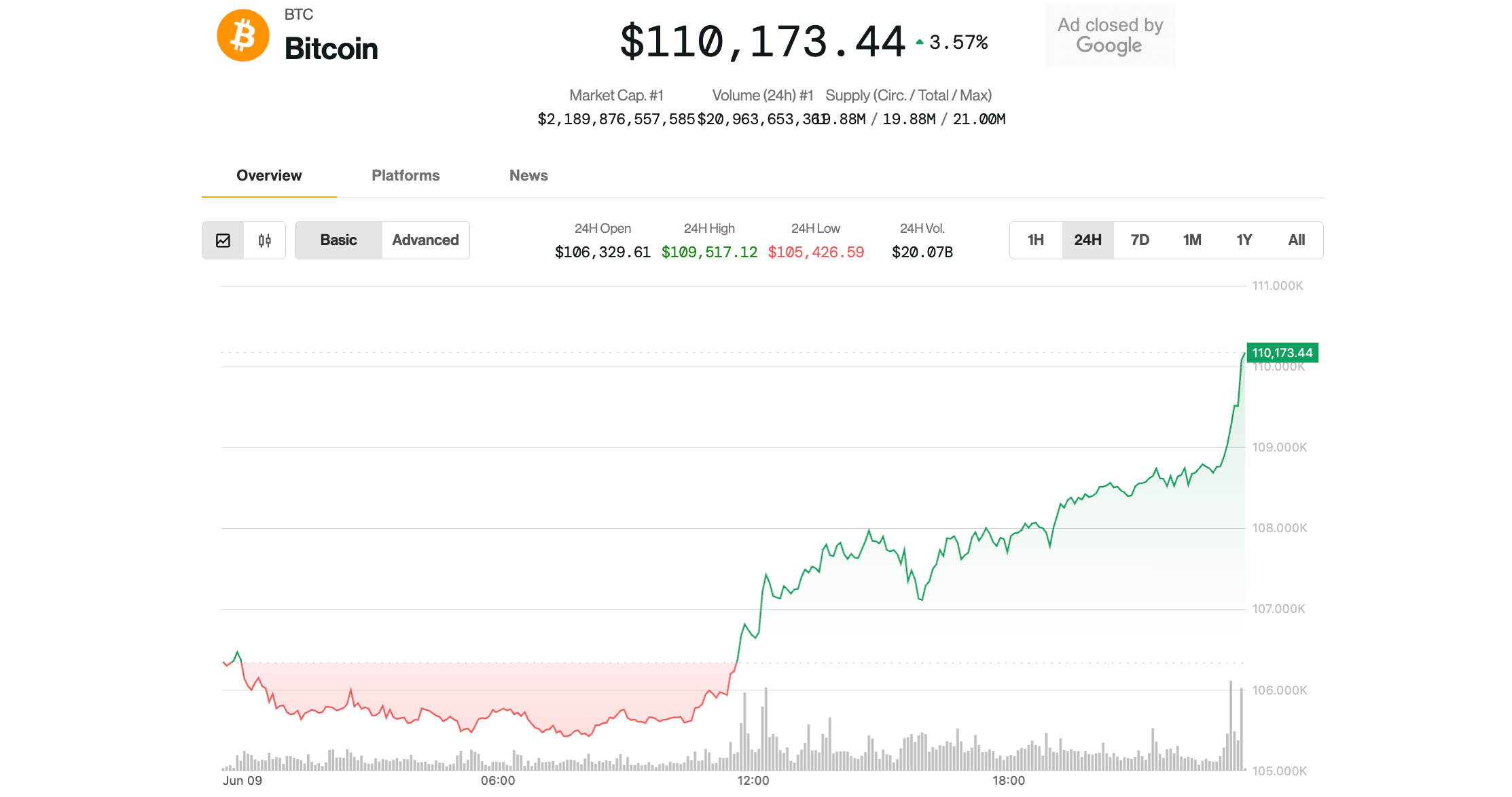

Bitcoin Rises to $110K as Altcoins Rally; Traders Skeptical of Breakout

Bitcoin Climbs Above $110K, ‘At Crossroads’ for Next Major Move

Bitcoin at $200K by Year-End Is Now Firmly in Play, Analyst Says After Muted U.S. Inflation Data

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-06-12 17:23