Ah, July 2025. The air is thick with anticipation, the whispers of fortunes made and lost swirling like dust devils across the digital steppes. Bitcoin, that fickle beast, briefly decided to play hide-and-seek below the $100,000 mark – a mere blip, of course, before launching itself back towards the heavens with a V-shaped recovery. Such drama! And, naturally, the altcoins have been scrambling to hitch a ride on its coattails. Predictability? Don’t be absurd. 🙄

Table of Contents

In this, shall we say, investigation, we shall peer into the murky crystal ball and attempt to discern what fate holds for Bitcoin (BTC) and a selection of its more… enthusiastic brethren in July 2025. Don’t expect certainty, mind you. Only informed speculation, and a healthy dose of cynicism.

Bitcoin price prediction

BTC, it seems, has been forced to contend with the petty squabbles of geopolitics. A minor inconvenience for a digital god, naturally. Despite a brief stumble below the aforementioned $100k, it now lounges comfortably above $118,000. A remarkable resilience, or perhaps simply a testament to the enduring power of hype? 🤔

As of July 22, 2025, Bitcoin is hovering around $118,400, having deigned to acknowledge the 50-day EMA (~$108,700) before promptly ignoring it. The short-term outlook is… uninspired, shall we say? Momentum indicators are exhibiting a distinct lack of conviction. Expect a tedious dance between $116,500 and $119,000 while the market collectively yawns. A decisive breach of $119,000–$120,000 *might* signal a move toward $122k–$124k, but don’t hold your breath. A fall below $116,000, however, would invite a more… sobering descent toward $114,800–$112,000.

Understand this: BTC’s whims dictate the fate of all. A wise strategy? Buy altcoins when BTC pauses for breath and sell them when it flexes its muscles. A simple equation, really. Though, naturally, complicated by human greed and irrationality.

Ethereum price prediction

Ethereum, ever the diligent student, has reclaimed its 200-day EMA (~$2,880) and is now forming a rather symmetrical triangle. A pleasing aesthetic, wouldn’t you agree? It currently sits nestled below a substantial supply zone between $3,800–$4,100, its momentum stubbornly intact. Support holds firm at $3,610–$3,550. A reassuring sight, or merely a temporary lull before the storm? 🧐

Institutional interest is, predictably, surging. ETF inflows are breaking records, and whales continue to hoard, contentedly above $2,520. A breakout past $3,800–$3,850 could unleash a rapid ascent to $4,100–$4,500, while a retreat to $3,550–$3,610 presents a tempting buying opportunity. But beware! A breach of $3,525 could trigger a more significant correction toward $3,100.

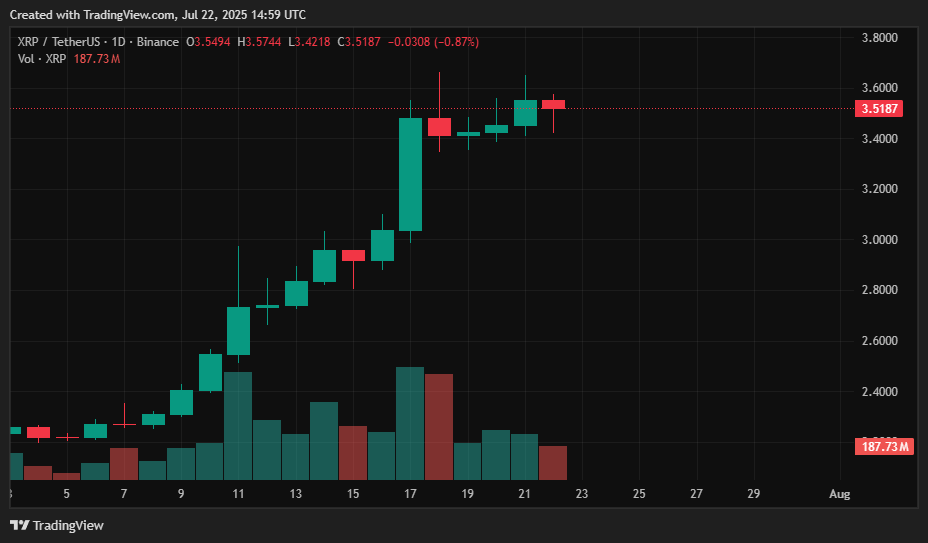

XRP price prediction

Ripple (XRP) has audaciously broken free of a multi-year symmetrical triangle. A rather dramatic escape, accompanied by a 56% rally in July, bringing it to a current trading price near $3.67. Support lingers at $3.55–$3.60, while resistance stubbornly forms at $3.84–$4.00. This breakout is fueled by—what else?—institutional interest, Ripple’s ambitious pursuit of a U.S. banking license, and record inflows into crypto funds following the signing of the GENIUS Act. A name that inspires confidence, wouldn’t you say? 😏

Momentum indicators remain, frustratingly, neutral. Plenty of room for movement, depending on the capricious whims of the broader market. Given Bitcoin’s current strength, XRP’s breakout remains viable, with a potential move toward $6.00 still on the cards.

Given BTC’s continued buoyancy, XRP is likely to remain within a bullish range between $3.55 and $4.00, with potential upside toward $4.50–$6.00 if it conquers $3.84. A minor pullback to $3.30–$3.55 should be viewed as a test of its newfound freedom. The upcoming SEC appeal decision on July 24, however, may introduce a brief period of turbulence into this otherwise optimistic narrative.

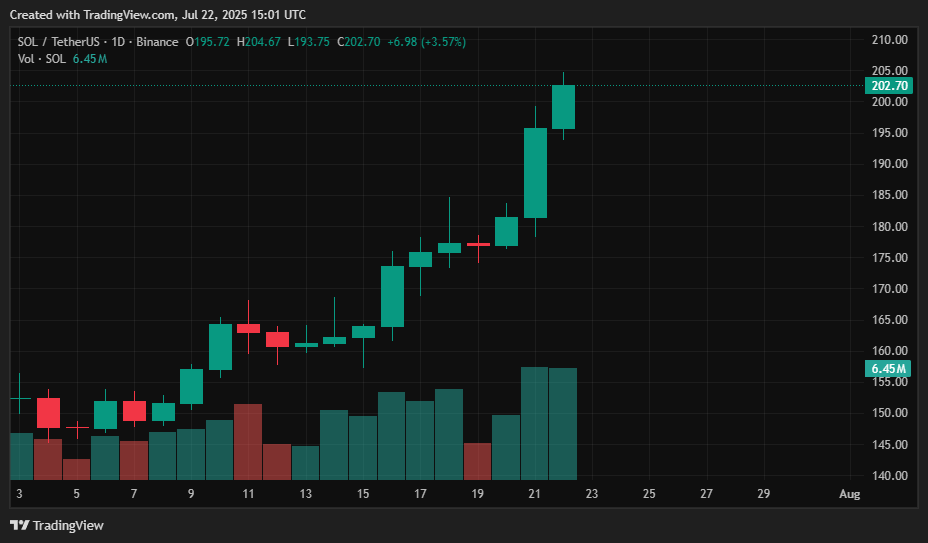

Solana price prediction

Solana’s resurgence in 2025 continues unabated, fueled by a revitalized DeFi and NFT ecosystem and, of course, institutional affection. SOL has reclaimed the coveted $200 level and now trades comfortably near $200.56 within its upward channel. Daily DEX volumes have swelled to a rather impressive $1.4 trillion, while staking ETFs (e.g., Rex‑Osprey) have attracted a substantial influx of capital ($42 M+). A promising sign, or merely a fleeting trend?

Technically speaking, SOL is targeting the $165–$170 zone, having firmly re-established $150 as support. A breakout above $170 could propel it toward $185, the pre‑March high. A thrilling prospect, wouldn’t you agree? 🎉

With Bitcoin trading serenely around $118,800, Solana is well-positioned to continue its upward trajectory. Expect a push toward $170–$185 in this favorable environment. A dip in Bitcoin, however, could drag SOL back to the $140–$145 support range, offering a fleeting opportunity for the cautious.

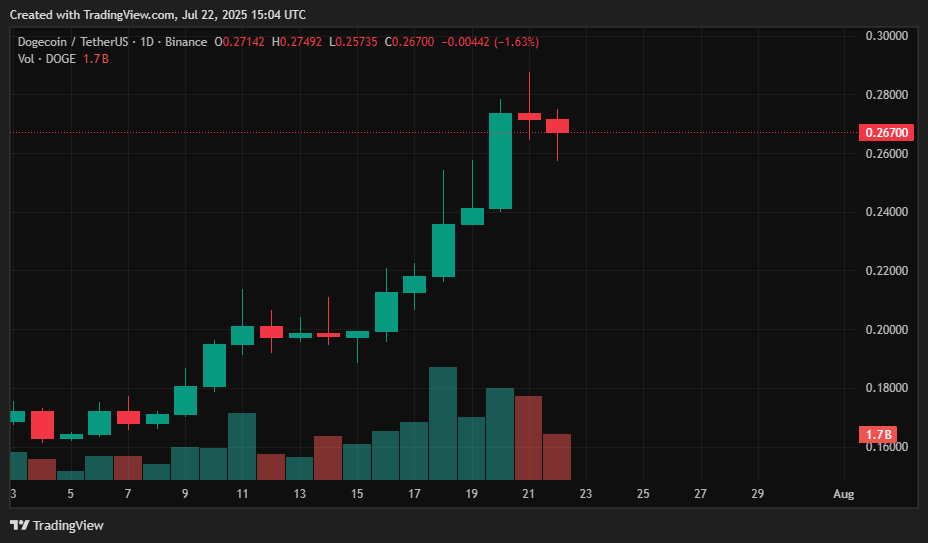

Dogecoin price prediction

Dogecoin (DOGE) has quietly risen amidst the general market euphoria and the persistent buzz surrounding its integration with X (formerly Twitter). It’s currently stabilizing around $0.26–$0.27—comfortably above the regained support at $0.15–$0.17—fueled by what can only be described as enthusiastic whale accumulation. Technically, Dogecoin exhibits signs of bullish divergence on the MACD, remaining above its 50-day EMA. A potential breakout, perhaps? 🐕

With Bitcoin trading near $117–119k, the macro climate favors altcoin rallies. In this context, DOGE may easily reach the $0.30–$0.35 zone, potentially even $0.45 if a meme-coin frenzy takes hold. However, should BTC falter (dropping to the $110k range), expect DOGE to retreat toward $0.20–$0.22, with deeper pullbacks around $0.20 offering a cynical entry point. Volatility remains a constant companion, so position sizing and risk management are, naturally, paramount.

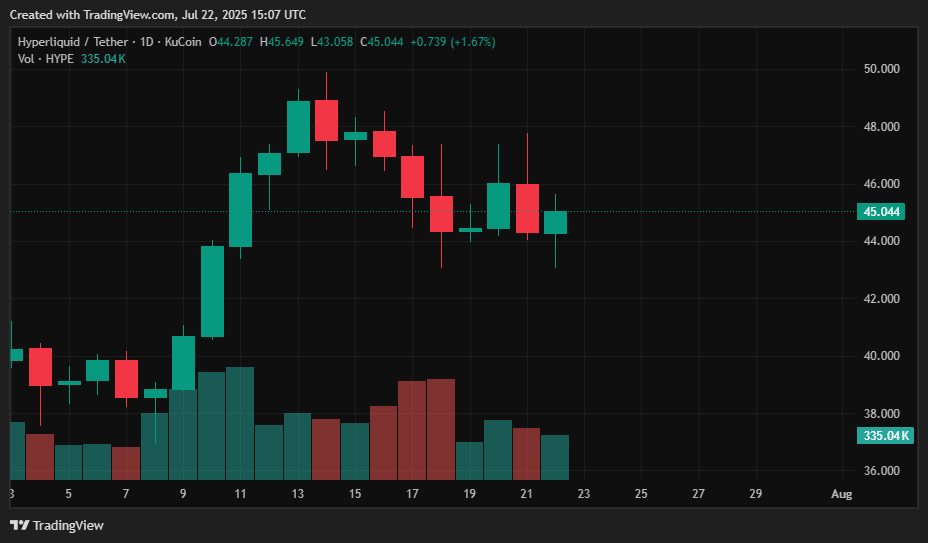

Hyperliquid price prediction

Hyperliquid (HYPE) currently trades around $44–$45, following a peak in June near $47–$48. It’s consolidating within a bullish pennant pattern, fueled by persistent whispers of a Binance.US listing and renewed whale activity. Daily trading volumes have surged (~20%). On the daily chart, HYPE remains comfortably above its 50‑day SMA (~$40), and the pennant formation suggests a readiness for… something. A move above $46–$47 could propel HYPE toward fresh all‑time highs around $50–$57, with key resistance zones lurking at $45–$48.

With Bitcoin hovering around $118,800, the outlook is… not entirely bleak. If bullish momentum persists, HYPE could challenge the $50–$57 range. A BTC pullback, however, might drag HYPE down to $35–$38, a potential entry zone for those with a penchant for risk.

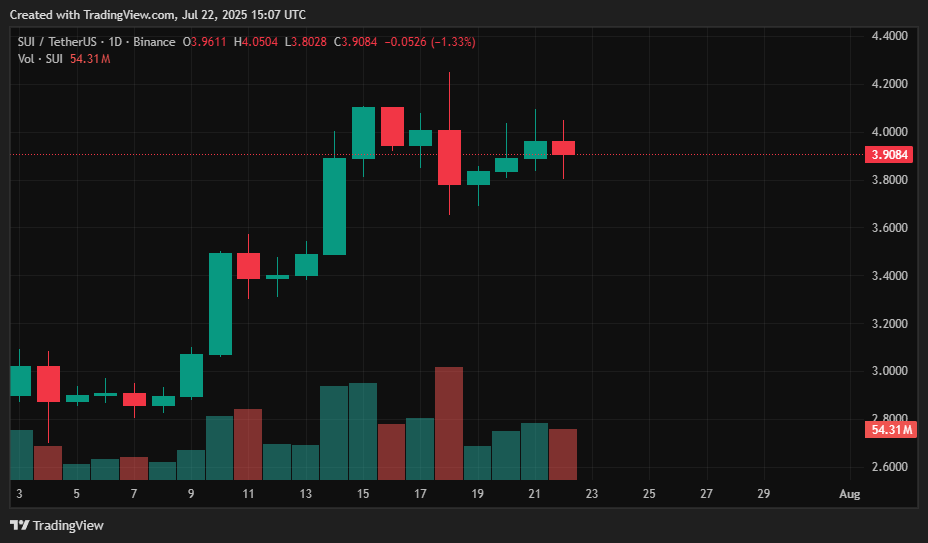

Sui price prediction

SUI is consolidating in a rather tight range between $3.82 and $3.92, having rebounded from crucial support above $3.80 after July’s rally. The Bollinger Bands are narrowing – an early sign of a potential… well, something. %B sits around 0.76, placing SUI near the upper band of its recent range ($4.23). A curious development, isn’t it?

Momentum indicators remain bullish: the RSI (~62), MACD, and histogram all suggest upward momentum without being overly optimistic. Daily support lies at $3.80–$3.85, while resistance clusters around $4.05–$4.10.

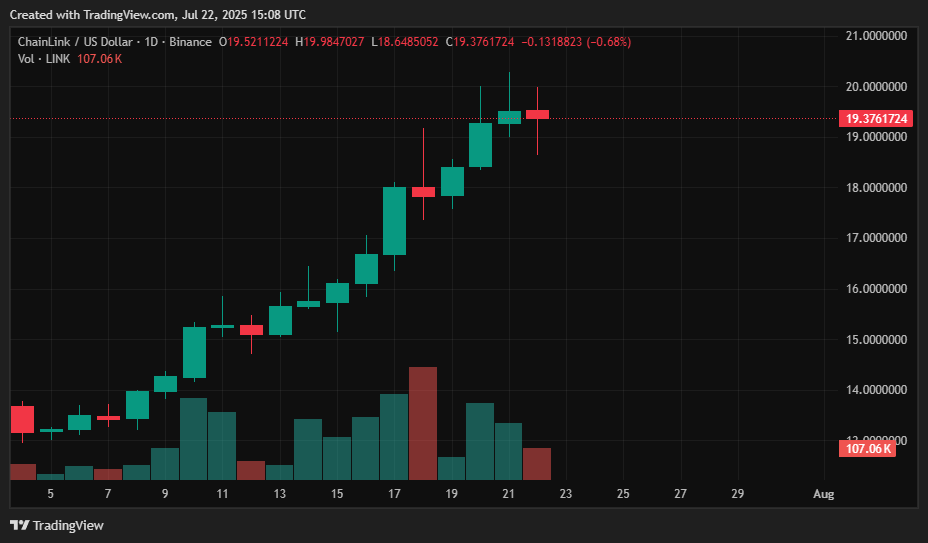

Chainlink price prediction

Chainlink’s (LINK) oracle network is gaining traction in both DeFi and TradFi, with European banks integrating its CCIP for FX settlements and new partnerships unlocking access to tokenised real-world assets – strengthening its relevance in regulated finance. On the daily chart, LINK is forming a bullish flag near $19.40, having reclaimed support around $17.50–$18.00. Trading volumes have surged (~70% in the past week), fueling – inevitably – optimism. With the upcoming CCIP v2 upgrade and its expanding institutional collaborations, a breakout above $20–$21 could drive LINK toward the $22–$23 range, with potential to $25–$28 if momentum prevails.

With Bitcoin holding above $119k, the outlook is generally favorable for altcoins. In this setting, LINK could reach the $22–$25 zone. A cautious accumulation zone lies between $18.00–$19.00, following a potential retest. The broader picture – growing on-chain outflows and Chainlink’s expanding institutional ties – supports a bullish outlook.

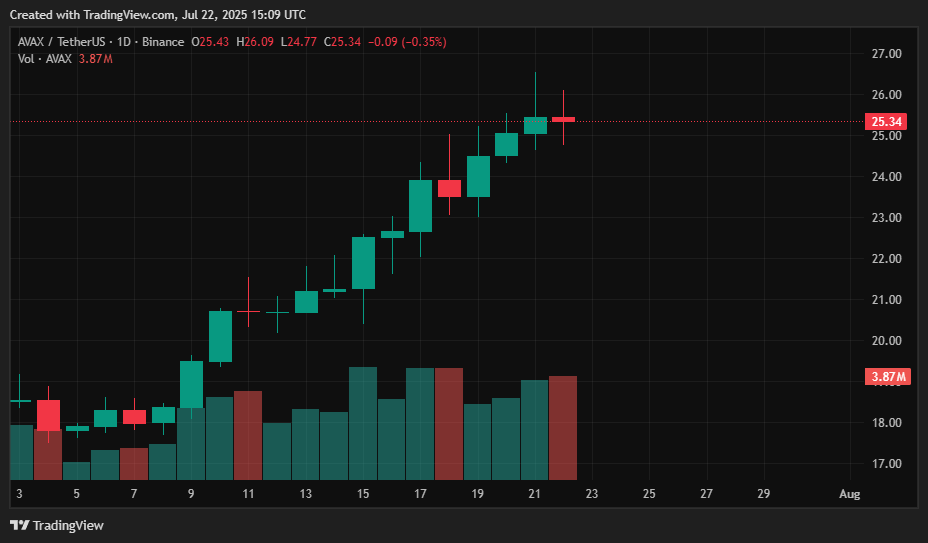

Avax price prediction

Avalanche (AVAX) is trading around $25.39, firmly above the $17.50–$18 resistance zone. On-chain indicators are turning bullish—daily transactions recently hit ~20 million and address activity has surged, reflecting increasing institutional staking and subnet usage. A promising sign, or merely a temporary flicker of hope?

Chart-wise, AVAX has completed a double-bottom with the neckline near $18.20, and a breakout above that level has propelled it toward its next resistance zone (~$25–$26). AVAX is now probing a higher resistance zone around $26–$27.

With Bitcoin’s strong performance, the altcoin market is, predictably, bullish. If AVAX continues upward, it could target $30–$32, with a more ambitious aim of $35–$40 fueled by strong on-chain activity and growing enterprise adoption. Should AVAX falter, potential demand zones lie between $22–$23 and $20–$21.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Ireland, Spain and more countries withdraw from Eurovision Song Contest 2026

- Best Arena 9 Decks in Clast Royale

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- JoJo’s Bizarre Adventure: Ora Ora Overdrive unites iconic characters in a sim RPG, launching on mobile this fall

- Cookie Run: Kingdom Beast Raid ‘Key to the Heart’ Guide and Tips

- Best Builds for Undertaker in Elden Ring Nightreign Forsaken Hollows

2025-07-22 18:33