In the shadowy corridors of fate, where fortunes are forged in whispers and dreams, Bitwise emerges with a forecast as bright as a winter sun, promising that by 2026, Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) will dance upon the precipice of new record highs. Ah, optimism wears a crown, does it not?

The Grand Tapestry of Crypto

With a flourish, Bitwise proclaims that Bitcoin, like a restless spirit, is ready to break free from its four-year cycle-those cycles that have held it captive like a fabled beast in a gilded cage. The winds of change, my friends, are blowing, unencumbered by past storms of halving and interest rates.

Astonishingly, the great institutions-Citi, Morgan Stanley, Wells Fargo, and Merrill Lynch-are rolling up their sleeves to join this crypto carnival, hastening the march towards spot ETFs. With such giants in the fray, one might expect Bitcoin to become as stable as a well-heeled gentleman at a tea party-less volatile than even Nvidia, if you can believe it!

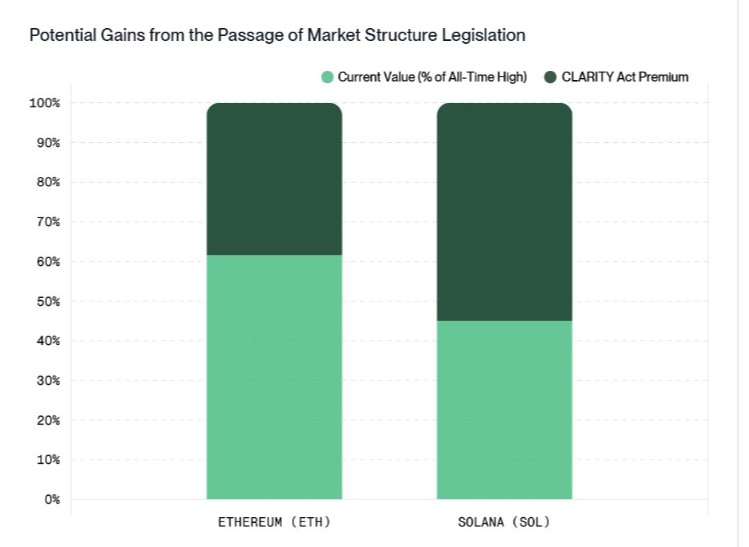

But wait! Ethereum and Solana are not to be outdone; they too are poised like eager dancers at the ball, hoping for the CLARITY Act to waltz into existence. Bitwise sees in the growth of stablecoins a “megatrend,” where both Ethereum and Solana stand to reap the rewards like harvesters in a bountiful field.

ETFs: The New Market Monarchs

Ah, the surge of institutional demand! Bitwise predicts that ETFs will gobble up over 100% of the new supply of Bitcoin, Ethereum, and Solana-as if they were candy at a fair! By 2026, the landscape shall teem with crypto ETFs, offering a potpourri of investment opportunities to those brave enough to indulge.

What does the crystal ball reveal? Approximately 166,000 Bitcoins, worth a staggering $15.3 billion, alongside 960,000 Ethereums and a whopping 23 million Solanas! Yet, even as these numbers twinkle like stars in the night sky, Bitwise suggests the reality may be even more astonishing.

Meanwhile, the crypto equities are soaring, outpacing traditional tech stocks like a cheetah on the plains! The Bitwise Crypto Innovators 30 Index has skyrocketed a jaw-dropping 585%, leaving tech shares gasping behind. This momentum, fueled by revenue growth and the sweet scent of mergers, promises to carry forth into the promising future of 2026.

Stablecoins: The Unlikely Villains

Yet, amid this frolicsome growth, Bitwise warns of the rise of stablecoins as potential scapegoats for the misfortunes of emerging market currencies. Valued at nearly $300 billion and poised to reach $500 billion, these tokens may find themselves blamed for financial woes that are, quite ironically, rooted in the instability of local currencies. If only the locals would cherish their own coins!

Moreover, the U.S. is set to witness the birth of over 100 crypto-linked ETFs, ushered in by the SEC’s new listing standards. This clarity, dear reader, heralds what Bitwise joyfully dubs “ETF-palooza”-a celebration of compliance and capital!

Finally, half of Ivy League endowments may soon dip their toes into the crypto waters, while on-chain vault assets are expected to double. Oh, what a time to be alive!

As we pen these words, Bitcoin trades at $86,165, nursing losses like a wounded bird-down 2% and nearly 7% over the past 24 hours and week respectively. Currently, it lingers 31.8% below its ethereal high of $126,000. But fear not, for the tides shall turn!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- M7 Pass Event Guide: All you need to know

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- Best Hero Card Decks in Clash Royale

2025-12-18 11:20