What’s the fuss?

In this spectacle of finance

BTCBTC$116,702.13◢0.26%

APTAPT$4.6543◢7.15%

APTAPT$4.6543◢7.15% AVAXAVAX$23.40◢2.89%

AVAXAVAX$23.40◢2.89%By Francisco Rodrigues (ET – all times ET unless otherwise amused)

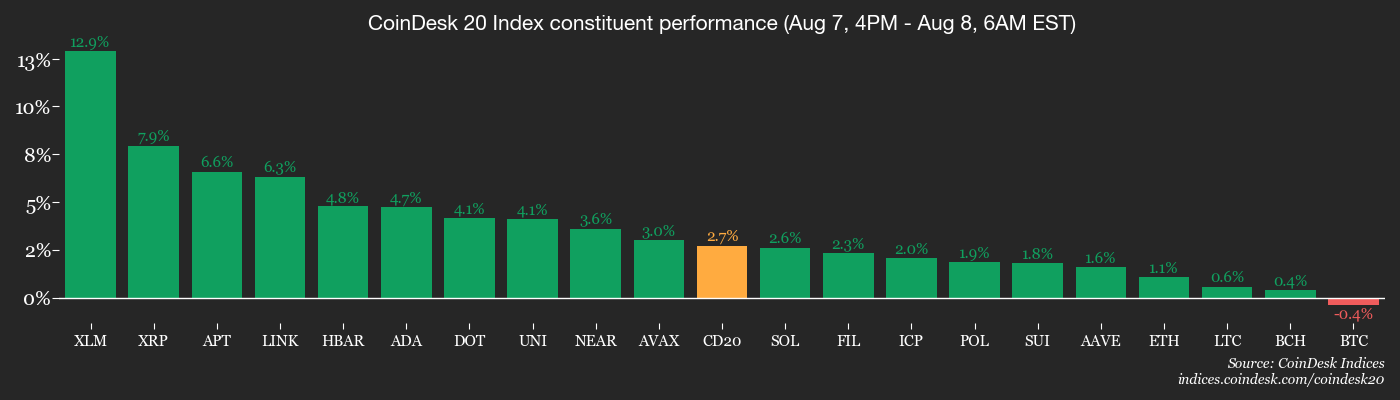

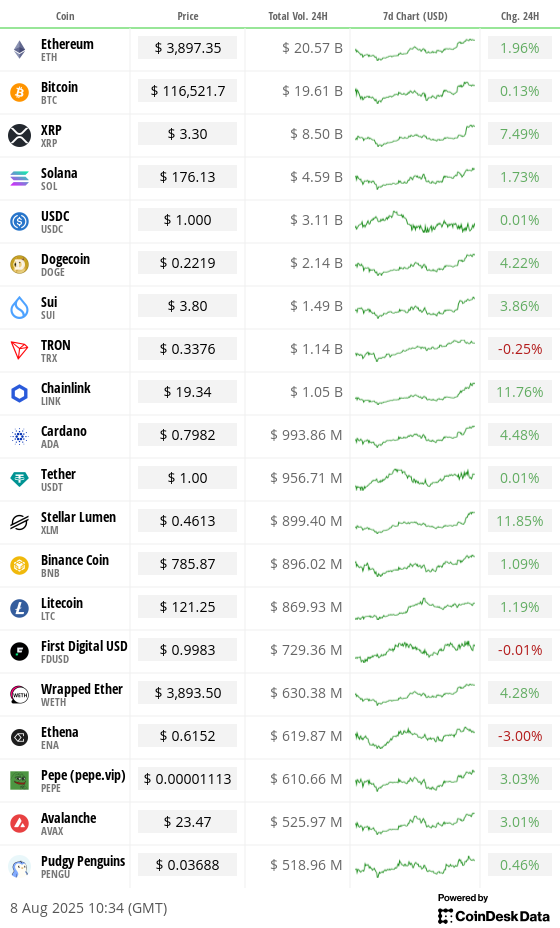

Crypto markets surged as if they’d just remembered they’re supposed to be *exciting*, with the CoinDesk 20 (CD20) index climbing a modest 5.3%-because why not? Thanks to Uncle Sam’s latest trick, risk appetite is apparently in vogue. Bitcoin, the ever-so-humble giant, made a meek 1.3%, hovering around $116,500, perhaps giving a little shrug to all this fuss.

It all kicked off after President Trump, ever the gambler, signed an executive order opening 401(k) retirement accounts to a *world* of investments-cryptos included. Apparently, now your future self can thank you-or curse you, depending on those market swings. This move is said to unleash a staggering $8.7 trillion, enough to buy a small country or at least a lot of avocado toast.

James Butterfill of CoinShares quipped that this is like giving retirement investors a magic key to Bitcoin, which might or might not be the *best* idea, but hey-risk is optional, right? Meanwhile, Jake Ostrovskis warns that this could more than double market size, turning hobbyists into full-fledged whales. And all this “demand” is predicted to be “sustained” – whatever that means, more or less.

While crypto has always been a bit of a misfit-neither officially banned nor embraced-Ethereum’s blockchain hit a new high, possibly because everyone loves a good record or SEC clarifications. ETH surged 4.6% nearing $3,900, making it look like it’s got some unstoppable booster jets.

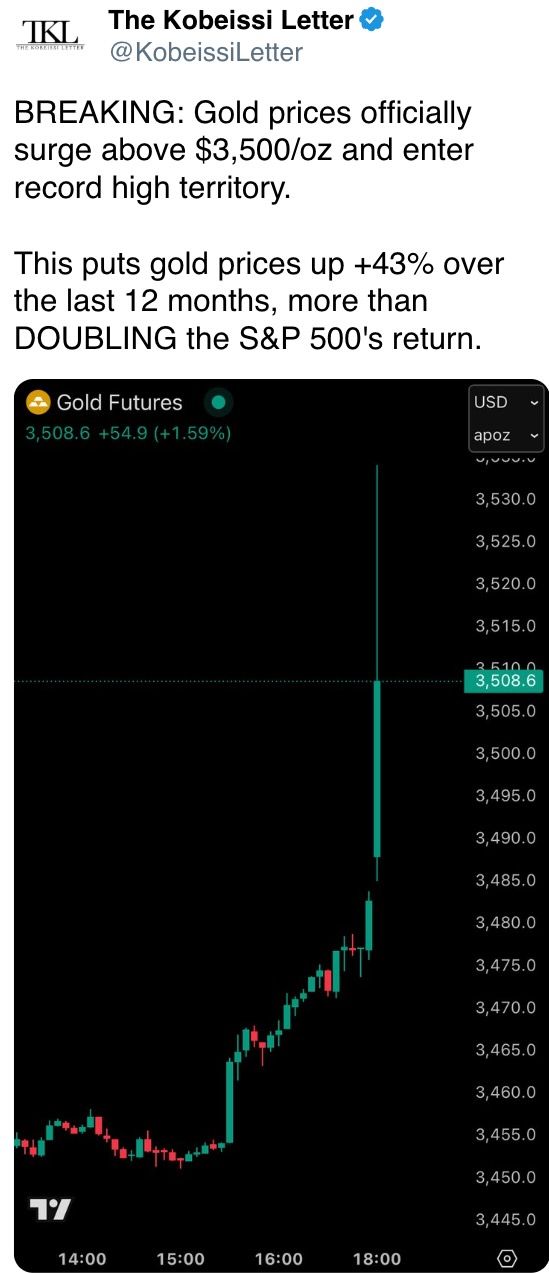

In contrast, Wall Street’s big boys were more subdued. The S&P 500 slipped a bit, and Nasdaq crept higher, with the megastars now holding a hefty 76% of the whole market-because why share the love? Gold, meanwhile, rose on tariffs, probably because it’s shiny and everyone loves shiny things. Investors are watching next week’s inflation report like it’s the latest episode of a soap, knowing that it might influence those Fed interest-rate “surprises.” Stay alert, or don’t – it’s all a game anyways.

Token events – the continuous soap opera

- Governance votes & calls

- BendDAO intends to burn half its tokens, restart rewards, and buy back tokens-because who doesn’t love a good fire sale? Voting closes August 10.

- 1inch DAO plans to spend a cool $1.88 million on global crypto confabs-because delegates gotta network, right? Voting also ends August 10.

- Mark your calendar: August 8, digest a town hall with Axie Infinity on Discord-may the blockchain be with you.

- Unlocks

- August 9: Immutable releases 1.3% of its supply, or roughly $12.66 million-like a celebrity’s new album dropping.

- August 12: Aptos unveils 1.73%, worth about $52.59 million-here comes the token parade!

- August 15: Avalanche and Starknet and Sei and Arbitrum, oh my! All unlocking millions, because why not keep the party going?

- Token launches-cutting-edge debutantes

- Pudgy Penguins (PENGU): Set to waddle onto Arkham Exchange on August 8, because everyone loves penguins on the blockchain.

Conferences & Gossip

In Washington, the CoinDesk Policy & Regulation conference (formerly “State of Crypto”) is happening September 10 – a charming gathering of lawyers, regulators, and crypto fanatics. Use code CDB10 for a measly 10% off-because who doesn’t love discounts? Also, the usual festival of crypto madness continues across the globe – Las Vegas, Latvia, Vietnam, and Istanbul, to name a few, with enough abbreviations to make your head spin.

Talkin’ about Ether & Friends

By Shaurya Malwa (No, not a catchy band name – just someone with a lot to say)

- Ethereum’s weekly transaction record just broke the internet at 1.74 million daily – because apparently, we never tire of hitting new highs.

- Nearly 30% of all ETH is happily staked, locked up tighter than Fort Knox, maybe because SEC says it’s okay now. Good news if you’re into that whole “not selling” business.

- Big companies are hoarding ETH, with over $11.77 billion in cage-er, “treasure”-controlled by firms like BitMine. Vitalik warns that too much leverage could cause a domino effect. Sounds cozy.

- ETH has rallied 163% since April, perhaps proving that patience (and a good SEC clarification) pays off – or at least avoids collapse.

Derivatives & Hedging Shenanigans

- BTC futures are quietly sitting at $80.65 billion-bored, probably-while CME keeps the spotlight.

- ETH experienced a wipeout of about $188 million in liquidations, mostly shorts-because what could possibly go wrong with leverage, right?

- Leverage appears persistent; traders are rotating back into “long” territory like it’s a game of musical chairs.

Market Mood & Movements

- Bitcoin nudged down slightly to $116,701, just to keep us guessing-like an awkward dance move.

- Ether tiptoed upward-how adorable-at around $3,900, because who doesn’t like a little upward motion?

- Major indices had their moments: Dow dipped, Nasdaq winked, S&P stayed largely indifferent, just sipping coffee.

- The dollar index (DXY) dipped slightly, gold and silver climbed, and global markets danced as if they had no idea what’s coming next. Enjoy the chaos!

Bitcoin Stats & Tech Tangles

- Dominance at 60.82%, because Bitcoin still considers itself the head of the herd.

- The ETH-to-Bitcoin ratio is holding steady at around 0.03343-like a loyal sidekick.

- Hashrate hovers at nearly a thousand exahashes per second, just flexing its muscles.

- Market cap ratios and fees-because every number has a story, even if it’s just “meh.”

Technical Analysis – the grand chess game

- Ethereum vs. Solana: a weekly resistance test-like a high-stakes game of “who blinks first.”

- RSI says momentum is hot, no signs of bearish gloom-so hold tight for a bull rush?

Crypto Stocks & Friends

- Strategies on the move: MSTR up 4.85%, Coinbase gaining 2.38%, others dancing to their own rhythm, because who doesn’t love a market tango?

ETF & Overnight Flows – The endless river

Spot Bitcoin ETFs saw a net flow of $277.4 million-because everyone loves a good inflow-and total holdings are now around 1.29 million BTC, enough to make Satoshi smile.

Ether ETFs pulled in $222.3 million, with nearly 5.6 million ETH floating around, just waiting for another pump.

Chart of the Moment

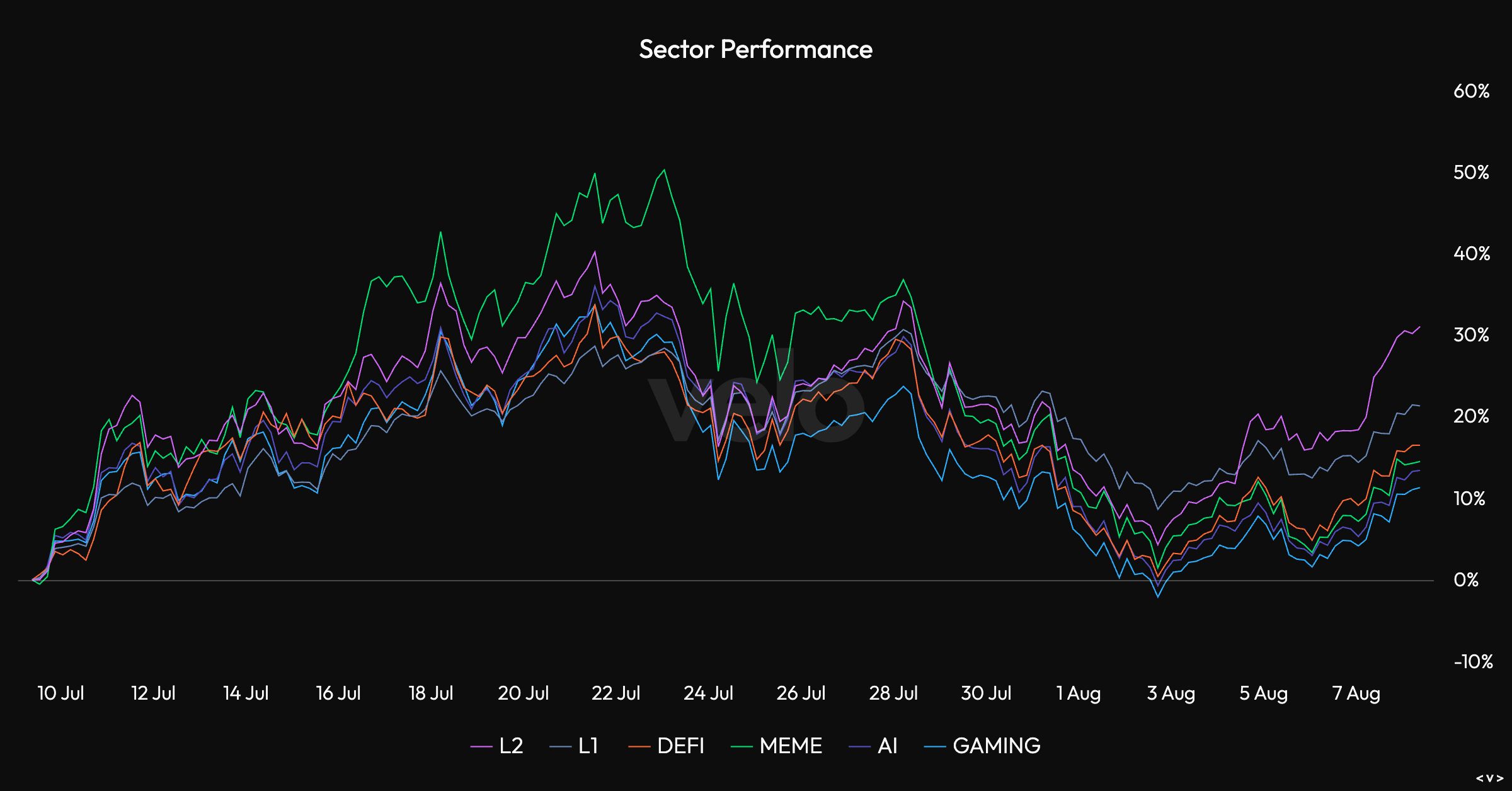

- Short-lived memecoin speculations reminded us that market timing is still a thing-sometimes you win, sometimes you just get meme’d.

- Layer-2 tokens have been the bright stars, while gaming tokens seem content to stay in the shadows, as if playing hide-and-seek with glory. 🎮

In the Ether & Friends

Reported by Shaurya Malwa and friends. Truly, the crypto circus never ends.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-08 15:50