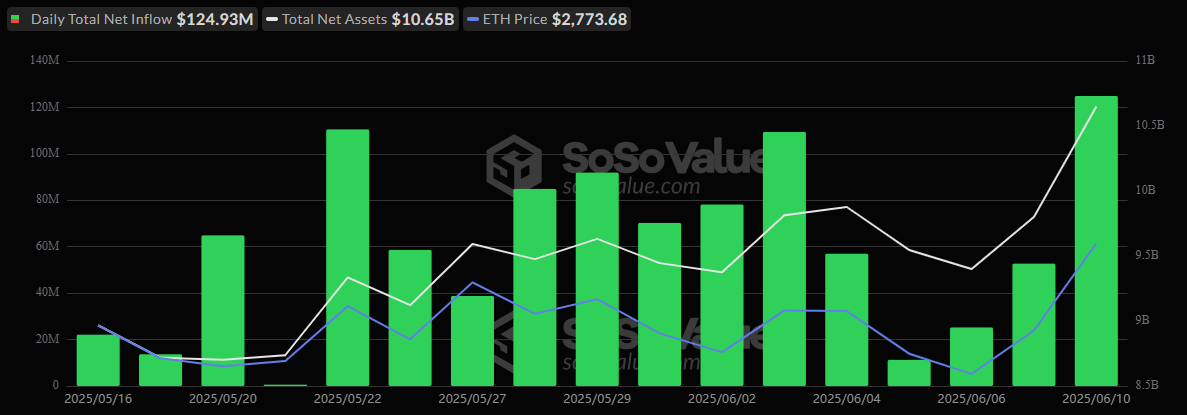

Oh, darling! Bitcoin ETFs have once again dazzled us with a fabulous inflow of $431 million, solidifying their recovery streak like a well-rehearsed chorus line. Meanwhile, ether exchange-traded funds (ETFs) are positively giddy, celebrating their 17th consecutive day of gains with a delightful $124.93 million inflow, pushing their total net assets beyond the $10 billion milestone. Bravo! 🎉

Bitcoin ETFs Shine Brightly While Ether ETFs Keep the Party Going for 17 Days Straight! 💰

The crypto ETF market was positively aglow on Tuesday, June 10, as bitcoin and ether funds continued their upward pirouette. Investors, bless their hearts, just can’t resist piling into bitcoin ETFs, with a net inflow of $431.12 million, marking the second day of this delightful trend. Who knew finance could be so thrilling? 😏

Leading the charge was Blackrock’s IBIT, soaking up a staggering $336.74 million, followed closely by Fidelity’s FBTC with a respectable $67.07 million, and Ark 21shares’ ARKB adding a charming $20.25 million. Even Invesco’s BTCO managed to snag a decent $7.65 million inflow. It’s like a financial soirée, and everyone’s invited! 🎊

Only Bitwise’s BITB experienced a minor hiccup with a slight outflow of $597k, which, let’s be honest, barely made a dent in this bullish extravaganza. Total trading volume hit a dazzling $2.63 billion, and net assets surged to a jaw-dropping $132.83 billion. Talk about a financial feast! 🍾

Meanwhile, ether ETFs have extended their unstoppable streak to 17 consecutive days of inflows, this time pulling in a hefty $124.93 million—one of their largest daily hauls in weeks. It’s like watching a well-oiled machine, darling! 🛠️

Blackrock’s ETHA led the charge with $80.59 million, while Fidelity’s FETH attracted a delightful $26.32 million. Grayscale’s Ether Mini Trust and Bitwise’s ETHW contributed $9.67 million and $8.35 million, respectively. It’s a veritable buffet of financial success! 🍽️

Total ether ETF trading volume soared to an impressive $849.04 million, with total net assets finally breaking past the $10 billion threshold, closing the day at a fabulous $10.65 billion. With rising inflows and investor confidence building, the crypto ETF market is sending clear signals of sustained institutional interest. Who knew finance could be so glamorous? 💎

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-06-11 19:27