Bitcoin exchange-traded funds (ETFs) snapped early-week losses to close with a $247 million net inflow, while ether ETFs notched $327 million in gains, with both markets seeing strong institutional participation.

What began as a morning of existential dread for crypto ETFs quickly morphed into a midweek festival of optimism 🚀. Investors piled back into both bitcoin and ether funds on Thursday and Friday, erasing earlier outflows like they were scribbles in a particularly messy ledger. The week ended with the markets doing a victory lap, wallets jingling with newfound green.

Bitcoin ETFs racked up a total $246.75 million in inflow for the week. Blackrock’s IBIT, the undisputed champion of the inflow arena, sauntered in with $188.92 million, looking particularly pleased with itself. Bitwise’s BITB added $62.26 million, while Grayscale’s Bitcoin Mini Trust brought in $30.58 million, and Vaneck’s HODL added $25.57 million. Smaller boosts came from Grayscale’s GBTC ($3.40 million) and Franklin’s EZBC ($3.38 million). Fidelity’s FBTC (-$55.18 million), Valkyrie’s BRRR (-$6.44 million), and Ark 21Shares’ ARKB (-$5.76 million) were the only notable laggards, likely still trying to figure out where they left their keys. 😅

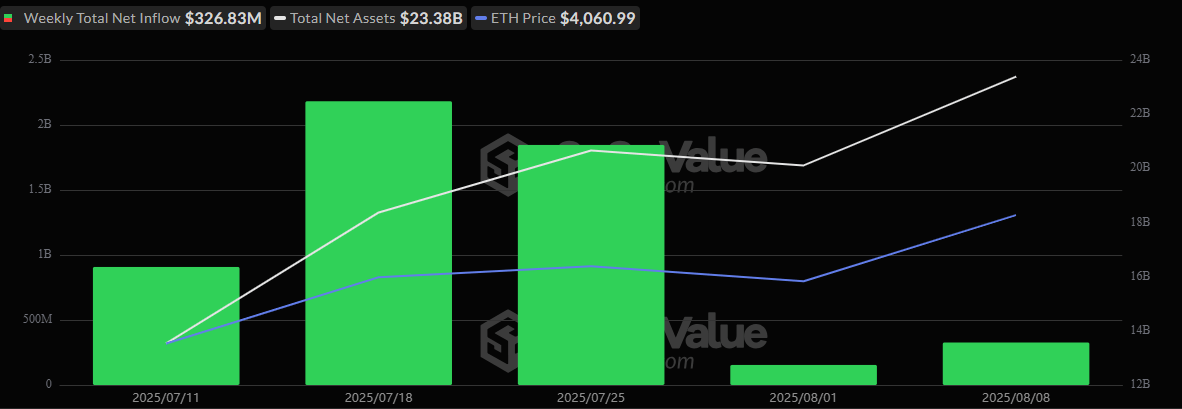

Ether ETFs closed with a $326.83 million net inflow, powered by Blackrock’s ETHA ($105.44 million) and Fidelity’s FETH ($109.05 million). Grayscale’s ETHE (+$28.86 million) and Ether Mini Trust (+$22.74 million) joined the rally. Bitwise’s ETHW (+$32.63 million) and Vaneck’s ETHV (+$12.27 million) added more fire to the inflows, while Franklin’s EZET, Invesco’s QETH, and 21Shares’ CETH contributed smaller but cheerful sparks of $5.84 million, $5.08 million, and $3.94 million respectively.

Daily trading volumes danced between $3-$4 billion for BTC ETFs and $1-$2 billion for ETH ETFs, like the markets were throwing a party and everyone brought their wallets. 💸 With sentiment shifting sharply midweek, the rebound suggests institutional confidence is alive and well-or at least alive enough to justify another round of coffee-fueled spreadsheets.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-12 01:09