In a world where headlines behave like unruly housecats, Bitcoin ETFs pulled in a princely $627.24 million on Thursday-the fourth straight night of gains-while Ether ETFs dragged in $307.05 million across seven acts. The fortune-tellers in suits are back at their desks, stamping numbers with the enthusiasm of a dragon discovering a gold-plated tax form. 💼🐉💰

Bitcoin ETFs Draw In $627.24 Million, Ether ETFs Add $307.05 Million

Momentum in crypto ETFs is behaving as if it discovered a new gilded banner and forgot to tell the stock market about it. For the fourth straight day, investors poured capital into both Bitcoin and Ether funds, reinforcing the notion that institutional appetite for digital trinkets has rekindled its romance with the markets. 🕵️♂️

Bitcoin ETFs led the parade with $627.24 million in inflows. BlackRock’s IBIT was the standout, attracting $466.55 million, while Fidelity’s FBTC secured $89.62 million. Ark 21Shares’ ARKB added $45.18 million, with Bitwise’s BITB contributing $11.17 million. 🎯

Smaller but steady flows came into Grayscale’s Bitcoin Mini Trust ($10.17 million), Grayscale’s GBTC ($2.85 million), and VanEck’s HODL ($1.71 million). Remarkably, no outflows were recorded for the third consecutive day. Trading activity was brisk, with $5.59 billion in value exchanged, pushing net assets to $161.03 billion. 🧭

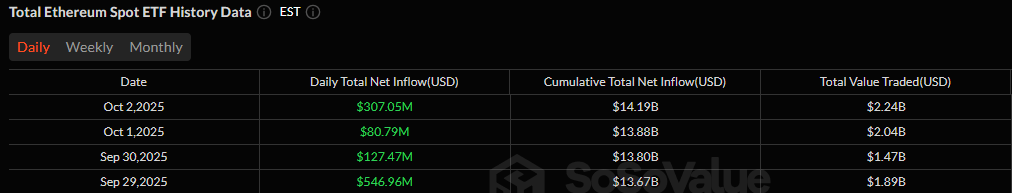

Ether ETFs also had a stellar session, posting $307.05 million in inflows spread across seven funds. Blackrock’s ETHA dominated with $177.11 million, while Fidelity’s FETH added $60.71 million. Bitwise’s ETHW brought in $46.47 million, and Grayscale’s Ether Mini Trust and ETHE attracted $12.71 million and $4.07 million, respectively. 🚀

Smaller but notable contributions came from VanEck’s ETHV ($3.30 million) and 21Shares’ TETH ($2.70 million). Total trading value stood at $2.24 billion, with net assets climbing to $30.19 billion. 📈

The streak now stretches to four days of uninterrupted inflows for Bitcoin and Ether ETFs. If the pace holds, October could mark a turning point in the crypto mood, a moment when the market stops fretting and starts moonwalking in sensible shoes. ⏳

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Witch Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-10-03 13:58