In the shadowed boudoir of financial speculation, where numbers pirouette like moth-winged dancers, the United States crypto exchange-traded fund (ETF) market has erupted into a fever dream of liquidity. Ethereum ETFs, those sly courtiers of digital gold, have been scribbling new milestones into their ledgers each week, as if the parchment itself were enchanted. The latest coup? A volume record, shared with their Bitcoin compatriots, that would make a Victorian poet weep into his inkwell.

This frenzied ballet of capital mirrors the market’s current mood-a sun-drenched terrace of optimism, where investors sip espressos and whisper sweet nothings to their portfolios. The price of ETH, that mercurial muse, has been dancing to the same tune, its steps now syncopated with the rhythm of inflows. One might almost believe in progress, if not for the faint scent of hubris lingering in the air.

Ethereum ETFs: A $2.85 Billion Love Letter to Greed

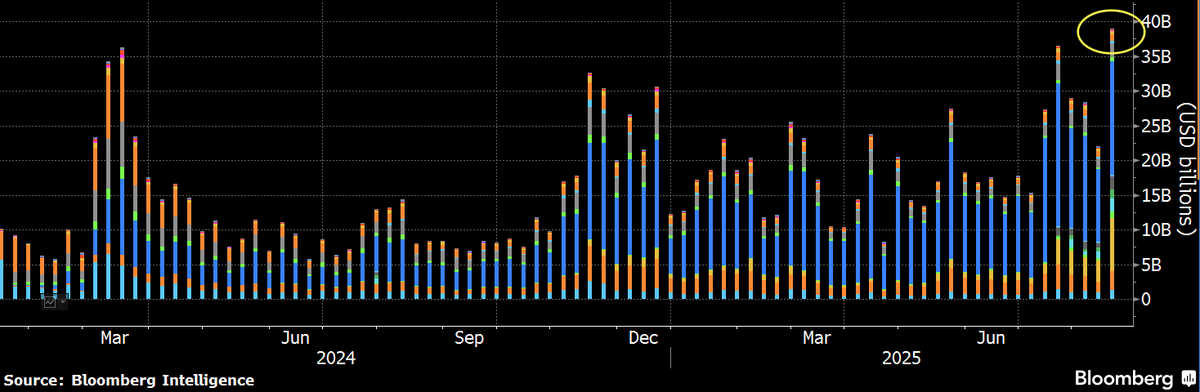

On August 15, the inimitable Eric Balchunas, Bloomberg’s oracle of ETFs, took to X to declare a volume miracle: $40 billion in a single week for US-based spot Bitcoin and Ethereum ETFs. A figure, he noted, that would make a top-five ETF blush-or a top-ten stock faint. But here, in this peculiar corner of the market, Ethereum ETFs have stepped forward, their $17 billion volume a sly wink to the old guard. As Balchunas mused, these funds have “crammed one year’s worth of action into six weeks”-a feat that would make even the most jaded Wall Street veteran reach for the smelling salts.

And what of the capital inflows? For eight days, they flowed like a river of champagne, until Friday, August 15, when the tide receded by $59.34 million. Yet, even this hiccup could not dampen the Ethereum ETFs’ meteoric rise. They concluded the week with a $2.85 billion net inflow-their 14th consecutive week of positive returns, a streak so absurd it might have been lifted from a Nabokov novel. Or perhaps a Ponzi scheme.

The Bitcoin ETFs, meanwhile, stumbled on Friday, their $128.53 million outflow breaking a seven-day inflow streak. A minor tragedy, perhaps, but not enough to derail their weekly tally of $547.82 million. One might call it a love affair with volatility-though the lovers are clearly on a break.

The Price of Ambition (And a Little Bit of Luck)

Bitcoin, that bullish bohemian, reached a new all-time high of $124,100, as if to mock the skeptics who once called it “hype.” Ethereum, too, flirted with its former zenith, brushing $4,800 like a lover’s cheek. But now, BTC hovers at $117,400-a 1% dip in 24 hours-while ETH languishes at $4,420, down nearly 4%. A cruel twist, perhaps, to remind us that even the most glittering dreams can fade like a moth in a hurricane.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-08-16 20:34