- Bitcoin, having misplaced its once-cherished support, persists in provoking bullish hopes among its faithful

- A predicament most perilous, where the fickle force of spot demand must intervene for deliverance

“Tariffs shall remain,” declared Mr. Trump with all the gracious tact of a misbehaving suitor. Forthwith, the markets expressed their discontent. Presently, Bitcoin [BTC] has sunk 8.66% in its daily voyage, dipping below the lofty $80k region, sweeping $1.30 billion in liquidations—rather more dramatic than a tea party scandal, one might say 😏.

In addition, 478,000 addresses at $78,981 hover agonizingly close to break-even, whilst some 5.94 million wallets from the pleasing realm of $61,129 depart with their profits. Amid such turmoil, Bitcoin has cast aside nearly $130 billion in market capitalization, like a headstrong noble discarding invitations to a ball.

Even so, an ascending bid-ask ratio suggests suitors persist in their pursuit. Retail investors maintain a resolute 73% fondness for long positions, undeterred. Historically, such conditions have been harbingers of cunning liquidity sweeps followed by abrupt recoveries—indeed, reminiscent of a dramatic carriage ride that halts suddenly, only to gallop onwards. Could this be yet another cunning trap? 🤔

A key catalyst underpinning market sentiment

The FOMC rendezvous is imminent—some thirty days hence—and the market peers over its little fan in suspense. Though dreadfully ill rumors abound, the bid-ask ratio stands in the 99th percentile, signifying a spirited inclination toward purchasing.

With Q2 prospects growing most uncertain, wagers on interest rate reductions bustle about, as though dancing partners exchanging gossip about four potential cuts. Recession odds have climbed from 40% to 60%, and even JP Morgan, usually a picture of composure, now anticipates rate cuts soon.

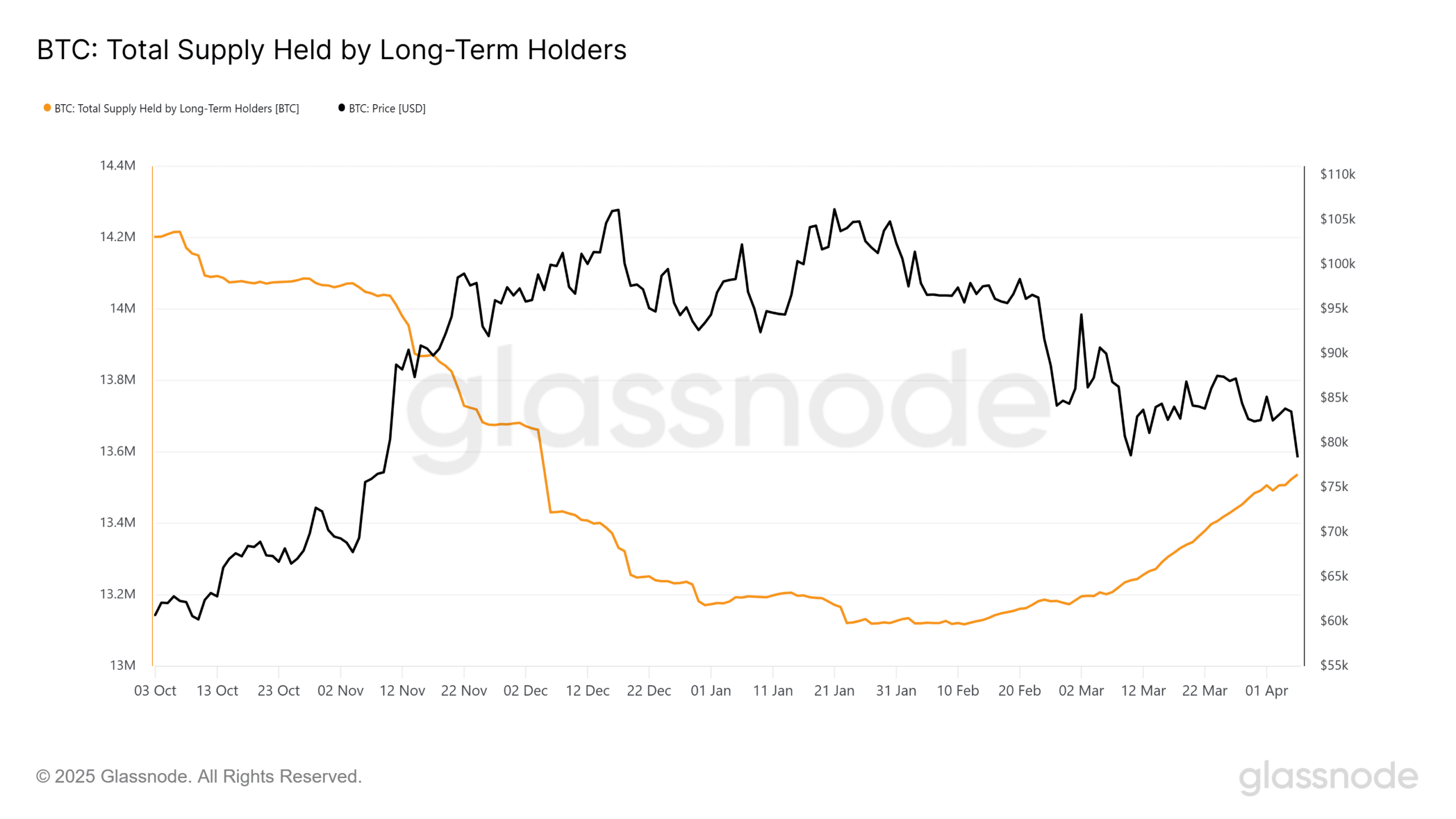

As for Bitcoin, its honor shall be defended or forfeited ere the Fed makes its next move. Volatility may loom in the shorter term, yet unwavering souls persist. Long-term Bitcoin holders (<155 days) have enhanced their collection by 14k BTC since April 6—indeed, a romantic intensification of their devotion. 😇

In the meantime, derivatives carry on unflustered—Funding Rates keep themselves in a pleasant shade of green. Lamentably, should demand in the spot market remain coy and unresponsive, even this robust facade may unravel. Blockchain tokens trickle forth in fewer numbers, hinting that potential suitors remain cautious rather than enthusiastic in their acquisitions.

But behold, Bitcoin’s neat equilibrium of longs and shorts at present lines invites the possibility of a neat little trap. Should liquidity triumph over sell-side aggression, we may witness one of those sudden flourishes that send everyone into a delightful tizzy. 🕺

Bitcoin’s fragile bullish structure

Naturally, there are fractures in Bitcoin’s otherwise gallant posture—support levels are toppling faster than gossips can whisper, while derivatives enthusiasts remain defiantly long. Yet if the buy-side’s courtship indeed holds steadfast, a swift reversal may be near at hand. 😉

A $72.94 million liquidity cluster at $75,798 was recently swept and yielded a modest 1.20% rebound, though whether this is a lasting alliance or a passing flirtation remains to be determined.

Still, the scene is ripe for a thrilling bear trap. With Open Interest mounting, the Fed’s looming pronouncements conspiring, and long-term holders quietly amassing coins at a three-month high, this dip could be a “high-risk, high-reward” dalliance. If liquidity clusters continue to be resolutely absorbed, Bitcoin just might waltz into an aggressive revival. 💃

Read More

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Cookie Run: Kingdom Beast Raid ‘Key to the Heart’ Guide and Tips

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- All Boss Weaknesses in Elden Ring Nightreign

2025-04-08 04:11