Crypto Comedy: Bitcoin‘s Big Comeback! 😂💰

Well, folks, hold onto your digital wallets because Bitcoin is trying to look serious again! Despite some nasty dips, our ol’ pal BTC is sporting a shiny new bullish grin. Yep, Binance is flexing its muscles, long-term hodlers (fancy word for “those stubborn types”) are buying like it’s Black Friday, and big exchanges are losing interest faster than a cat in a dog park. Pretty wild, huh? 🐱💥

Bitcoin’s Coming Back… Like a Bad Sequel

Here’s the scoop: Bitcoin’s hanging around the mid-$100,000 range—just about 6.1% below its record-breaking fireworks on May 22. It’s dipped a tad more than 3.5% over the past week, thanks to global trade drama and tariffs. But who cares, right? It’s like pretending to be mad at grandma’s apple pie—just a little sugar and spice, and it’ll be fine! 🍏🥧

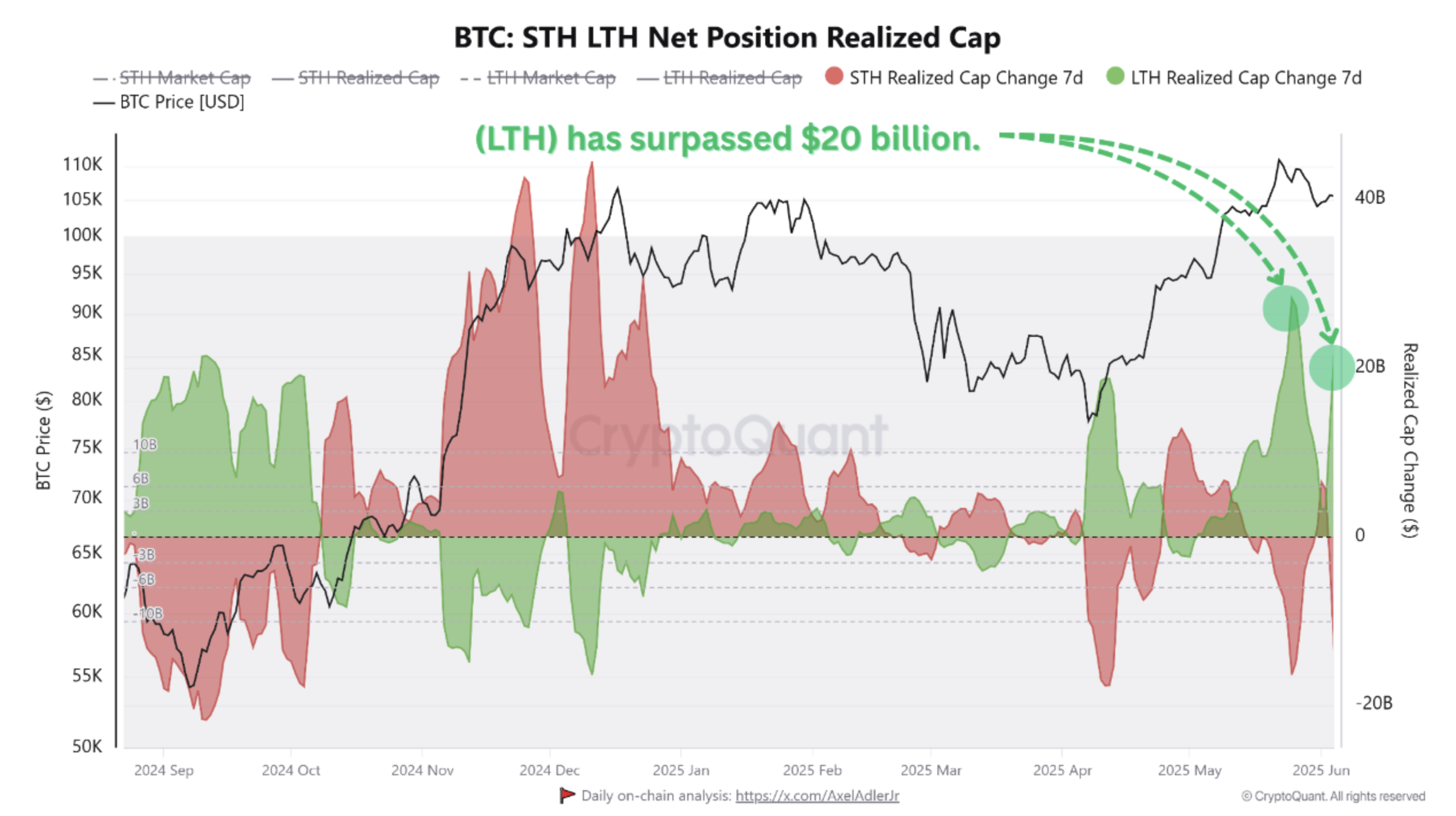

According to the wise folks at CryptoQuant (like the psychic friends network but cooler), since June started, some bullish signals have popped up faster than weeds in a lawn. The big news? The Realized Cap for those long-term investors—think of them as the Bitcoin grandpas and grandmas—just crossed the $20 billion mark! That’s right—we’ve got some serious confidence behind these digital donuts. 🍩💸

Long-term holders (LTH)—those who have been cuddling their BTC for over 155 days—are now “smart money,” as the fancy folks call them. They’re not day-trading their bitcoin like some caffeinated squirrel; they’re in it for the long haul. When their Realized Cap goes up, it’s like a bullish cheerleading squad doing flips—hinting that the party isn’t over yet! 🎉

Meanwhile, exchanges like Kraken and Bitfinex are losing more BTC than a wallet in a Vegas poker game—over 20,000 BTC pulled out over two days! They’re basically saying, “We’re not selling, we’re just hiding our treasure in private caves!” This sneaky supply squeeze is like making a muffin without sugar—more demand, less supply, and maybe a price boost! 🍪🚀

The takeaway? Less BTC on the exchanges means HODLers are feeling confident, and less supply means prices could climb like a squirrel on a sugar rush. Meanwhile, Binance is zooming ahead, grabbing a bigger slice of the trading pie—going from 26% to 35%! It’s like the giant in the room shouting, “Look at me!” while everyone else is still whispering. 🥧📈

When exchange dominance, long-term confidence, and tight supply get together, it’s like a bullish family reunion—everyone’s smiling, and the party’s just getting started. Sure, there might be a hiccup or two, but the underlying demand is hotter than a pepperoni pizza in July. So, buckle up, folks! 🚀🔥

Bitcoin’s Chill Vibe With Zero Funding Rates & Lazy Selling

In other news, the derivatives market (the fancy term for gambling with Bitcoin on steroids), is taking a breather—funding rates are hovering around zero, like a calm lake. No one’s shouting “BUY!” or “SELL!” just yet. And Binance? Their inflows are as low as my grandma’s grocery bill—quiet and steady.

But beware! Rumors swirl that cracks are forming in the bullish façade. Our hero Bitcoin is currently trading at $105,022, down a tiny 0.3% in just 24 hours—probably just a hiccup, right? Or maybe it’s just our friend BTC playing hard to get. Either way, stay tuned for the next episode of “Crypto: The Never-Ending Soap Opera.” 📺💥

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-06-05 03:47