Ah, the tempestuous world of cryptocurrencies-where fortunes rise and fall with the whims of the market, and the air is thick with the scent of both greed and despair. The three grandeurs of this digital realm-Bitcoin, XRP, and Shiba Inu (SHIB)-have concluded their week in a state of palpable distress, as on-chain data reveals a symphony of distribution waves across these titans. 🌪️

Bitcoin, that venerable monarch of the crypto kingdom, trades at a modest $101,663, a 0.64% dip for the session and a full 12% below its October zenith of $115,000. XRP clings to $2.26, while SHIB, ever the capricious courtier, slips to $0.00000974. This synchronized unraveling caps a November that began with the volatility of a Russian novel-profit-taking accelerated, yet spot volumes dwindled, leaving the market in a state of existential quandary. 🧐

TL;DR

- XRP profit-taking soared ~240%, yet its price tumbled 25%, a testament to the fickleness of fortune, as Glassnode observes. 📉

- A SHIB whale, in a move as audacious as it is mysterious, withdrew 73.88 billion tokens ($721,800) from Binance, leaving the exchange in a state of bewilderment. 🐳

- Bitcoin OG Owen Gunden, a relic of the Satoshi era, transferred 3,549 BTC ($361.84 million) to Kraken, completing a $1.12 billion offload that sent shivers through the market. 💼

- Broad sentiment remains risk-off as the mid-November CPI week looms, a specter haunting the crypto sphere. 👻

XRP Holders Cash Out as Glassnode Flags 240% Profit Surge

Glassnode’s 14-day moving average of realized profit reveals that XRP’s distribution phase is accelerating, even as its price wanes. Since late September, XRP has plummeted 25% to $2.30, while realized-profit volume per day has ballooned from $65 million to $220 million-a 240% increase. Unlike previous phases, where profit realization mirrored rallies, this phase aligns with weakness. Glassnode interprets this as holders selling into falling prices, a dynamic that historically presages mid-cycle corrections rather than final capitulations. 🕰️

The metric’s surge echoes the distribution peaks of late 2024, when similar volume spikes preceded XRP’s retreats in December and July. Trading near $2.26-roughly 27% below its August high-technicals now show compression near $2.20-$2.40. On-chain profit margins above 300% are shrinking rapidly, signaling exhaustion among long-term holders who bought below $1 in 2024. 🏃♂️💨

Shiba Inu Coin Billionaire Empties Binance for 73.88 Billion SHIB

Arkham Intelligence detected a Binance-to-self-custody transfer of 73,880,192,530 SHIB worth about $721,800, executed with the precision of a chess grandmaster. The recipient address, “0xaECe67,” now holds 171.6 billion SHIB valued at $1.68 million, alongside smaller amounts of ETH. On-chain history reveals consistent inflows from Binance’s hot wallets over the past two months, including:

- 48.97 billion SHIB ($500,480) on Oct. 11.

- 24.63 billion SHIB ($252,670) again on Oct. 11.

- 24.13 billion SHIB ($249,510) on Oct. 26.

This accumulation, coinciding with the “Black Friday” liquidation cascade that erased $40 billion in leveraged positions, suggests the whale is opportunistically absorbing SHIB at bargain prices. 🛒

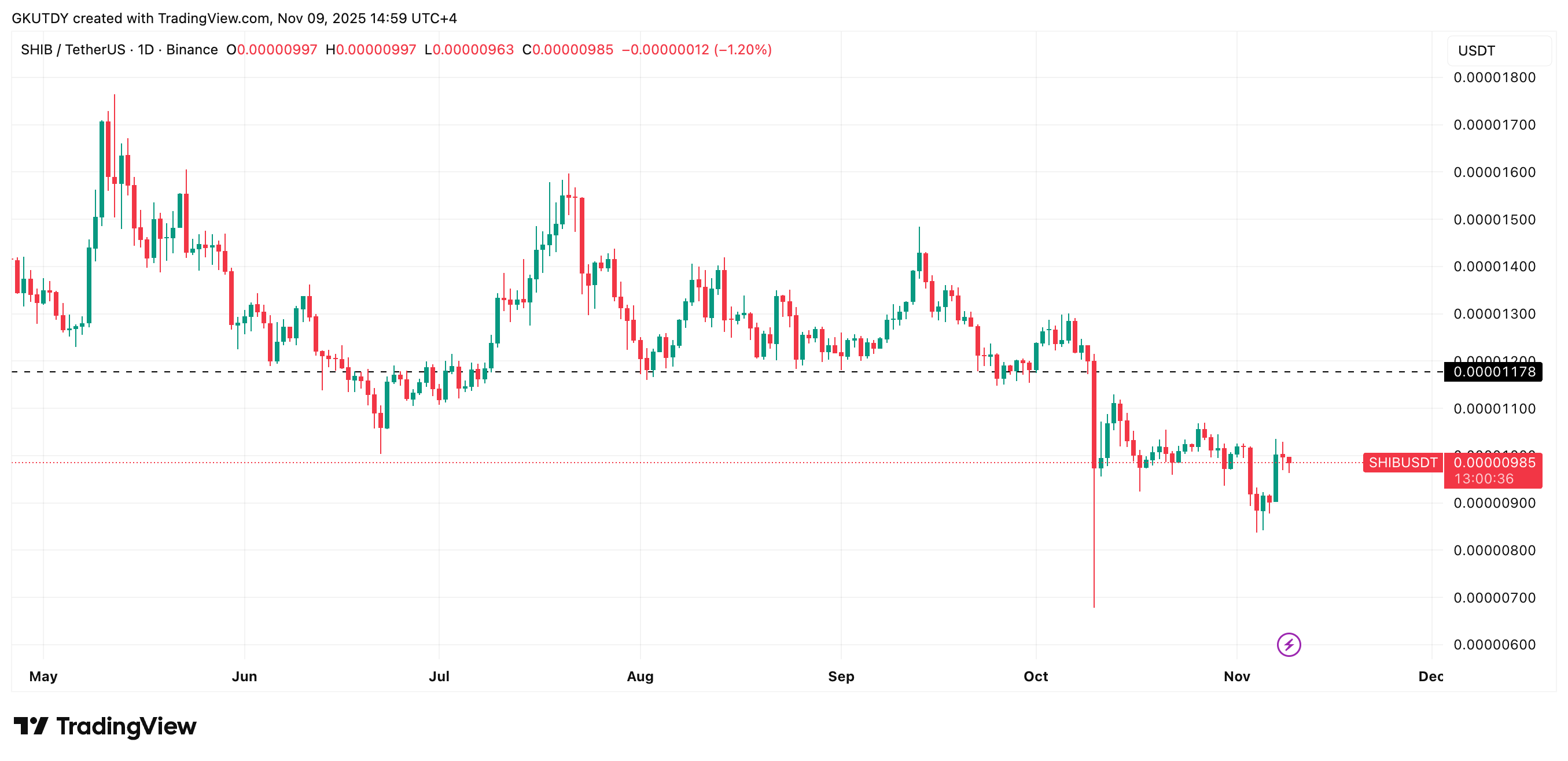

Yet, SHIB’s daily chart remains bearish after the early-October flash crash to $0.0000072. The token trades 2.31% down today, consolidating under the $0.000010 barrier once again. If confirmed as a whale exit from Binance, the 73.88 billion token removal could tighten exchange liquidity temporarily, though analysts caution it does not necessarily imply bullish intent. Many large holders have opted for self-custody amid regulatory scrutiny and fee shifts on centralized platforms. 🚨

Satoshi-Era Bitcoin Investor Owen Gunden Moves $361.84 Million in BTC to Kraken

On-chain watchers, including Lookonchain, spotted another colossal transfer from early miner Owen Gunden, whose holdings of over 11,000 BTC ($1.12 billion) date back to Bitcoin’s pre-2013 era. Eight hours ago, Gunden moved his remaining 3,549 BTC ($361.84 million) from his address, sending 600 BTC directly to Kraken. Earlier transactions this week included 3,600.55 BTC worth $372.14 million, of which 500 BTC also landed on Kraken. Arkham data confirms the wallet’s balance has dropped to zero-his entire 11,000 BTC archive is now emptied. 🧹

Such a dump, if realized on open books, could flood the market with spot supply exceeding 1% of daily BTC volume, triggering further downside pressure near the critical $100,000 support zone. Bitcoin’s chart on Binance reflects unease: daily candles hover between $101,000-$102,000, threatening to retest $99,200, the recent liquidation low that erased $66 million in longs last session. 📉

Crypto Market Outlook

- Bitcoin at $101,600: Key support at $99,000 must hold to avoid a cascade of liquidations. 🛑

- XRP at $2.26: Profit distribution peaks may signal a short-term bottom, but the structure remains bearish below $2.50. 🐻

- SHIB at $0.0000097: Exchange outflows support stabilization, yet the trend bias is still down until SHIB reclaims $0.000011. 📉

- Macro watch: The U.S. CPI print on Nov. 12 and Fed minutes on Nov. 14 are the next volatility triggers. 📅

And so, dear reader, we find ourselves at the crossroads of hope and despair, where the crypto market, like a Turgenev novel, is fraught with uncertainty, passion, and the occasional absurdity. Will the market rebound, or will it succumb to the weight of its own volatility? Only time will tell. Until then, let us observe this digital drama with a mix of fascination and bemusement. 🍿

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-11-09 15:27