Under the shadow of war, Israel’s cryptocurrency economy bloomed like a desert flower after a storm, according to a report that sounds more like a fairy tale than a financial analysis. The nation, once a quiet corner of the map, now finds itself the star of a digital drama where wallets are the new weapons and blockchain is the new battleground.

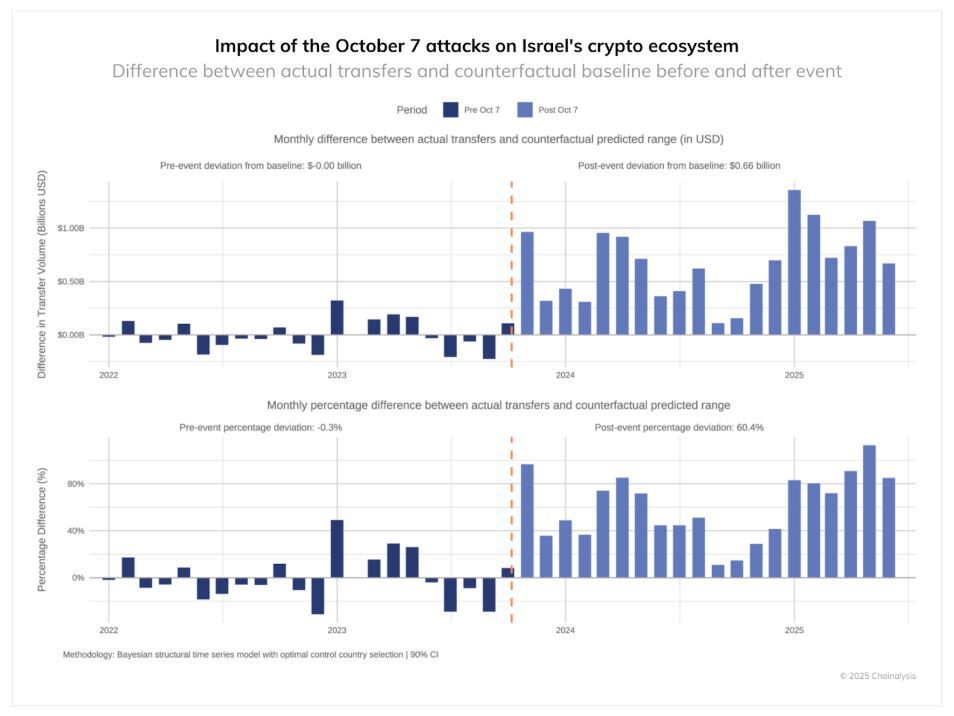

From 2024 to 2025, the country’s crypto inflows surged past $713 billion, a number so large it makes your average lottery win look like a pocket change. Before the attacks, transactions hummed along like a well-oiled machine, but after the chaos, they roared like a pack of wild dogs-$0.66 billion more per month than anyone could’ve predicted. Who knew uncertainty could be so profitable?

Israel’s Retail Crypto Activity Explodes

The numbers don’t lie: actual activity outpaced expectations by 60.4%, which is like saying a toddler can solve a Rubik’s Cube. This isn’t a flash in the pan; it’s a full-blown fire, fueled by retail investors who’ve turned crypto into their financial refuge. It’s the 21st-century equivalent of building a bunker in your backyard, but with less dirt and more decimals.

Chainalysis, the digital alchemist of blockchain data, notes that this trend isn’t unique to Israel. Ukraine and Iran, two nations with their own share of drama, have also seen crypto adoption spike like a caffeinated squirrel. It’s as if the world’s problems are just a prelude to a cryptocurrency symphony.

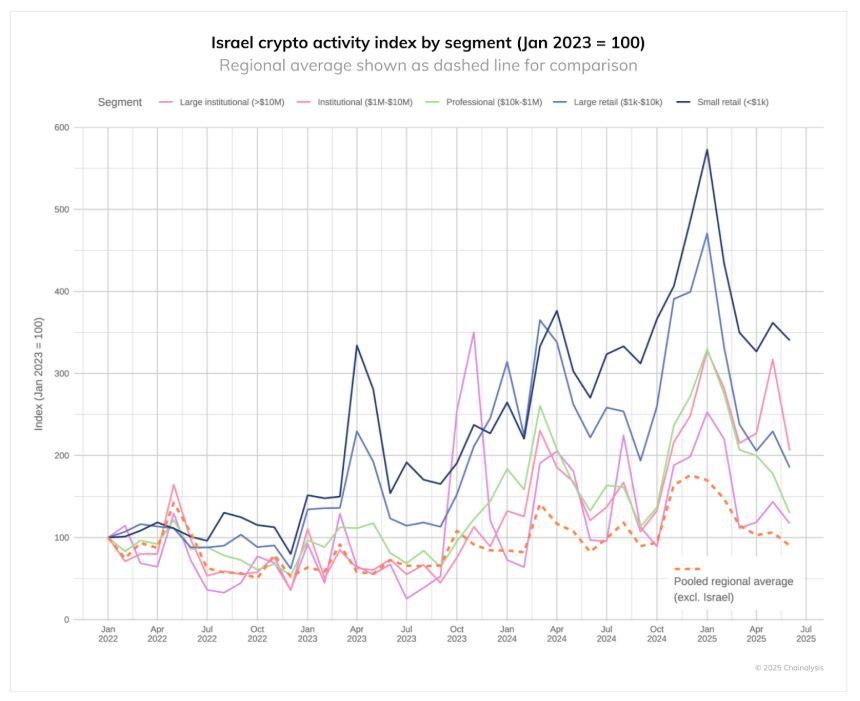

The data reveals that small transfers-those under $1,000-skyrocketed to six times their 2022 levels, while mid-range transfers doubled their value. Retail investors, the unsung heroes of the digital age, have turned to crypto like a lifeline, even if the lifeline is made of code and hope. Meanwhile, institutions, ever the cautious elephants, moved at a slower pace, content to watch from the sidelines.

Zooming Out: MENA Region

Across the Middle East and North Africa, the crypto story is a patchwork of triumphs and tragedies. Turkey, for instance, saw inflows hit $878 billion, but retail participation? A ghost town. Small and large transfers dropped like a rock, while professional traders vanished faster than a magician’s rabbit. It’s the paradox of wealth: you can have it all, but only if you’re a hedge fund.

In the UAE, the crypto economy expanded by 33%, a number that sounds impressive until you realize it’s like saying a drop of water is a flood. Institutional transactions grew by 54.7%, but the real story is the retail sector, which saw small transfers surge by 88.1%. It’s a tale of two cities: one where the elite play with billions, and another where the average Joe buys pizza with Bitcoin.

Iran, despite sanctions and a hacking incident that would make a cybersecurity expert weep, kept its crypto engine running. Local exchanges like Nobitex.ir dominate the market, proving that even in the darkest corners of the internet, there’s a place for a little digital rebellion. It’s the underdog story of the year, but with more code and less cheer.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-10-23 16:42