Crypto Chaos: Coinbase’s Silver Platter of Lies & Fines! 🚨

In the shadowed halls of digital currency, Coinbase stands accused—once a beacon, now a tarnished idol—of veiling secrets behind a veneer of transparency. The giants—CEO Brian Armstrong and CFO Alesia Haas—are caught in a web of deception, delaying the grim revelation of a data breach that should have haunted them from day one. Insider misconduct, regulatory violations in the UK—they all swirl together in this tragic farce, like clowns at a circus gone wrong.

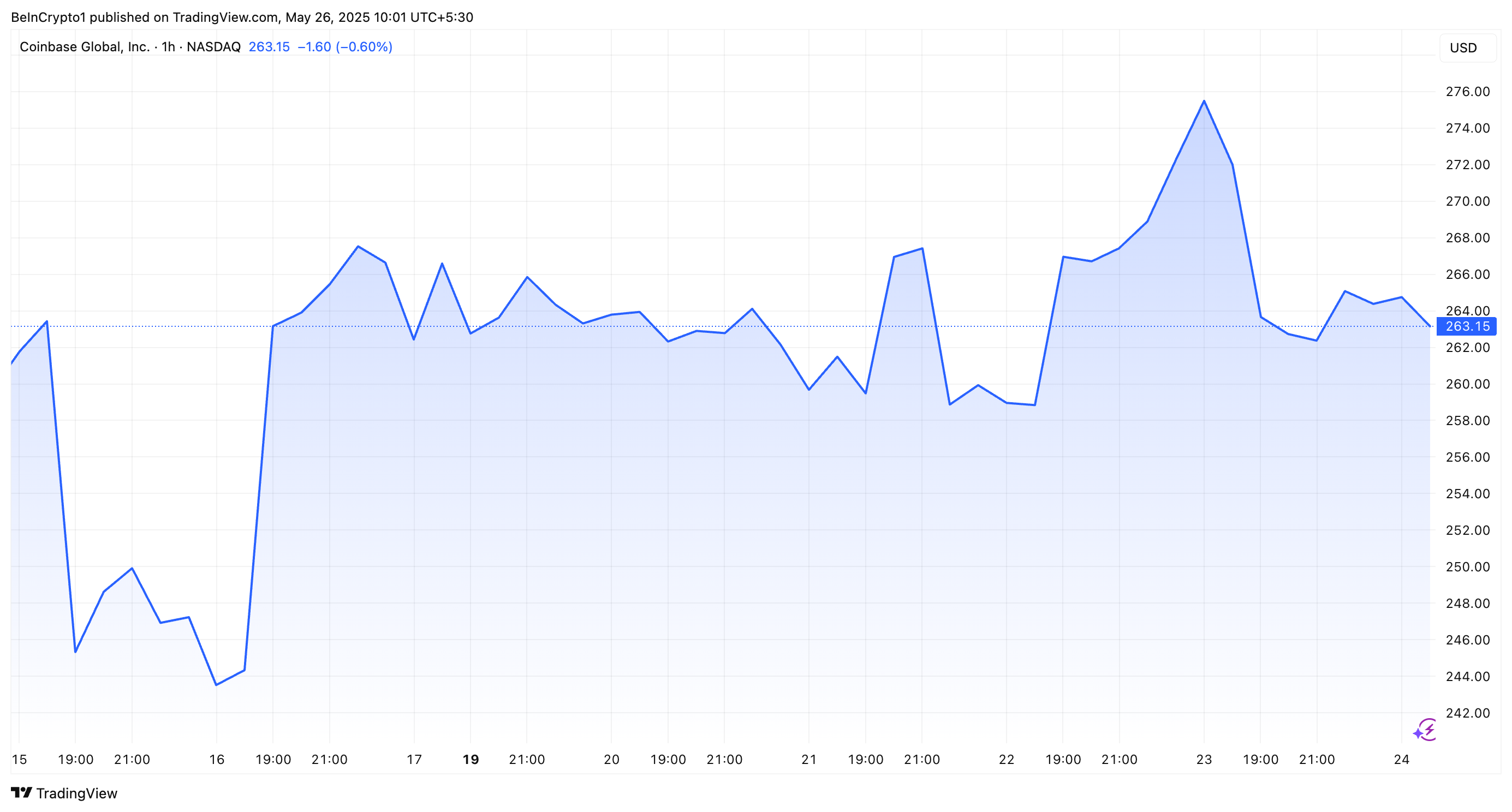

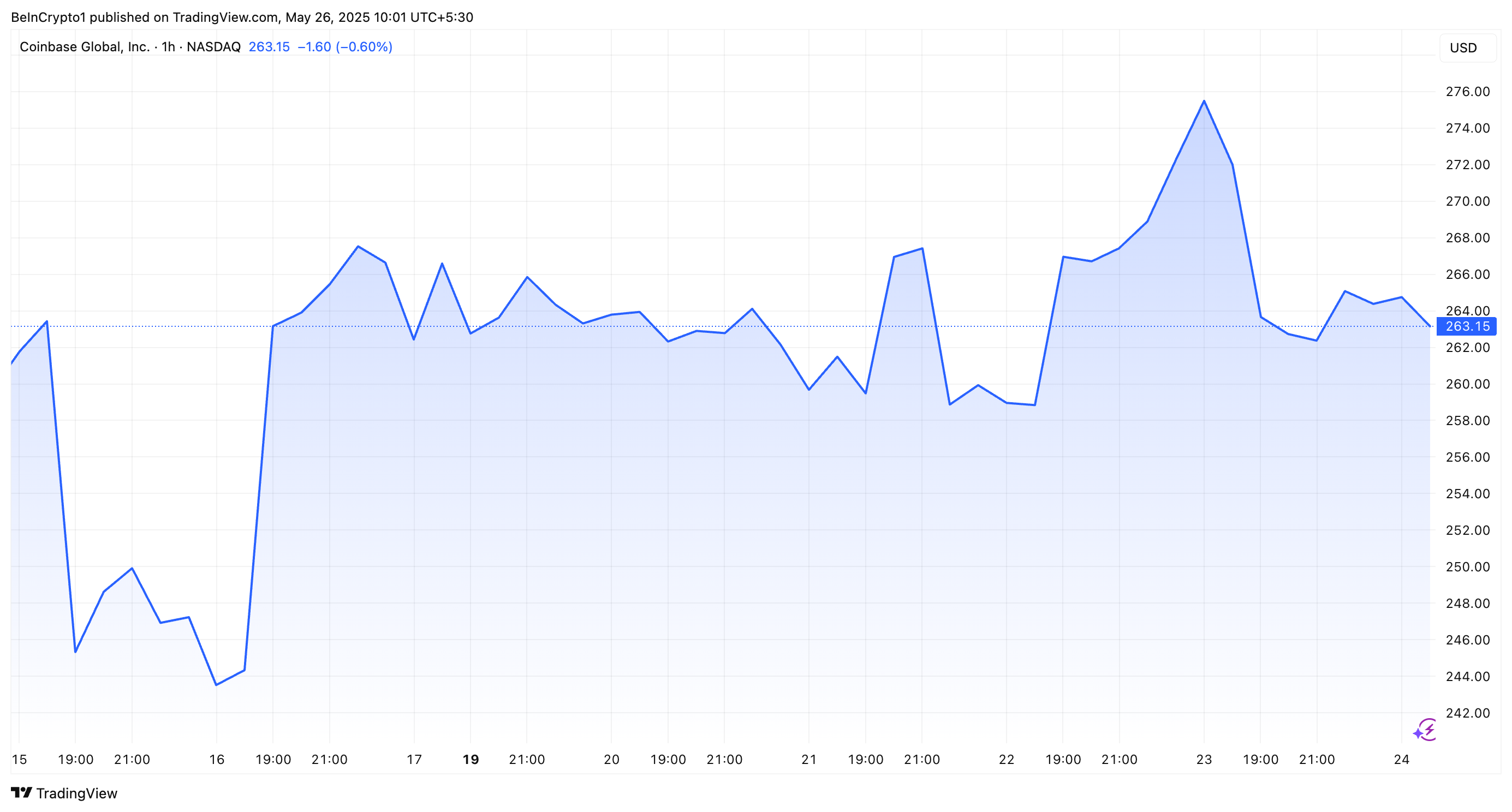

For the uninitiated, here’s the punchline: Coinbase’s silence about a cyberattack—thanks to some cybercriminals bribing overseas agents—let sensitive customer data walk right out the door. Names, addresses, IDs—all on parade for the digital bandits. But no worries, they claimed it affected “less than 1%” of users. Yet, when the truth finally slipped out on May 15, 2025, the stock took a nosedive—7.2%, to be exact, closing at a modest $244. Investors, like hapless soldiers in a losing war, watched their fortunes evaporate.

“As a result of Defendants’ wrongful acts and omissions, and the precipitous decline in the market value of the Company’s common shares, Plaintiff and other Class members have suffered significant losses and damages,” Nessler exclaimed. As if we needed an oracle to divine that. 🙄

But wait, the comedy continues. A year earlier, in July 2024, the United Kingdom’s FCA—famous for its strict rules and even stricter fines—slapped Coinbase’s UK subsidiary, CB Payments Ltd., with a hefty £3.5 million penalty. Because allowing 13,416 high-risk users to gamble in the crypto casino—totaling nearly $226 million—was evidently too much even for their lax standards. Regulatory violations? Just a minor hiccup, they say. But the fines tell a different story—like a slapstick slap in the face for shareholders blinded by false promises.

“On this news, the price of Coinbase’s common stock fell by $13.52 per share, or 5.52%, to close at $231.52 on July 25, 2024,” the lawsuit notes—reliable as a broken clock, ticking down towards disaster.

The plaintiff, Brady Nessler—a brave soul indeed—has filed a lawsuit seeking justice, damages, and a jury that hopefully isn’t too friendly with Coinbase’s top brass. As of now, Coinbase remains silent—perhaps pondering its next grand deception while shareholders watch their investments melt away like snow on a sunny day.

Meanwhile, the stock, ever the reluctant phoenix, has attempted a modest recovery from its lows. Yet on May 23, sentiment took another hit—a 3.23% decline, costing investors nearly nine dollars more in a game of musical chairs played at the market’s whim. Ah, the eternal dance of money and lies—how poetic, how tragic, how dadgummed funny. 😂

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-05-26 08:22