How the Digital Gold Rush Turned Into a Panic Sale-Yessiree, Them Crypto Folks Get the Same “Oops” as the Riverboat Gambler

Markets

Now, Here’s What’s Worth Gawking At:

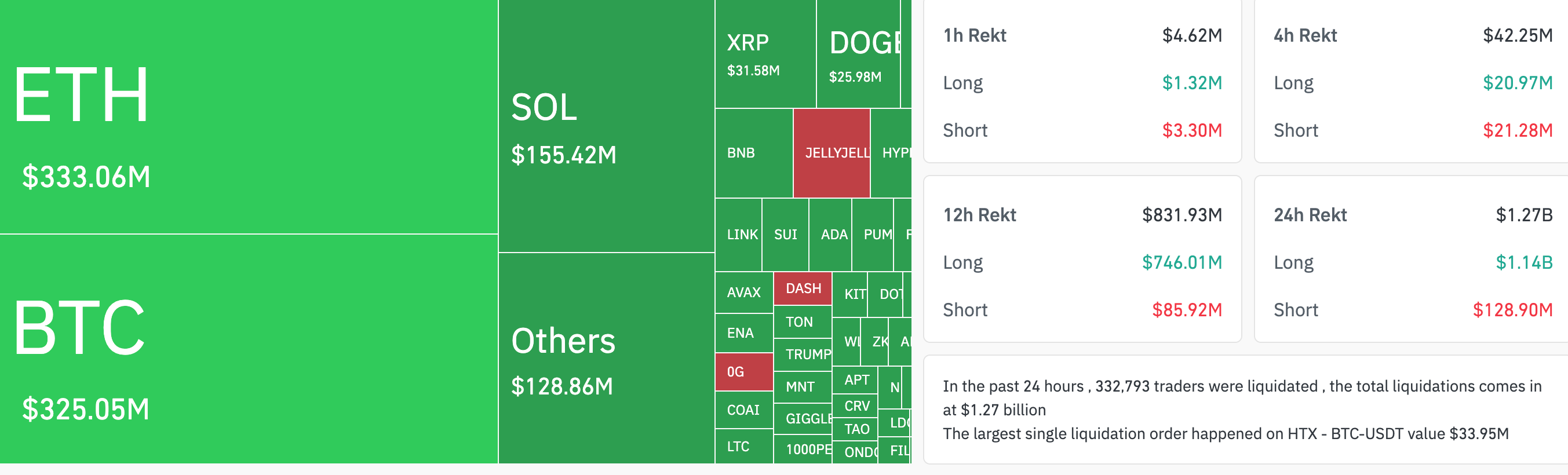

- Well, stranger, Bitcoin decided it was time for a little somersault-dropping from $112,000 to below $106,000-causing a mighty storm that wiped out a cool $1.27 billion worth of folks’ borrowed fortunes, or as traders call it, “liquidation.”

- The big show was led by the long traders-those fellows betting on prices climbing-almost 90% of the wreckage, $1.14 billion in bets erased quicker than a magician’s rabbit.

- The grand finale was a $33.95 million Bitcoin long on HTX-proof that even the big dogs got caught in the quicksand, with Hyperliquid tidying up its toys as if it were Christmas morning, losing $374 million in forced closures.

So, here’s the tale: Bitcoin looked like it was riding high, perched at an impressive $112,000-like a cat strutting on a fence-then it suddenly decided to take a mighty nosedive, turning all those leveraged dreams into dust faster than a tumbleweed in a dust storm. This caused a ripple effect where over a billion dollars was lifted from the pockets of traders, leaving many scratching their heads and muttering about the “good old days”.

And it wasn’t just some scrappy amateurs. Nope, long traders-those folks betting the farm on prices going higher-got hit hardest, with nearly 90% of the losses. Shorts? Well, they managed to only lose about $128 million-those cats always seem a tad smarter about when to run.

The way it works, you see, is that traders borrow money to make bets-’cause who doesn’t want to play with borrowed silver?-but when the market turns sour, the platform steps in and sells their positions faster than a chicken on a junebug, to keep everyone honest. When enough traders get wiped out in quick succession, it signals that maybe the market’s taken its last lurch, and perhaps, just perhaps, it’s time to sit back and enjoy a pipe.

The biggest calamity was at HTX where a $33.95 million Bitcoin-long was yanked out like a carrot from a garden-proof that even giants can stumble over their own shoelaces. Hyperliquid was busy shutting down $374 million worth of long bets, and that’s more than enough to make a man wonder if he’s been betting with his mortgage money.

This sudden plummet came after Bitcoin flirted with an overconfidence above $113,000, only to get a big cold shoulder, and what’s worse, the market was as thin as a dime in a needle factory-meaning prices swung wildly, like a temperamental mule. When things get thin, everyone’s just waiting for the next disaster to unfold, like a barnyard full of crows.

But as Twain might have said, it’s just another chapter in the great American gamble, where fortunes are made and lost faster than a wink. Traders sit tight, watching the tides, with open interest hanging around $30 billion, and only a slight easing in funding rates. The wise ones think a storm might be brewing, especially with the Fed playing puppet master later this week.

Ethereum and Solana weren’t spared the calamity either-losing over $300 million combined-while the rest of them altcoins? Well, they’re just slouching lower, content to fade into the background of this wild rodeo of speculation and panic.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-11-04 06:17