Darling, the crypto world is serving up a delightful drama of liquidation lunacy, proving that some traders are leveraging their way to financial ruin with all the finesse of a bull in a china shop. 🐂🍽️

According to the latest Glassnode and Fasanara report, average daily wipeouts have skyrocketed from a rather pedestrian $28 million in longs and $15 million in shorts to a positively theatrical $68 million in longs and $45 million in shorts. Single sell-offs have become as violent as a diva’s tantrum at a Broadway flop. 🎭💥

Early Black Friday: A Tragedy in One Act

October 10th was the pièce de résistance of this financial melodrama. Bitcoin’s plunge from $121,000 to $102,000 saw over $640 million per hour in long positions liquidated-a performance worthy of a standing ovation, if one weren’t losing their shirt. 🎭💸

Open interest dropped by 22% in less than 12 hours, plummeting from nearly $50 billion to $39 billion. Traders felt the sting faster than a soufflé collapsing in a drafty kitchen. Glassnode called it one of Bitcoin’s sharpest deleveraging events, a title no one wanted. 🍰💔

Futures Frenzy: A Record-Breaking Spectacle

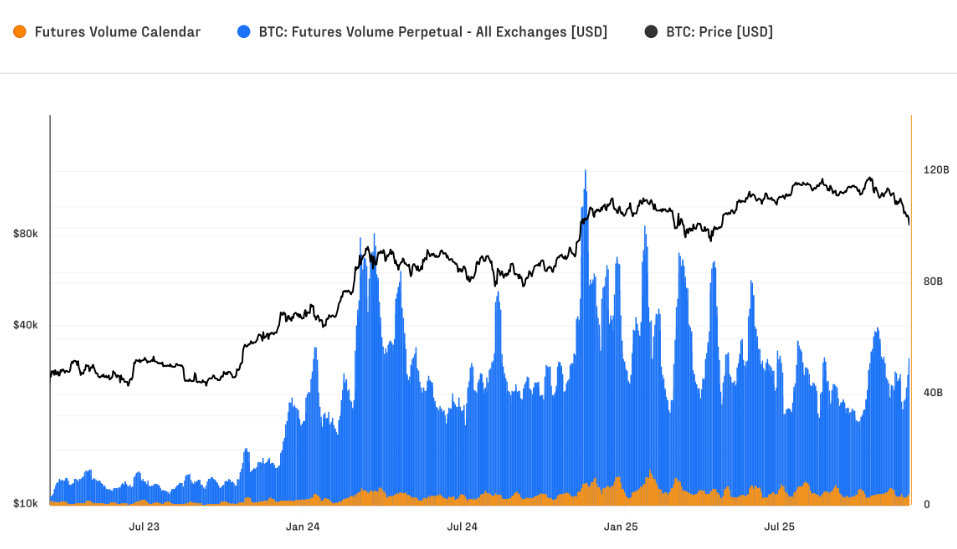

Futures markets have swelled like a balloon at a birthday party for insomniacs. Open interest hit a record $68 billion, with daily futures turnover peaking at $69 billion in mid-October. Perpetual contracts now dominate, accounting for over 90% of activity-concentrating risk like a tightrope walker without a safety net. 🎈🤹

Daily futures wipeouts averaging $68 million in longs and $45 million in shorts are the price one pays for this high-wire act. Big swings, darling, come with big bills. 💸🎪

Spot Trading: Doubling Down on Drama

Spot trading has also taken center stage, with Bitcoin’s volume doubling to an $8 billion to $22 billion daily range. During the October 10th crash, hourly spot volume spiked to $7.3 billion, with traders rushing to buy the dip like bargain hunters at a fire sale. 🛒🔥

Capital Flows & Market Share: The Numbers Are In

Monthly inflows into Bitcoin have ranged from $40 billion to $190 billion, pushing realized market capitalization to a record $1.1 trillion. Since the November 2022 low, $730 billion has flowed into the network-more than all previous cycles combined. Bitcoin’s share of the crypto market cap has risen from 38% to 58%, a triumph of sorts, if one ignores the screams of altcoin investors. 📈🏆

Bitcoin as Settlement Rail: A Stroke of Genius or Madness?

Over the past 90 days, the Bitcoin network processed nearly $7 trillion in transfers, outpacing major card networks. Some now see Bitcoin not just as a store of value but as an increasingly important settlement rail-a development as surprising as discovering your butler writes poetry. 📜💼

Bitcoin Price Action: The Finale 🎬

At the time of writing, Bitcoin was trading at $93,165, up 6.5% daily and nearly 7% weekly. A modest recovery, but in the world of crypto, darling, even modest victories are worth celebrating. 🍾🥂

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

2025-12-04 06:07