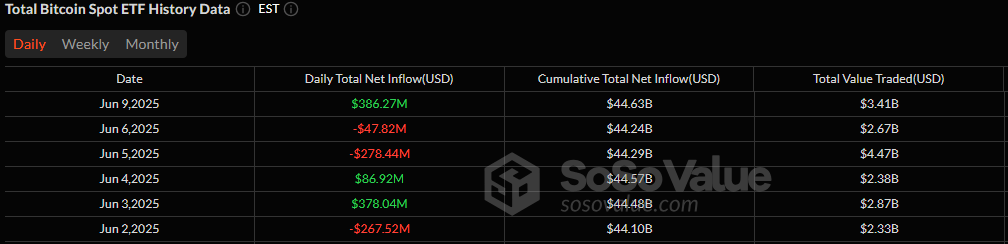

Bitcoin ETFs, bless their little cotton socks, reversed course with a whopping \$386 million inflow. Yes, you heard right. Broke a two-day outflow streak, apparently. Net assets back over \$130 billion. Honestly, who even understands these numbers? Meanwhile, ether ETFs are just showing off now, extending their historic streak with a 16th consecutive day of net inflows, adding another \$52.71 million. Showoffs.

Crypto ETF Momentum Returns: Bitcoin Reclaims \$130 Billion AuM As Ether Keeps Surging

Just as the market started prepping for more doom and gloom (because that’s what we all secretly enjoy, isn’t it?), bitcoin exchange-traded funds (ETFs) pulled a rabbit out of a hat, dragging in \$386.27 million and snapping a two-day red streak. A clean sweep across 6 ETFs, darling. Fidelity’s FBTC leading the charge at \$172.99 million, closely followed by Blackrock’s IBIT with \$120.93 million. Honestly, it’s like watching a very boring horse race. But with money.

Investors also fancied Bitwise’s BITB, which snagged \$68.55 million, while Ark 21Shares’ ARKB (\$10.83 million), Vaneck’s HODL (\$7.68 million), and Grayscale’s Bitcoin Mini Trust (\$5.29 million) added modest but meaningful inflows. No ETF recorded outflows, which is frankly suspicious. Total value traded stood at \$3.41 billion, and net assets climbed to \$131.06 billion. Someone’s having a good day. Probably not me.

Over in ether ETFs, the bullish streak just won’t quit, rolling into its 16th straight day. Blackrock’s ETHA attracted the lion’s share of Monday’s \$52.71 million inflow, adding \$35.19 million on its own. Fidelity’s FETH followed with \$12.90 million, while Grayscale’s Ether Mini Trust contributed \$4.62 million. Daily volume hit \$398.72 million, with total net assets reaching \$9.80 billion. I need a drink. 🍸

With consistent inflows, climbing Assets under Management (AuM), and BTC trading above \$110,000, both bitcoin and ether ETFs are flashing strong signals that institutional confidence remains intact heading into mid-June. Or maybe they’re just messing with us. Who knows? 🤷♀️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Wuthering Waves Mornye Build Guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-06-10 14:59