- Investors, disillusioned and trembling, cast off a staggering $795 million from crypto funds in the past week, a sum that could feed a small nation for a year!

- Only XRP, that rebellious upstart, and multi-asset funds, those bastions of mediocrity, saw a glimmer of demand, while the rest were purged in a cleansing fire of sell-offs. The market weeps! 😭

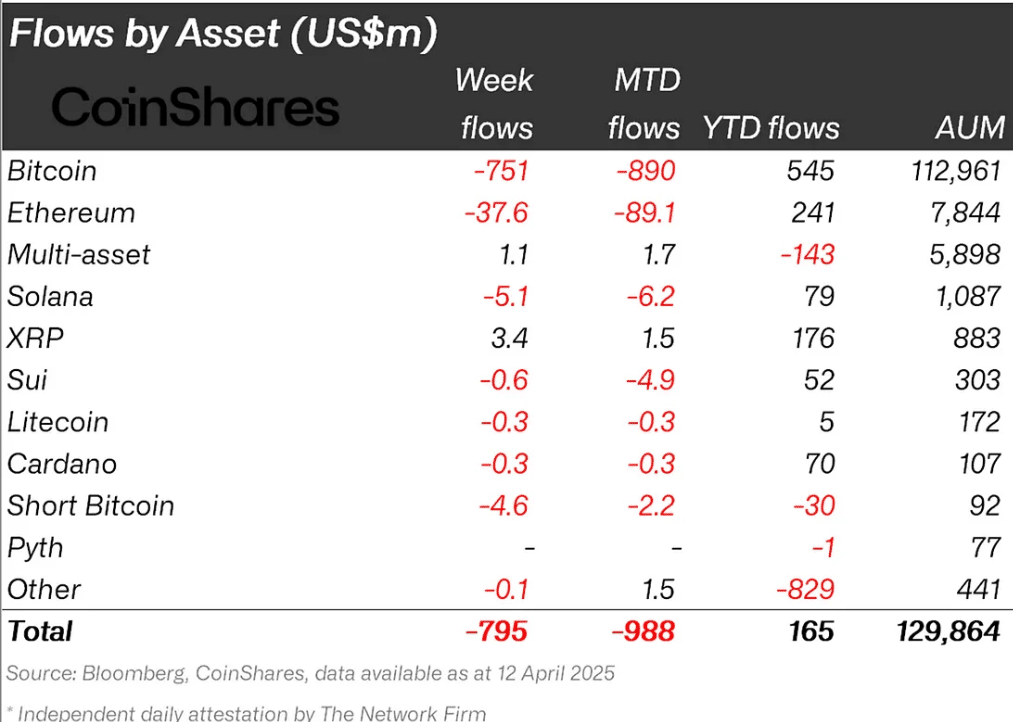

Investors, seized by a collective terror, abandoned $795 million in crypto funds last week, marking the third week of this agonizing exodus. According to the CoinShares’ weekly asset flows report, a document surely penned by the grim hand of fate itself, Bitcoin [BTC] led the rout with a soul-crushing $751 million outflow, while Ethereum bled a pathetic $37.6 million. The report, ever eager to justify the suffering, blamed the extended decline on the looming specter of tariff uncertainty.

“Digital asset investment products endured a 3rd consecutive week of outflows last week, totalling US$795m, as recent tariff activity continues to weigh on sentiment towards the asset class.” (As if tariffs were the only thing to fear in this godforsaken world!)

Investors, in their infinite wisdom, prefer XRP

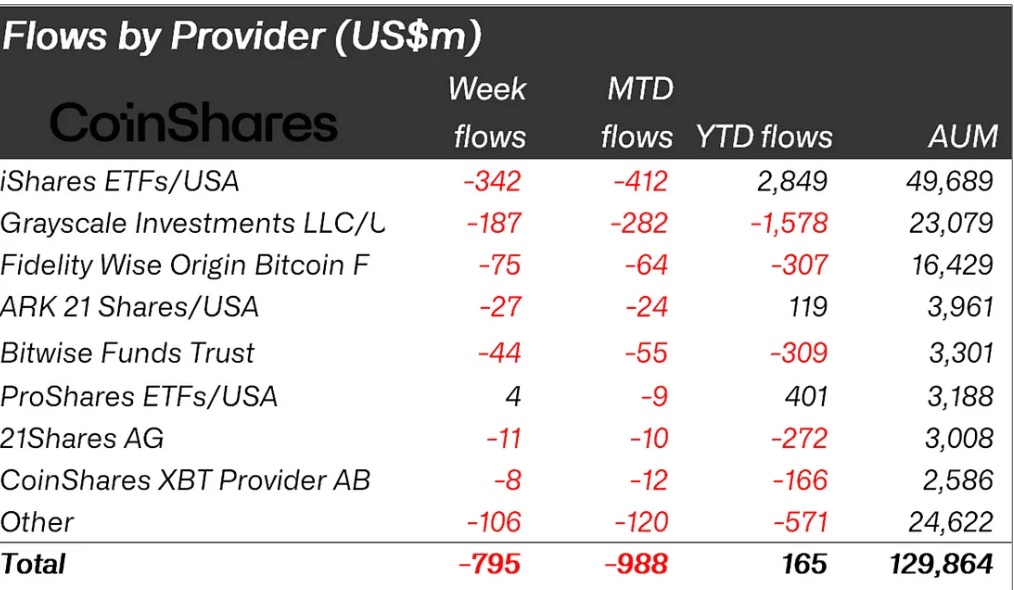

BlackRock’s iShares ETF products, those monuments to capitalist excess, recorded the highest investor withdrawals (sell-off). iShares’ BTC ETFs and ETH ETFs, in their combined misery, saw $342 million flow out into the cold, uncaring void last week.

From a month-to-date (MTD) perspective, BlackRock, that behemoth of finance, bled $412 million, nearly half a billion over the past two weeks alone. A sum that would make even the most hardened oligarch weep with joy… or perhaps just weep. 🤔

Grayscale products, those pale imitations of BlackRock’s grandeur, followed closely with $187 million outflows, nearly half of BlackRock’s dump. A pathetic showing, indeed!

On the altcoins front, Solana-based products, those fleeting promises of riches, ranked third after ETH in outflows. They saw a measly $5.1 million sell-off. Surprisingly, XRP-based and multi-asset funds were the only outliers during last week’s decline. Luck or madness? Only time will tell. 🤪

The report noted that XRP, that digital enigma, saw $3.4 million inflows last week, and the overall MTD flows stood at $1.5 million. Investors, in their desperation, preferred XRP and multi-asset (crypto index ETFs) to individual assets like BTC or ETH in the first half of April. A triumph of the herd mentality!

Additionally, the aforementioned idea was further supported by record inflows into the new 2x Tecrium XRP ETF. A double dose of madness, perhaps?

Worth noting, however, that some macro analysts, those prophets of doom, projected that the decline could continue. Quinn Thompson, founder of macro-focused hedge fund Lekker Capital, stated that a recent speech by Fed chair Jerome Powell will be bad for risk assets in May, including crypto. The speech, no doubt, contained hidden messages only decipherable by the initiated.

“Barring a collapse in economic data before then, they (Powell and Governor Waller) prefer patience amidst the elevated uncertainty. This is good for bonds but bad for risk assets.” A chilling pronouncement! Run for your lives! 🏃♂️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-04-16 10:23