KEY POINTS:

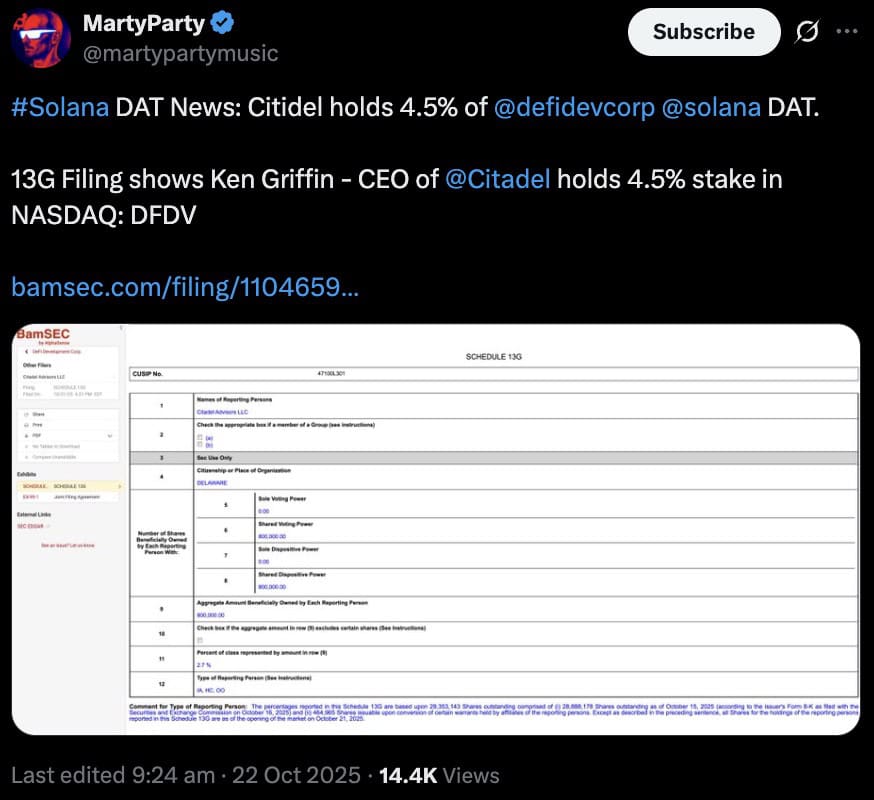

In an astonishing display of forward-thinking, Citadel’s CEO has taken a personal plunge into the Solana ocean. With a modest 4.5% stake in DeFi Development Corp., he’s signaling a new wave of institutional interest in Solana and altcoins. This isn’t your typical hedge fund move, but one that promises something more-potential profits lurking in the currents of blockchain. 🤑💰

DeFi Development Corp, the juggernaut holding 2.19M $SOL worth over $415M, is one of the largest Solana treasuries in the world. And the price of Solana? Well, it has nearly doubled since April, and analysts are now whispering about a possible breakout to $260. Go ahead, call it a “crypto miracle.”

Snorter Token ($SNORT), a gateway to Solana’s next liquidity wave, has already raised $5.45M ahead of its October 27 claim event. Talk about a rush for the next big thing. 🚀

Griffin has now entered the scene as one of the first Wall Street giants to take a direct equity position in a company built around Solana’s blockchain. His filing with the US Securities and Exchange Commission reveals Griffin holds 1.3M shares, while Citadel Advisors holds an additional 800K, totaling a 7.2% stake in the project.

Just when you thought crypto was too volatile for the big players, Griffin swoops in. But don’t get too comfortable-the digital currency world never sleeps. ⏳

DeFi Development Corp’s strategy is as simple as it is genius: buy and stake Solana ($SOL) to generate yield while it appreciates. Not much different from old-school Wall Street tactics, except with a blockchain twist.

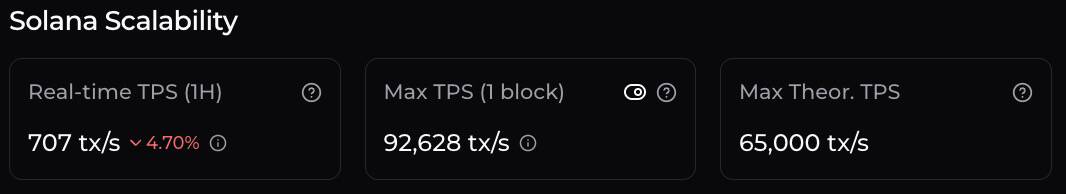

This move signals a new kind of institutional hunger-one that’s pivoting away from the Bitcoin-heavy strategies of the past toward a higher-throughput future.

Solana’s appeal lies not only in its speed but in its deep liquidity-a major advantage for both yield-seeking firms and DeFi developers looking to build the next generation of digital tools. 🌐

Griffin’s investment is more than just a personal win; it signals to Wall Street that Solana is maturing into credible collateral. Traditional finance is waking up, and DeFi is now an institutional asset class. 🏦

It’s a well-known pattern: once institutions jump on board, retail traders rush in to ride the wave. And when they do, tools like Snorter Token ($SNORT) will be right there to amplify every on-chain move, turning minor traders into major players. 📈

The Institutional Solana Play

DeFi Development Corp’s game plan is hardly revolutionary. Stake Solana, earn yield, and watch it appreciate. It’s as old as Wall Street itself-just with blockchain tokens. 🏦💥

This approach transforms volatile assets like Solana into reliable sources of income, something the world of hedge funds understands all too well.

Technical charts are flashing green: Solana’s double-bottom reversal suggests a potential breakout toward $260, assuming the resistance clears. Hold onto your hats, folks! 🎩🚀

Institutional players are also helping to elevate the entire Solana ecosystem. DeFi protocols, NFT marketplaces, and meme coins are all benefiting from increased liquidity and visibility. A rising tide lifts all ships-or in this case, memes. 😆🚢

And what’s the punchline? Institutional investment injects liquidity, and liquidity fuels meme seasons. Prepare for a rotation that could reward Solana-native tools-like Snorter Token ($SNORT)-that allow you to trade faster, smarter, and cheaper.

Cue Snorter Token ($SNORT). 🏁

Snorter Token ($SNORT) – Final Chance to Buy Before Claim Opens

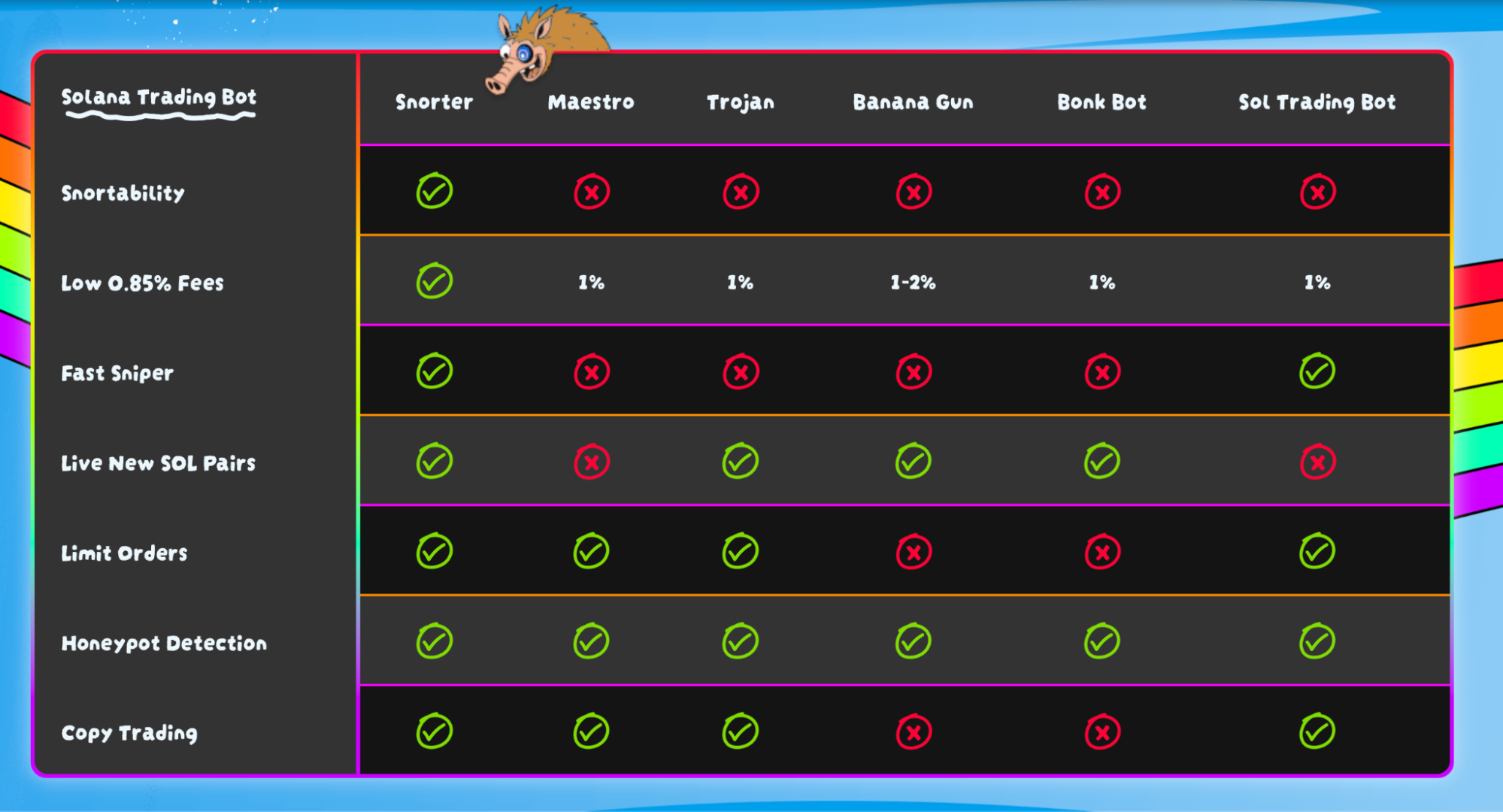

Built for Telegram and spanning both Solana and Ethereum, $SNORT turns your chats into a trading terminal. Need to swap, snipe, copy trade, or track portfolios? You can do it all without ever leaving your Telegram app. Talk about frictionless. 😎

On top of that, holding $SNORT slashes your trading fees from 1.5% to just 0.85%. If that doesn’t scream “value,” I don’t know what does. 💸

During its closed beta, $SNORT’s rug and honeypot detection flagged bad contracts with an impressive 85% accuracy. A small but mighty guard against the chaos of meme coin trading. 🛡️

The numbers are speaking for themselves: $SNORT has raised over $5.45M in its presale, with over 16K investors already onboard. Analysts are predicting a potential price surge to $1.07 before the end of the year. That’s nearly a 10x return. 🏆

But you better act fast-there are only four days left before the claim event goes live on October 27 at 2 PM UTC. Staking yields of 102% are also available until then to help fatten your crypto wallet. 💰

So, if Citadel and Ken Griffin are betting on Solana for yield, retail traders are chasing it for speed. $SNORT gives you both. Grab your trading, staking, and analytics all in one place. 🏃♂️💨

Don’t miss the boat-join the Snorter Token presale before the claim window opens!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-10-23 16:56