On this serene Christmas, the market’s darlin’ chose to rustle up against the warmth of a glowing hearth, holding firm at $87,489, quieter than a barn full of sleeping cows. With the sparkle of Christmas lights, Bitcoin dallied with the lower bounds of its trading range, as cautious as a night owl, eschewing the exuberant spirit of the season.🎄

Bitcoin Chart Gaze

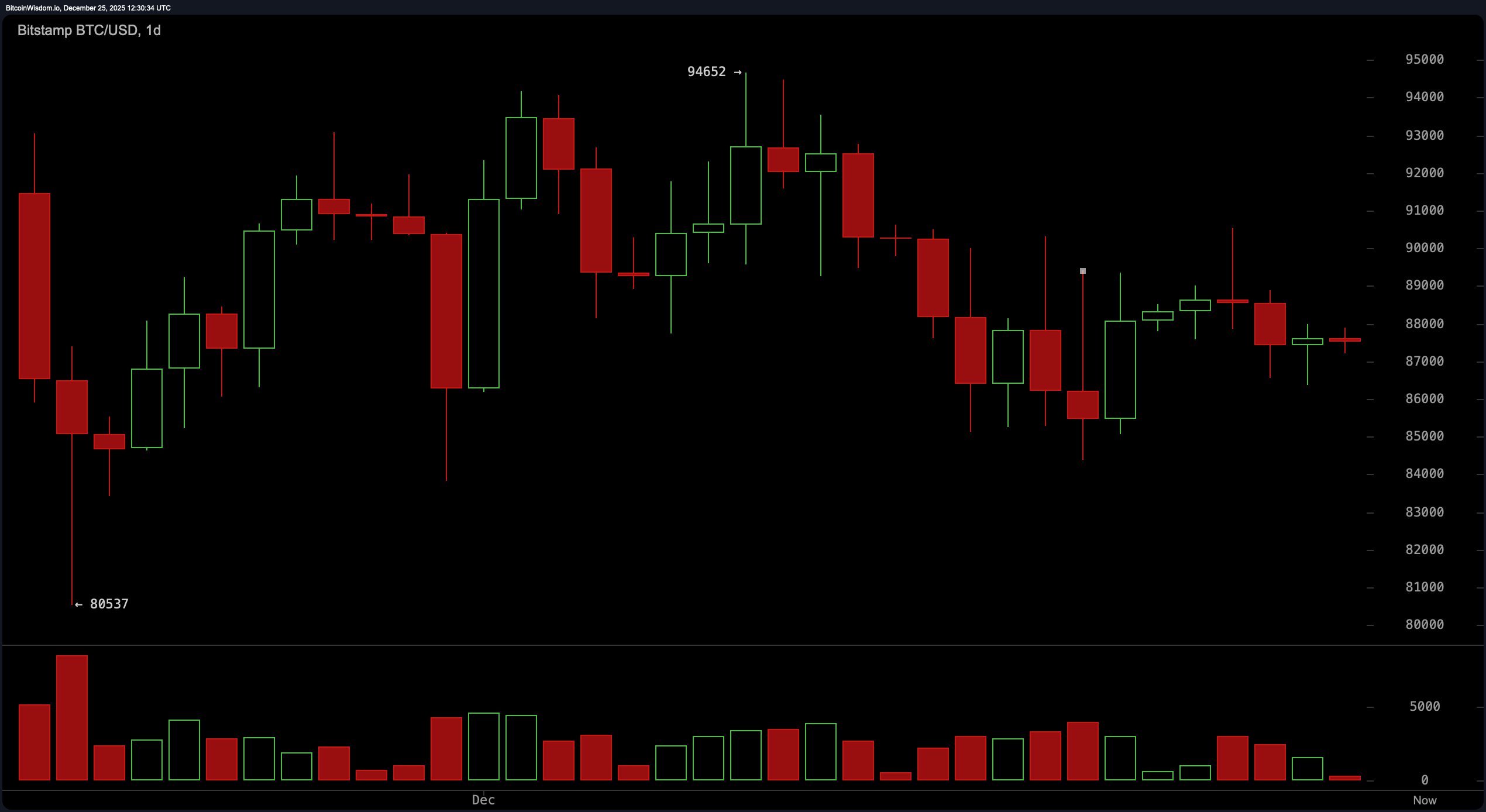

In the daily chart, Bitcoin sits gingerly over recent peaks, backing away firm from a lofty high of $94,652. It furtively cozies up near a predictable support band of $86,000-$87,000, providing solace amidst the market’s daily bustle.

Yet, with candlesticks that are as indecisive as a frog contemplating a leap-small bodies and Doji types-the trend remains a corrective phase. Following its upswing, investors should hold their breath rather than pop the cork prematurely; momentum is lean, and eagerness for a return of bullish vigor seems distant.

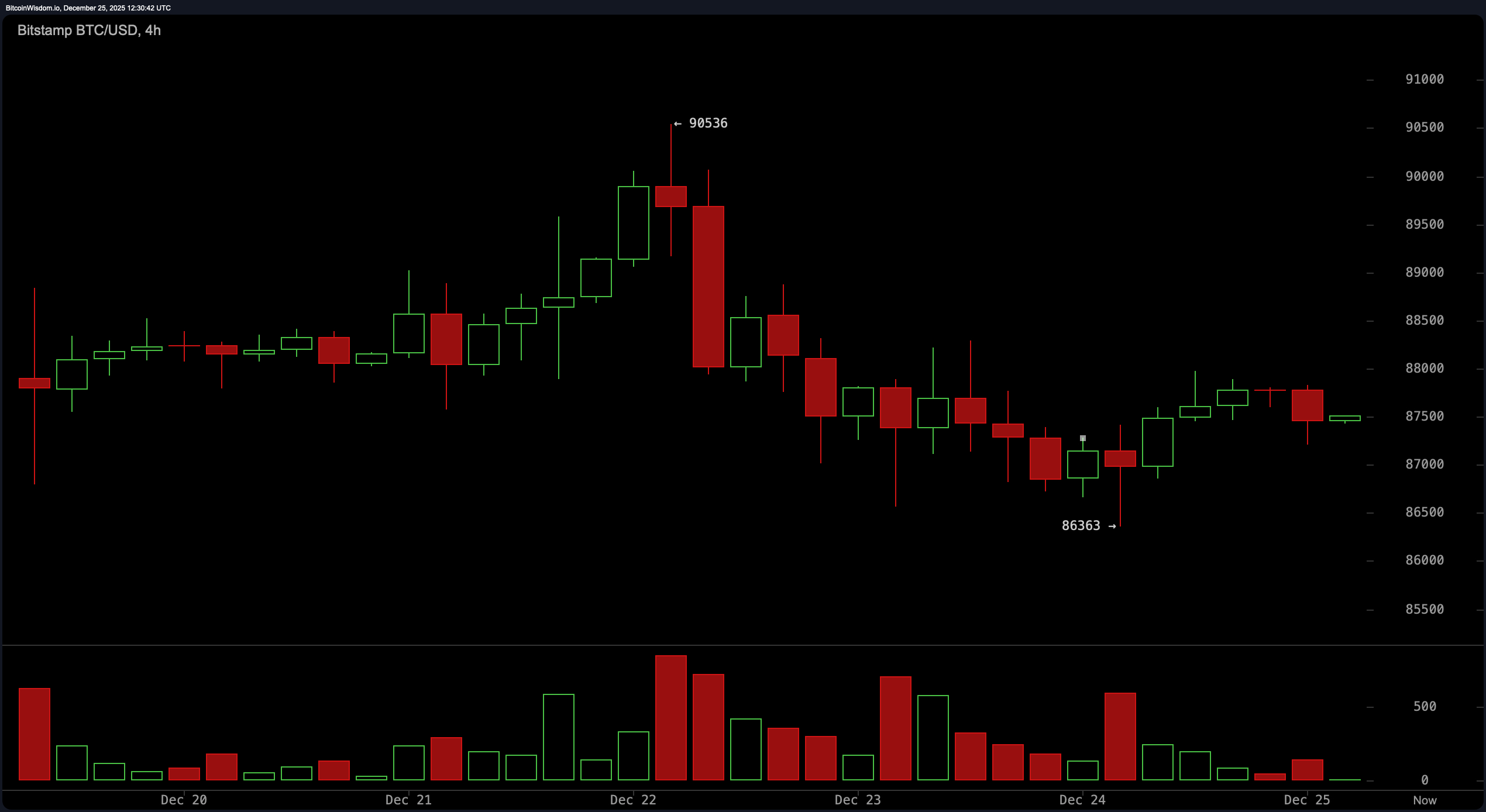

The 4-hour chart hums a gentle lullaby of balance. After a tentative brush against $86,363, Bitcoin tiptoed upward, caressing the $88,000 mark, albeit with volume that keels over like a lackluster fruitcake. A carryover beyond $88,800 remains a mirage, turning this sideways drift into a waiting game, as traders sip cocoa on the bench for a more spunky push to justify any directional flair.

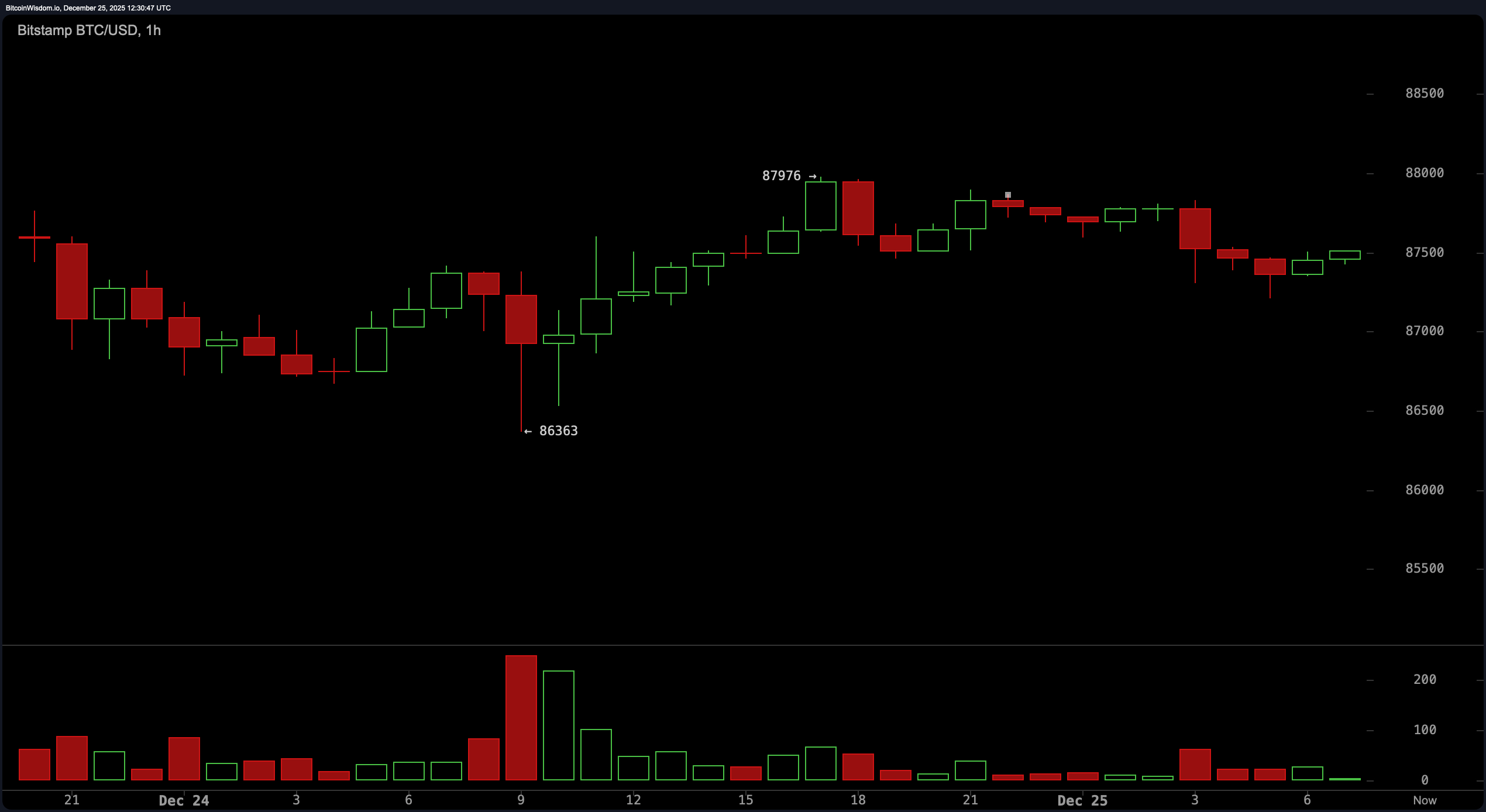

Looking through the lens of the 1-hour chart, Bitcoin wavers between bearish and neutral, much like a hesitant steer. A tentative rise from $86,363 to a modest peak at $87,976 floundered into a tight range between $87,300 and $87,800. As volume thins like holiday eggnog, the candle-tamers seem spent, leaving Bitcoin-a gentle giant-tucked in a holding pattern. A clear surge beyond $88,000 might whiff of ambition, while a descent below $87,000 could unravel support quicker than unwinding a sweater by mistake.

Oscillators aren’t throwing any cheerful bells either. The RSI rests at 43, the stochastic oscillator at 34, and the commodity channel index (CCI) hovers at -62-all signaling a lather of neutrality. Meanwhile, the average directional index (ADX) fixates on 23, laying bare a lack of trend strength. Undereye the canvas, the awesome oscillator sports a red dress at -1,182, while momentum, albeit modestly positive at 1,096, and the MACD suggesting bullish divergence at -1,327, shine with a faint glimmer of hope. So, there’s a whisper of sparkle lurking ‘neath the surface-just nowhere near dazzling.

Moving averages, however, rain on Bitcoin’s festive parade. Each prominent exponential moving average (EMA) and simple moving average (SMA) from 10-period to 200-period stand aloof above the present price-a wrathful bearish warning. The 10-period EMA settles at $87,962, with frost spreading further: the 200-period SMA looms like a steep mountain at $107,611. Until the moving averages bend to obedient yesses or Bitcoin breaks into new turf, its short-range fate swings on the craggy precipes of base support zones.

In sum, Bitcoin is teetering on a precipice: bound within a range, its volume feeling more the quiet attic than a bustling bazaar, and stalked by technical headwinds. Whether it vaults through the stratospheres or slips down between snowdrifts hinges more on unwavering volume and macro sentiment than a flurry of angelic carolers. For now, those clutching charts might also do well to ply a watchful eye over those dwindling holiday sweets.

Bull Verdict:

If Bitcoin can stake claim over $88,000 with resolve and seal it on the 4-hour or daily stand, it might spark a rally aimed toward the $90,000-$93,000 ridge. A bounce off the $86,000-$87,000 support, propelling volume and a shift in oscillators, would trumpet the bulls’ readiness to charge forth.

Bear Verdict:

Should Bitcoin slip beneath the $86,000 side-road, it might tumble to $84,000 or drift even deeper toward $80,500. Given the crowd of moving averages cast above the price and indicators leaning neutral or on clergy knees, the bears are all perked and poised to drag sentiment further south should the freeze linger.

FAQ 🎄

- Where is Bitcoin trading today?

Bitcoin hovers around $87,489, rooted snugly near essential troughs. - Is Bitcoin bullish or bearish right now?

Momentum straddles the middle ground, while indicators drape themselves, albeit cautiously, in bearish frock coats. - What price levels are critical for Bitcoin next?

Support nestles at $86,000-$87,000, while resistance lurks near $88,000 and $91,000. - Why is Bitcoin volume so low this week?

The thrum of holiday excitement coupled with a novella of market whispers has subdued intrepid traders into a cautious pause.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-12-25 16:58