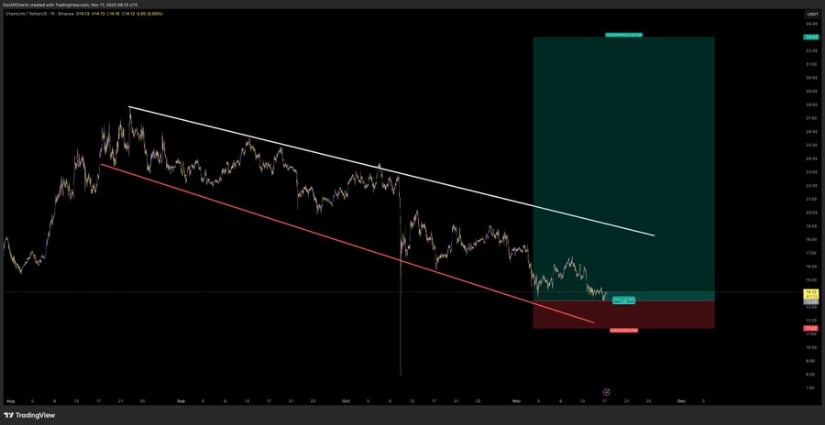

In the quiet chaos of markets, one might say the Chainlink price now waltzes with caution, not panic, as if it’s rehearsing for a role in a financial soap opera. The historical support levels, those old friends from mid-2023, are being courted again, though the coin seems to hover near the edge of a metaphorical cliff-$12 and $11, the next chapters in this suspenseful tale.

Analyst Trendline Breakdown Scenario and Support Layer Mapping

Ali, our intrepid analyst, has charted this dance of decline with the precision of a poet dissecting a sonnet. The ascending support line, once a fortress, now feels like a leaky umbrella in a downpour. The price’s flirtation with the lower boundary? A risky tango, indeed. Ali’s notes on $12 and $11 are less a roadmap and more a “just in case” survival kit for crypto’s most dramatic exit.

Meanwhile, @DonaldsTrades, with all the gravitas of a Shakespearean actor, frames this mess as a “long-cycle recovery path.” Spoiler: it’s not. The $11-12 range is less about accumulation and more about “hope you brought snacks.” His optimism is commendable, but the market’s current mood is less “recovery” and more “I’ll take a nap in this bear market, thanks.”

Chainlink Price Pulls Back but Maintains Key Support Levels

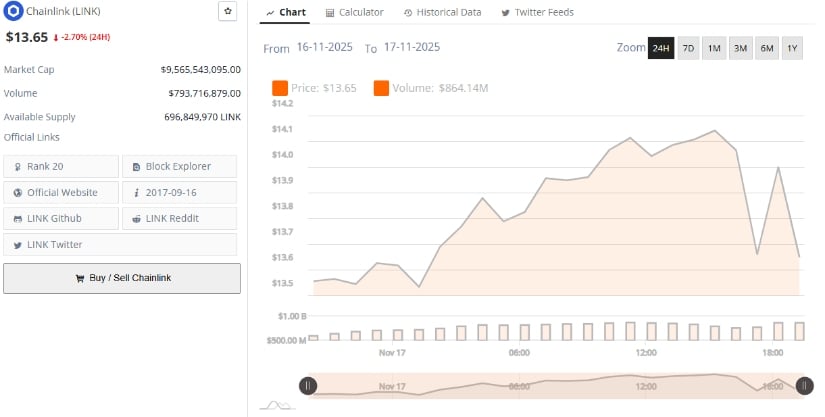

The past 24 hours? A masterclass in disappointment. Down -2.70%, trading near $13.65 like it’s the last gasp of a dying star. The $14.03 resistance zone? A mirage. Sellers are out here playing chess with profits, while buyers are… well, nowhere to be found. The market cap of $9.5 billion? A polite nod to relevance, not a celebration.

Consolidating near $14.03? Sounds like a bad Airbnb listing. The “short-term accumulation base” is less a foundation and more a rental agreement with a sketchy landlord.

Market Metrics Show Controlled Trading Range With Mid-Term Neutrality

The $14.13 price tag feels like a middle finger to volatility. Volume? Stable, but not exciting. It’s the crypto equivalent of a “meh” sandwich. The $3.70-$15.00 range is less a trading zone and more a “nothing to see here” curtain call. Neutral markets are the emotional equivalent of lukewarm soup-safe, but uninspired.

No supply-driven drama, no volume fireworks-just a collective shrug from traders. They’re waiting for a sign, any sign, while sipping lukewarm coffee and eyeing the exits.

Technical Indicators Show Reduced Momentum With Early Stabilization Signs

Bollinger Bands? They’re whispering, “We’re close to oversold,” but no one’s listening. The mid-band at $15.55 is a “maybe tomorrow” promise. MACD remains bearish, but the histogram’s flatness is like a cat napping on a keyboard-unimpressed. A daily close above $15.55? That’s the plot twist we’ve all been waiting for. Until then, the $12-$11 support sequence is just another cliffhanger.

In this symphony of uncertainty, the only thing certain is that Chainlink’s story is far from over. It’s just… very, very slow. 🤷♂️📉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

2025-11-18 02:40