Bitcoin’s $120K Surge: Whales Cry, Retailers Swoon 🐳📈

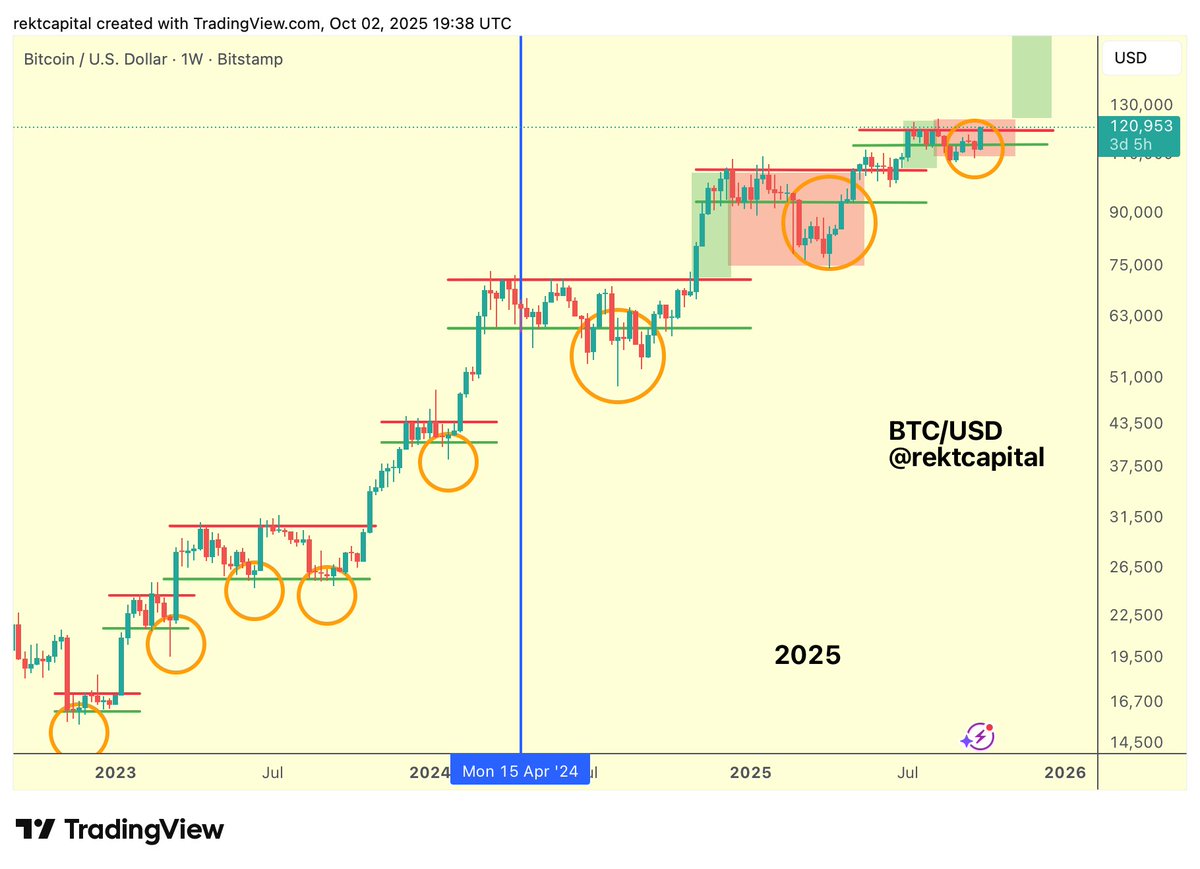

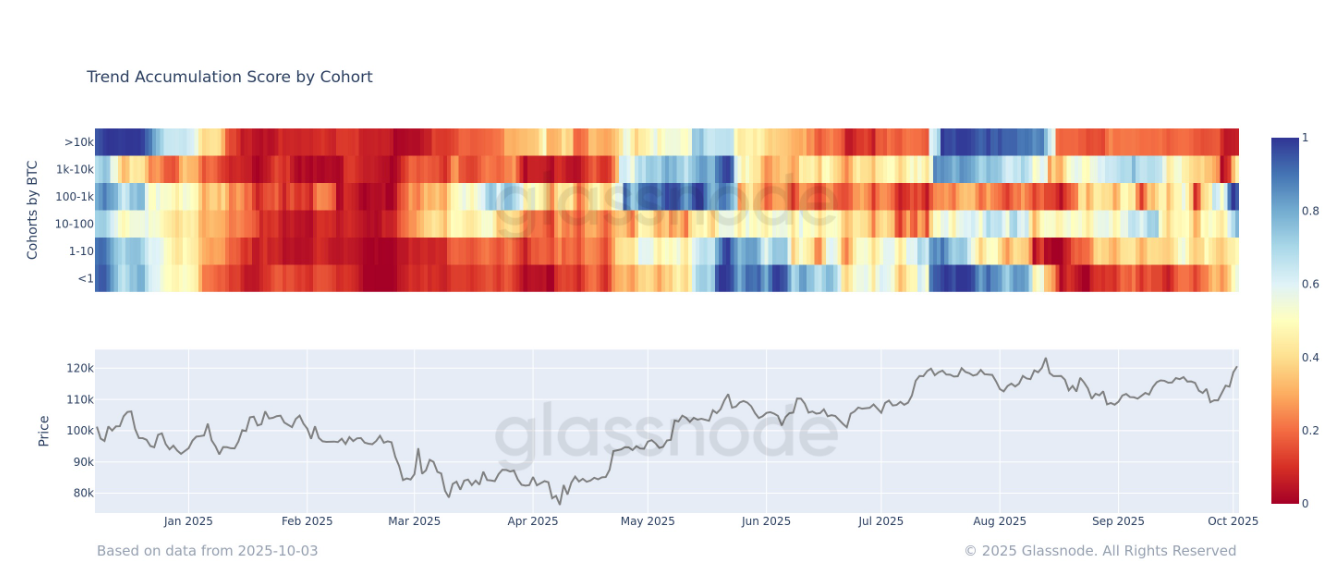

Bitcoin has risen 10% this week, as if the market itself had suddenly remembered how to breathe. Wallets, those digital reliquaries of wealth, have abandoned distribution for accumulation like penitents seeking redemption. On Thursday, Bitcoin pierced $121,000-a height last seen in August, when the world was younger and hope less expensive.