Bitcoin’s Daring Dance: To Plunge or Soar?

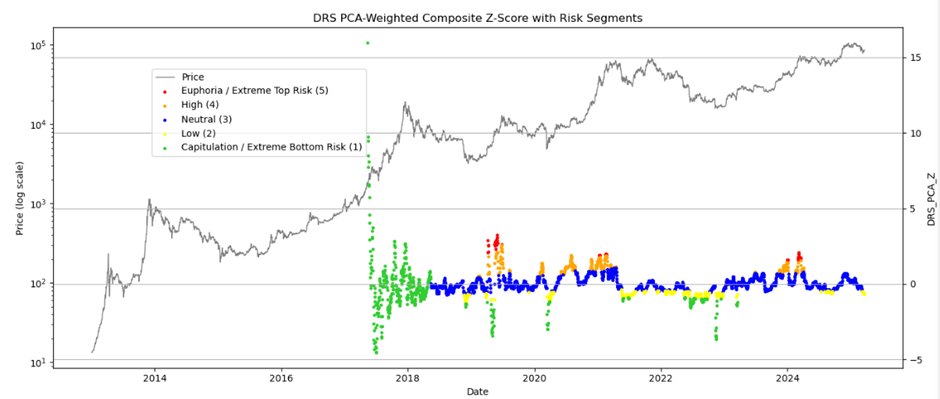

Mr. Coutts, in a missive dispatched via the modern contrivance known as X, has unveiled his preliminary venture with the DRS model. He reflects upon the recent “Cat5 euphoria” of Q12024, a spectacle which, to the surprise of many, was succeeded by a mere30% retreat. This he contrasts with a similar episode in2019, where the decline was a more robust50%, or70% if one includes the unfortunate COVID shock. “I am still quite taken aback,” he muses, “that the pullback was so modest. The only comparable event outside a cycle top was in2019, with a drop of50% (or70%, should one account for the COVID shock).”