Is XRP the New Cinderella? From SEC Drama to Market Meltdown! 🥴

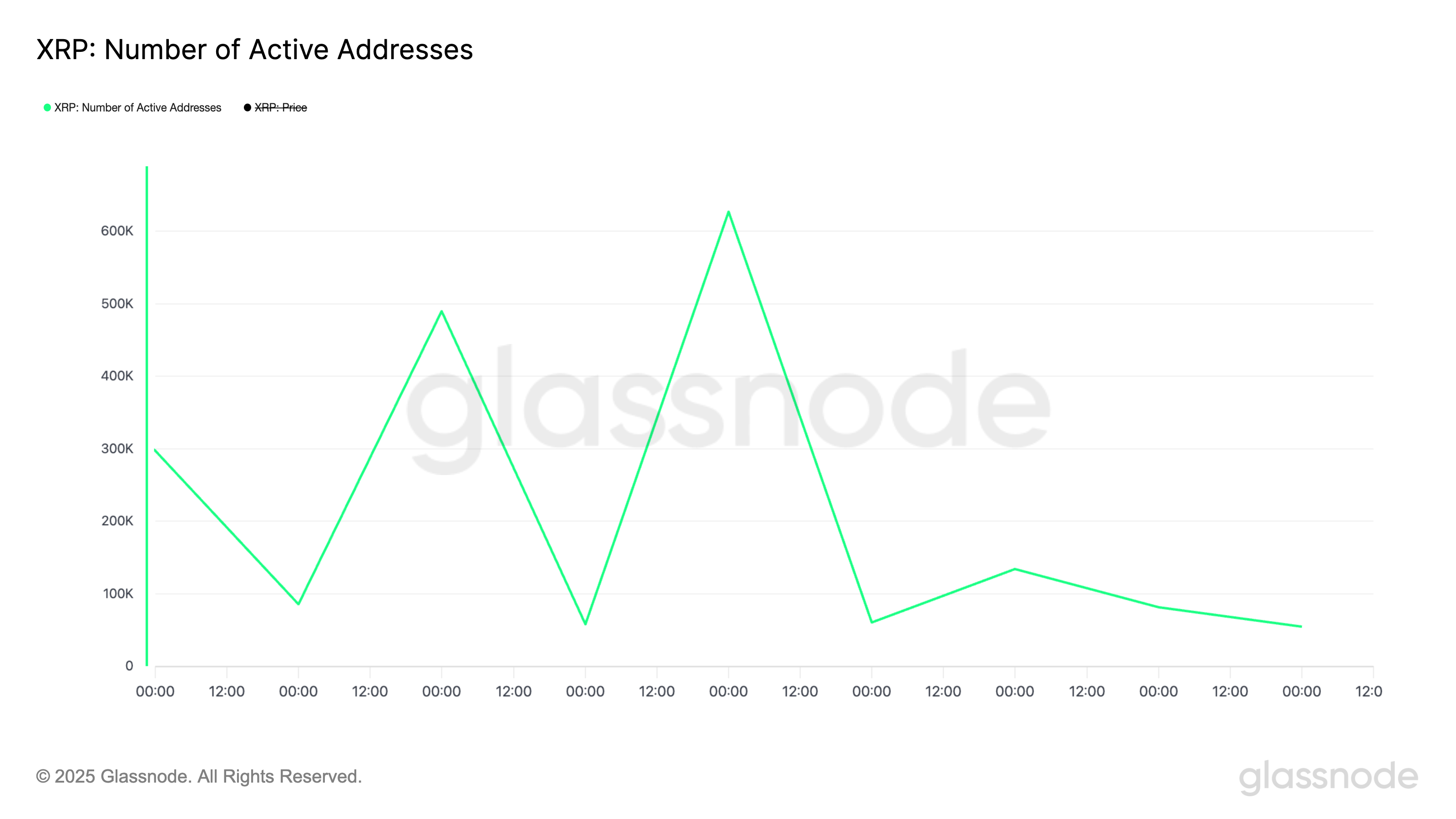

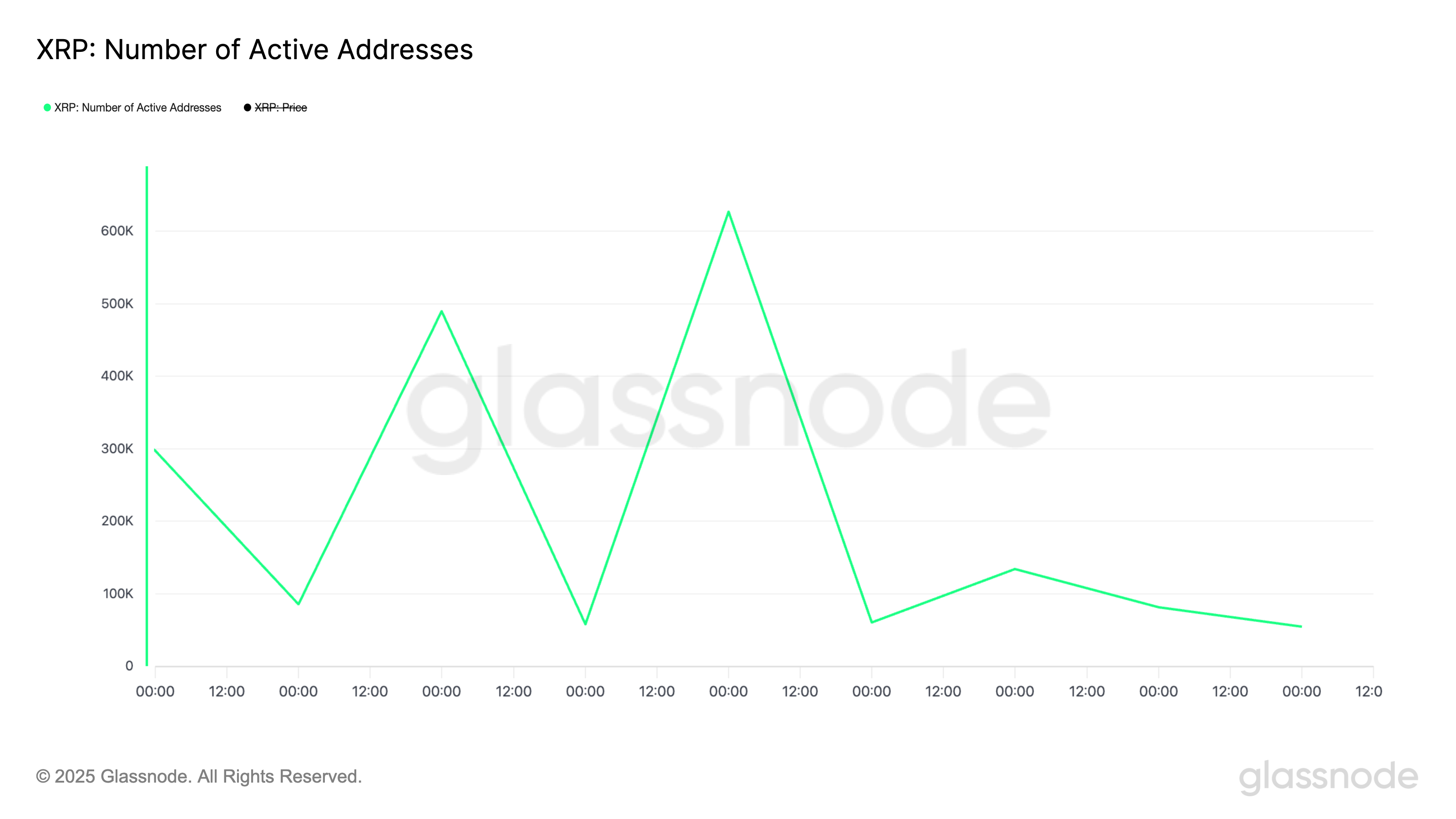

But, hold your horses! 🐴 This party was short-lived, as on-chain data shows a steady decline in active wallet counts since then. Talk about a buzzkill!

But, hold your horses! 🐴 This party was short-lived, as on-chain data shows a steady decline in active wallet counts since then. Talk about a buzzkill!

🏆 Ethereum, not to be outdone, has also joined the rally, reclaiming its throne above $2,000 after a modest2% hike, now trading hands at $2,050. Ripple, Solana, Dogecoin, and a plethora of other altcoins have followed suit, painting the market green with envy and substantial gains.

In a plot twist to rival your favorite soap opera, software intelligence firm Microstrategy, now dramatically rebranded as “Strategy” (because branding is life, obviously) said on March 24, “Hold my spreadsheet” and bought up 6,911 BTC for—wait for it—$584.1 million. All this while the rest of us are trying to decide if we can afford guac on our burrito bowls. 🥑😩

Our friend James Butterfill, the Head of Research at CoinShares, has a theory about this sudden burst of enthusiasm. He claims it’s all thanks to a hefty dose of market confidence that’s been brewing in the digital asset pot. Why, just last week, crypto ETPs were rolling in the dough, breaking a 17-day streak of outflows like a kid breaking a piñata at a birthday party! 🎉

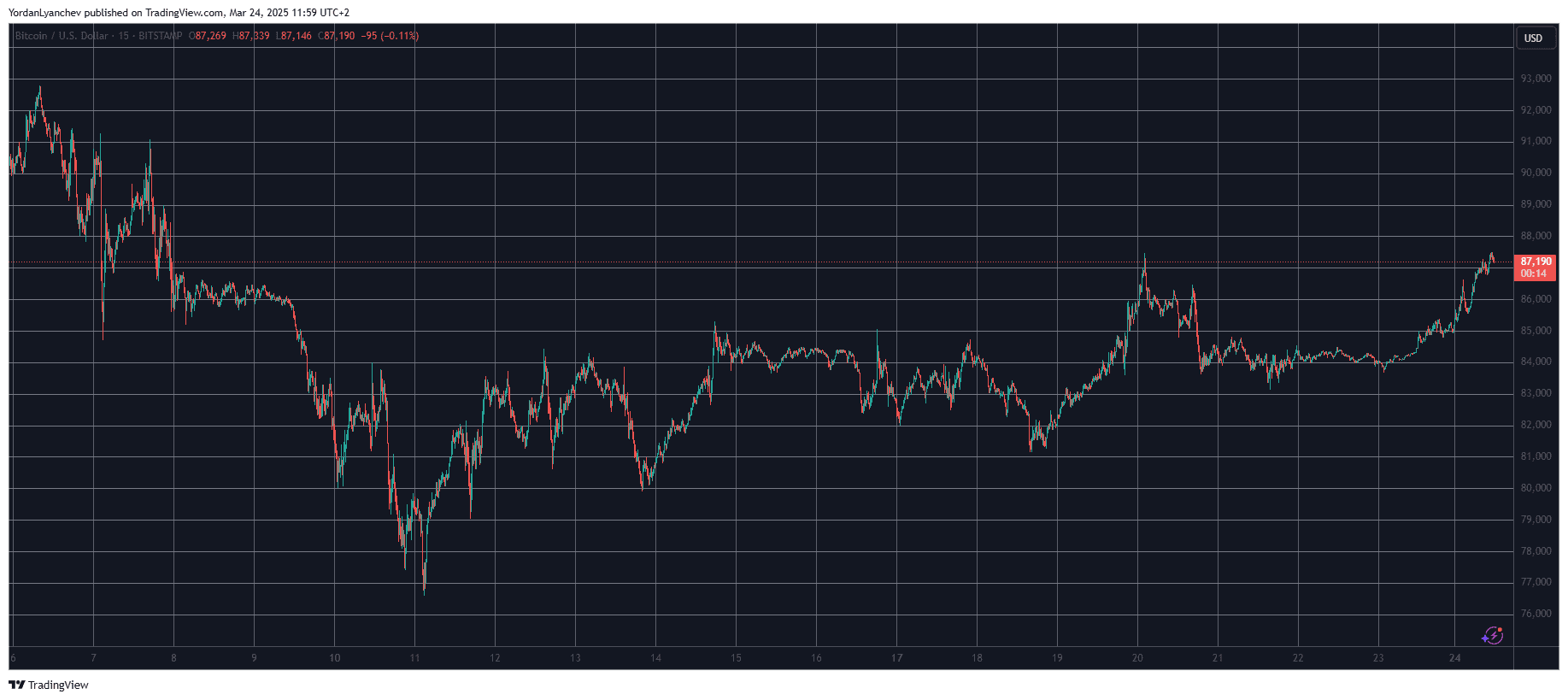

Oh joy, oh rapture! Bitcoin’s price has finally managed to tap $87,600, a feat it hadn’t achieved since March 7. I mean, it’s not like it’s a big deal or anything, but hey, a 17-day high is worth celebrating, right? 🎉

“There is no reason to build an L2.

L1s can be faster, cheaper, and more secure.

They aren’t slowed down by a glacially moving L1 data availability stack, or have to compromise security with complex fraud proofs and upgrade multisigs.”

But wait! The plot thickens! Enter Paul Atkins, the alleged nominee from the illustrious Donald Trump, who is set to grace the SEC with his presence next month. Before he takes the stage, he must first face the Senate Banking Committee on March 27, 2025, a date that will surely be marked in the calendars of many a crypto enthusiast. If the stars align and he is approved, we might see him don the SEC Chair hat as early as April. So, dear investors, let us ponder which crypto tokens to snatch up before this grand event unfolds.

He goes and compares it to Bitcoin’s own ritualistic halving dance—how quaint! And wouldn’t you know it, the investors’ ears perked up quicker than a cat at the sound of a can opener. What could this mean for those brave souls navigating these wild trading waters? Grab your life jackets, friends!

As of January 31, 2025, the company based in Tokyo began accepting Bitcoin as a form of payment. At that time, Bitcoin and Ethereum were the primary cryptocurrencies used for transactions. Recently, Open House has expanded its options by including three additional digital currencies: XRP (Ripple), SOL (Solana), and DOGE (Dogecoin). Consequently, customers now have a total of five diverse cryptocurrencies to select from when purchasing real estate.

Let’s talk numbers, darlings. Hayes confidently predicts Bitcoin will gallop through the finish line at $110K before cooling its jets to casually nap at the $76,500 mark—how pretentious! Why so bold, you ask? Hayes is betting on the Federal Reserve to pivot from quantitative tightening (QT) to quantitative easing (QE). It’s like switching from CrossFit to yoga—it brings in liquidity, calms stress, and reminds you that Bitcoin is bad at taking direction from overly serious economists.