🚨 Crypto’s Dirty Little Secret: Billions Down the Drain! 🤑

Now, now, dear investors, don’t be too glum. This figure does represent about two-thirds of the total amount swiped throughout 2024. Silver linings, and all that rot… 🌫️

Now, now, dear investors, don’t be too glum. This figure does represent about two-thirds of the total amount swiped throughout 2024. Silver linings, and all that rot… 🌫️

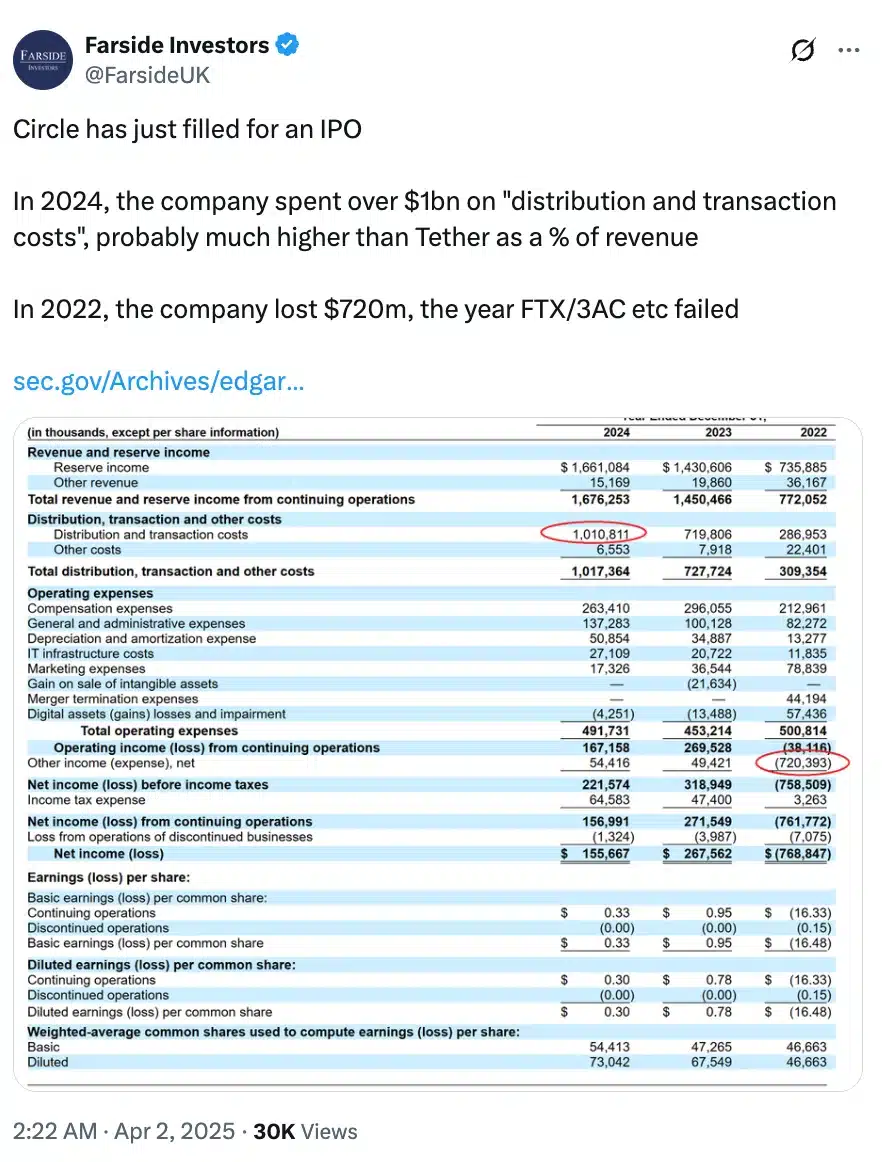

The company has, with a flourish, submitted its prospectus to the SEC, aiming to make a splash on the New York Stock Exchange with the rather catchy ticker symbol “CRCL.”

As the world teeters on the brink of economic collapse, tech giant Sony Electronics has decided to take a bold step into the unknown. In a move that can only be described as a cry for help, Sony announced that it would accept USDC stablecoin payments in Singapore, with transactions facilitated through Crypto.com’s payment services.

In a move that has left many scratching their heads, Crypto.com has partnered with Sony Electronics to bring the exchange’s expansion into Singapore. Because, you know, what could possibly go wrong when a cryptocurrency exchange teams up with a Japanese electronics giant? 🤔

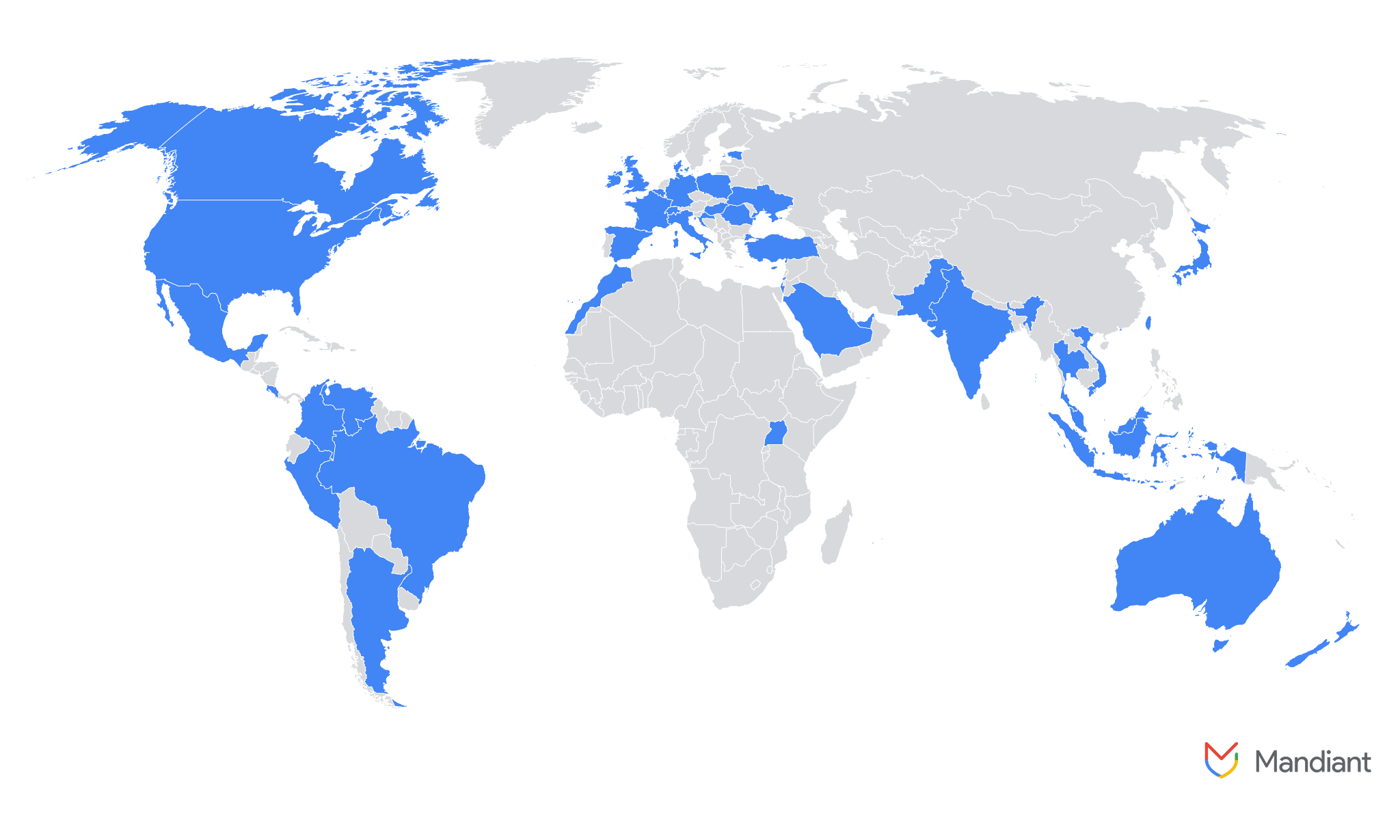

Since last year’s shenanigans, Google’s Threat Intelligence Group has spotted a surge in DPRK’s IT workers slithering into Europe’s finest tech companies. With a bag full of fake identities, these chameleons blend in perfectly, often posing as a whole team of experts! 🦎🎩

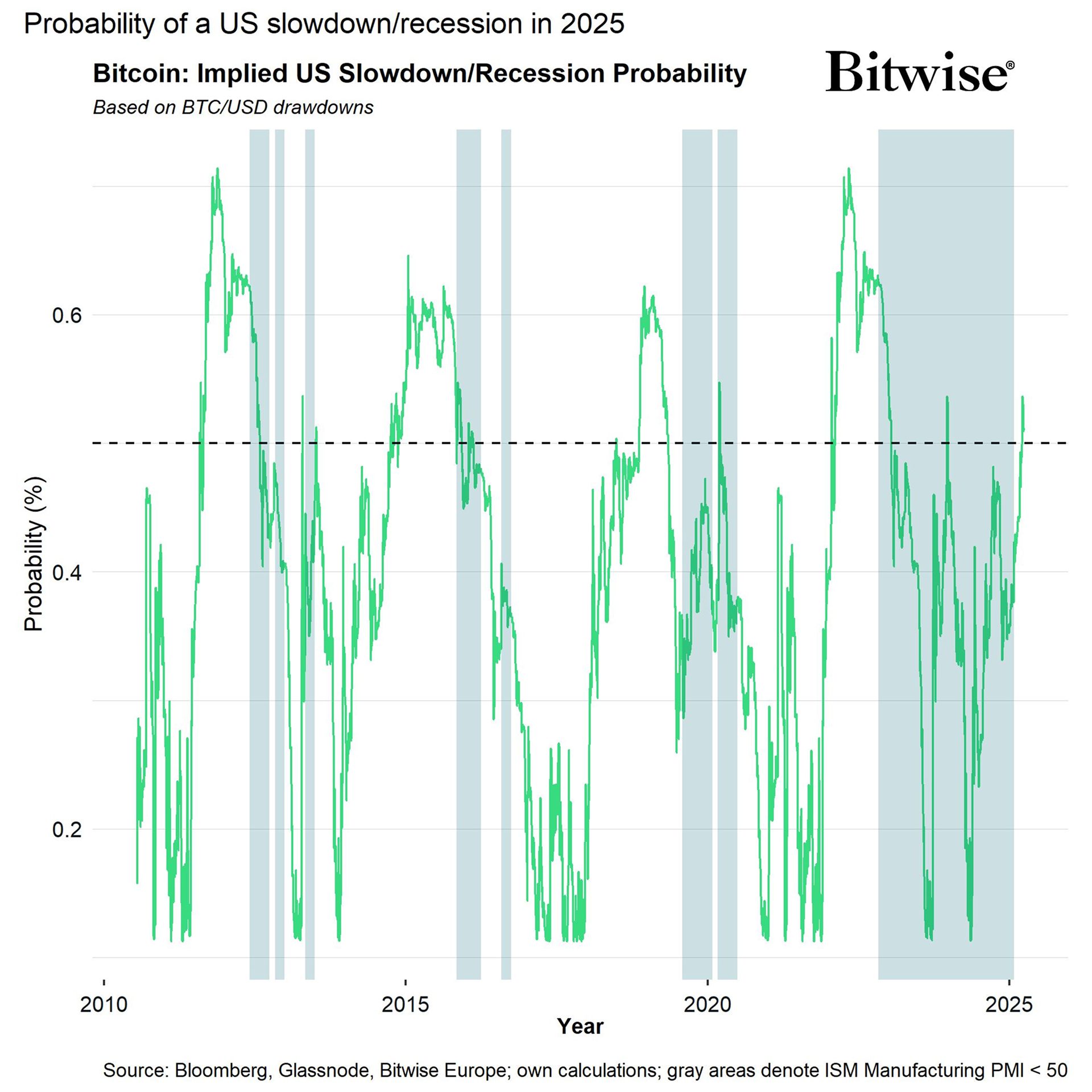

Both Bitcoin (BTC) and its lesser-known companions (we call them altcoins) have likely already priced in most of the U.S. recession jitters. However, if the recession actually happens, watch out—there might be a bit more tumble in the works. 🚀📉

At precisely 4 p.m. E.T., in the hallowed grounds of the White House Rose Garden, Trump will take center stage to announce his new tariff plans. Picture it: the sun setting, the roses blooming, and the world’s economy teetering on the edge of a precipice. 🎪 The tariffs, rumored to be as high as 20%, are Trump’s answer to the “free deals” that have allegedly turned the U.S. into a $3 trillion playground for imported goods. American workers and manufacturers, he claims, have been left weeping in the shadows. 🎭

So, Amber Group popped up on Nasdaq like a particularly glamorous NFT, you know? 💅 Paul Veradittakit, a fancy pants at Pantera Capital, reckons this is just the tip of the iceberg. More crypto companies are gonna be hitting the public market faster than you can say “blockchain,” bringing in all those institutional investors who’ve been hiding under the bed in fear. 🤡

In an interview with BeInCrypto, Matt Pearl, director of the Strategic Technologies Program at the Center for Strategic and International Studies (CSIS), explained that tariffs on China will disrupt supply chains and inflate operational costs for the US mining industry. Because, of course, why not make life harder for everyone? 🤷♂️

In his infinite wisdom—or is it merely the light of a market flickering out?—Kiyosaki has deemed silver the “hottest investment today.” Why, you ask? Because the wretched demand for this shiny morsel far outstrips the paltry supply, especially for those industrious applications. A true marvel of human ingenuity—who knew we harbored such a craving for shiny things? 🤔