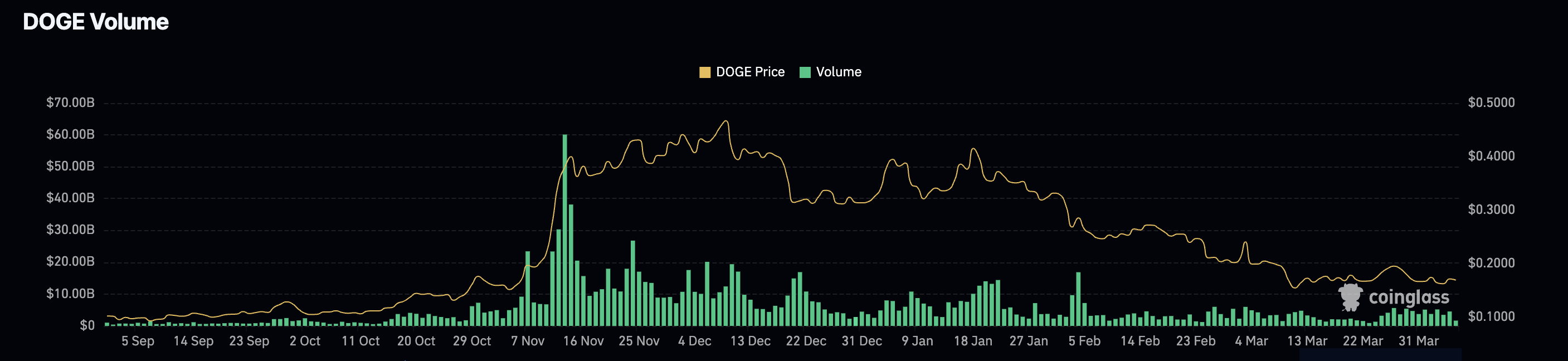

DOGE Tanks! Will The Meme Coin Soar Again?

Back in November 2024, Dogecoin’s volume happily pranced around two-year highs, getting just about everyone’s attention. But faster than you can say “doggy biscuits,” that volume took a nosedive. The price dove, too, shedding over half its value in less than six months. Now, with daily trading seemingly on a juice cleanse below $5 billion, the outlook’s as bright as a solar eclipse at midnight.