Gogol-esque Crypto Warning: CLARITY Act and the 2026 Rally

He wrote, “To imagine what’s at stake, picture Senator Elizabeth Warren as the next chair of the SEC.”

He wrote, “To imagine what’s at stake, picture Senator Elizabeth Warren as the next chair of the SEC.”

Memecoins, those absurd yet irresistible creatures, have long been the lifeblood of Solana’s DEX volumes, and by extension, the fate of its native token, SOL. Thus, this resurgence of speculative fervor may well be the zephyr that fills the sails of both PUMP and SOL. How quaintly circular, no?

//media.crypto.news/2026/01/Image-28-01-2026-at-10.14.webp”/>

But fear not, dear readers, for the altcoin circus is in full swing! XRP ETFs, the underdog with a chip on its shoulder, managed to woo investors to the tune of $9.16 million. And let’s not forget Solana, the plucky upstart, which pocketed a tidy $1.87 million. It seems the crypto crowd is craving something spicier than the usual Bitcoin and Ethereum fare-a bit like swapping a bland bowl of porridge for a plate of flaming jalapeños.

On a Tuesday, no less, when the world was busy sipping its tea, the precious metal decided to flaunt its grandeur, as the US Dollar Index (DXY) plunged to depths unseen since the days of yore (or at least 2011). A tragedy, you say? Nay, a comedy of errors!

On Monday – a Monday, mind you, the most melancholy of days – the Committee on State Building and Legislation, a body whose name alone suggests endless bureaucratic processes, decided to formally allow the plucking of crypto assets from the hands of the wicked (and perhaps the merely unfortunate). It seems a legal “vacuum” existed, hindering their ability to… well, to take things. A most distressing situation, indeed!

They call it volatility. I call it mass hysteria dressed in algorithms. Bitcoin, stubbornly clinging to its illusion of value, hovers near ninety thousand, as if that number holds some cosmic significance. Ethereum, ever the loyal follower, hangs on at three thousand, while XRP… well, XRP just exists. A polite cough in the grand scheme of things. They wait for a signal, a whisper from Washington, and one imagines they hold their breath, which is, admittedly, a rather peculiar feat for a digital asset.

Grayscale insiders and affiliated entities have adjusted their exposure to select altcoin exchange-traded products, their actions as enigmatic as a riddle posed by a sphinx.

In what can only be described as a masterclass in digital misfortune, Clawdbot-excuse me, Moltbot-found itself in hot water after its founder, Peter Steinberger, discovered that crypto scammers had hijacked his accounts like unwanted houseguests who refuse to leave.

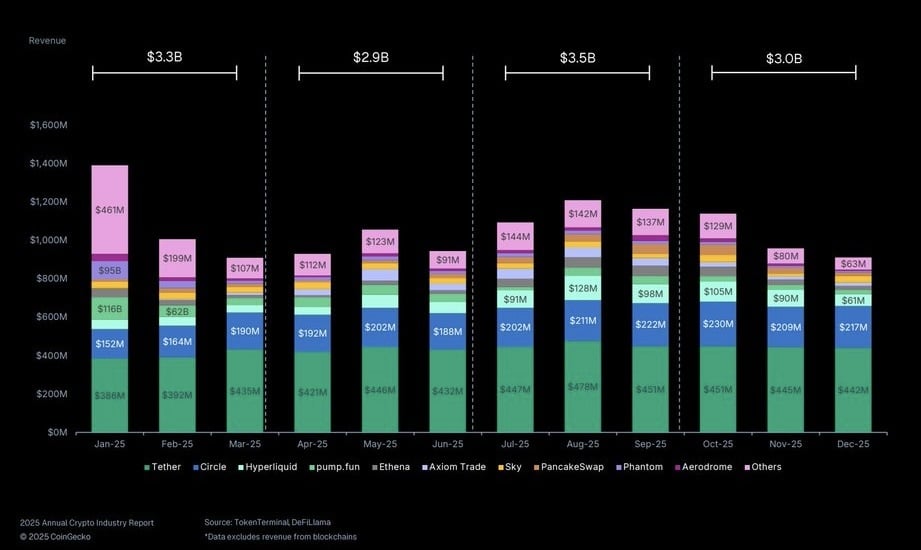

Once upon a not-so-distant future, a very research-y study by Coingecko waltzed into our lives. And guess who reigned supreme? Tether, of course! Sashaying through the crypto scene, Tether bagged $5.2 billion, which is basically the moon when you compare it to the rest of the revenue pool. Not bad for just stopping currencies from whizzing around like a manic squirrel with ADHD, huh?