Bitcoin Soars to $70K as Panic Peaks!

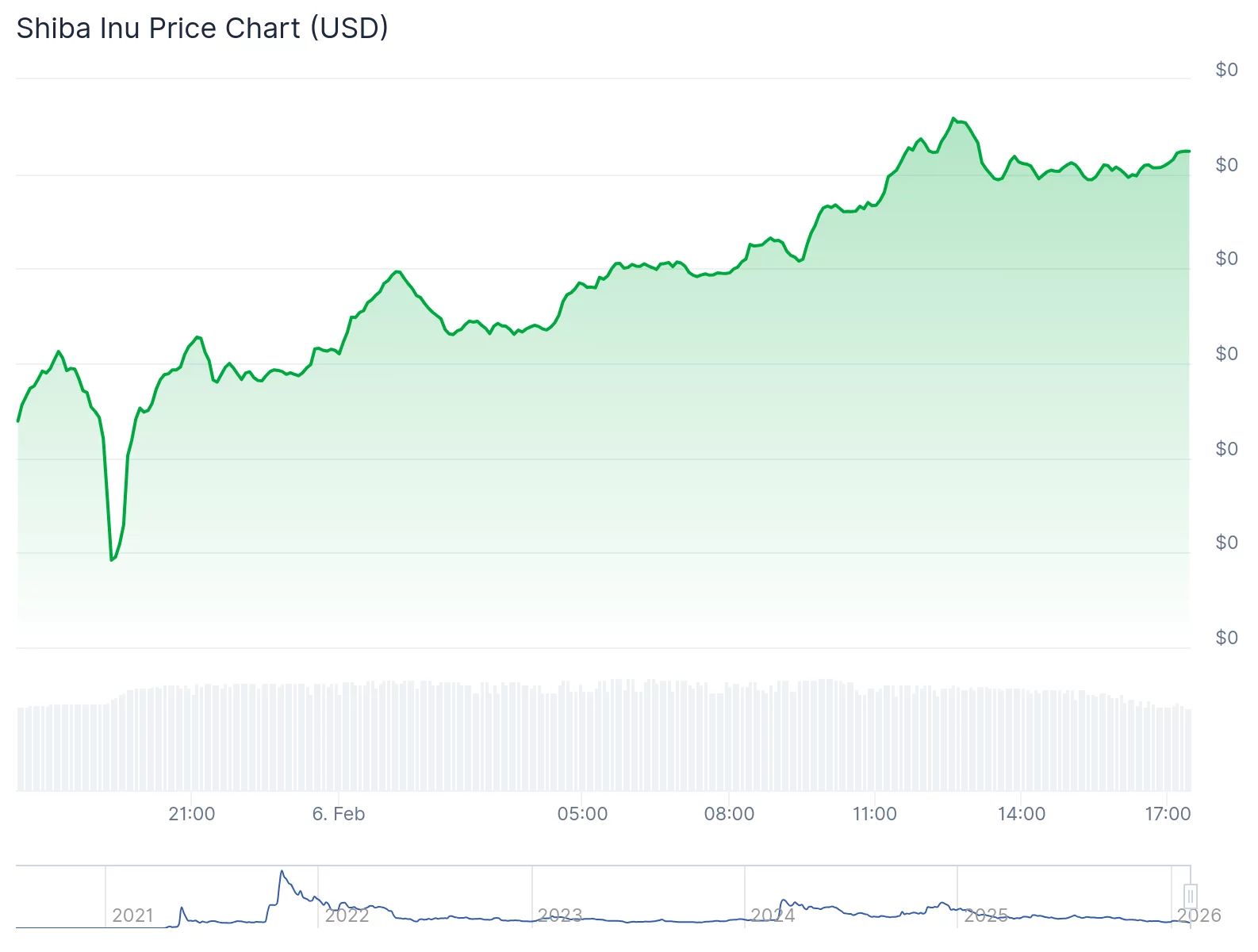

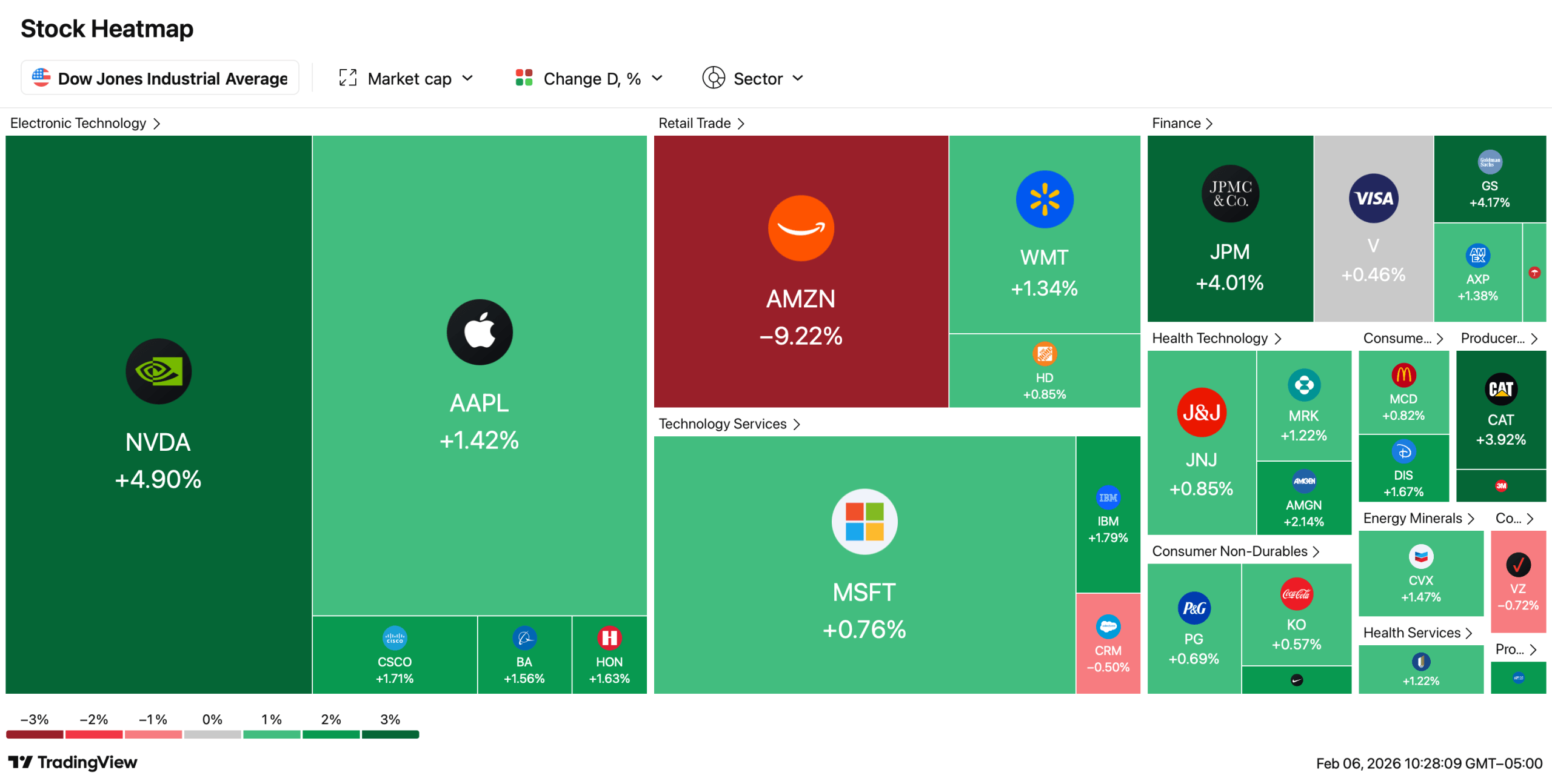

Bitcoin, that mischievous digital trickster, made a dramatic return to around $70,600 on February 7 after a 14% plunge from its early February highs, which was about as exciting as a drowsy sloth in a library. Meanwhile, the Crypto Fear and Greed Index, that ever-reliable barometer of investor sanity, hit rock bottom with a reading … Read more