XRP Bounces Back Like a Rubber Chicken: Is the Bottom Finally Here?

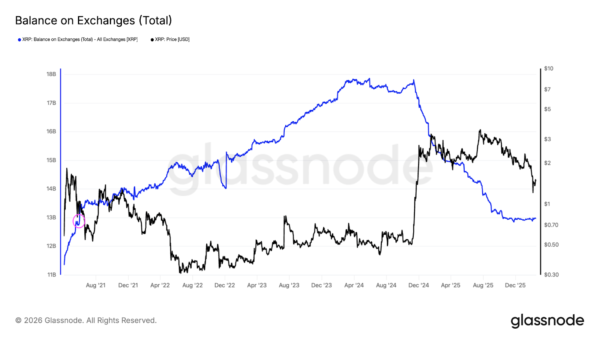

Well, knock me down with a feather and call me surprised! XRP has decided to stop its nosedive and bounce back like a rubber chicken at a wizard’s convention. After hitting a 15-month low earlier in February, the price surged 50% to a high of $1.67 from the Feb. 6 low of $1.12. That’s right, folks, the buyers have finally remembered where they left their wallets. Though it’s still trading 60% below its multi-year peak of $3.66, several on-chain and derivatives indicators suggest this dip might be as shallow as a troll’s philosophy.