Morgan Stanley’s Crypto Waltz: Wall Street’s Latest Fling with Digital Assets

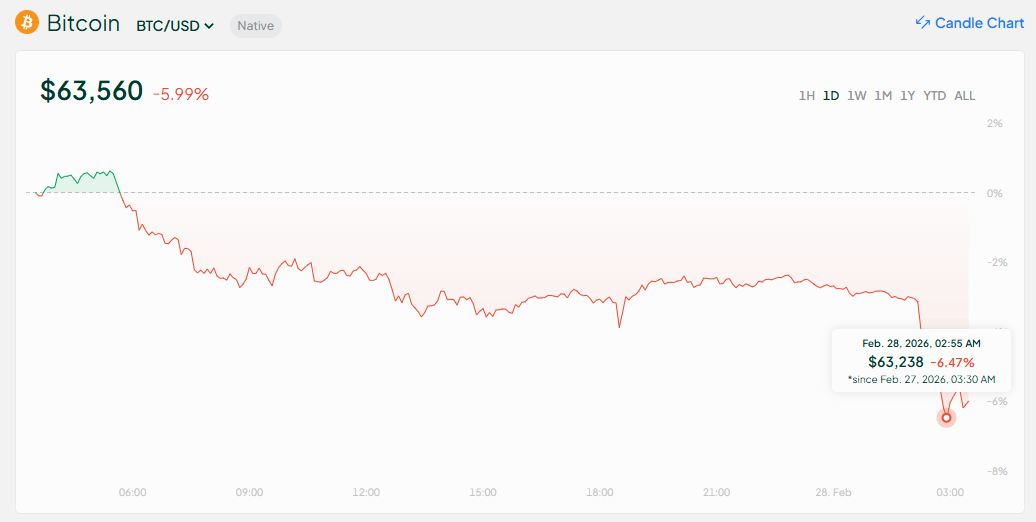

According to the ever-vigilant scribes at Bloomberg, on the 27th of February, Morgan Stanley, that titan of Wall Street, filed for a de novo national trust bank charter. This, they proclaim, will grant them the privilege of custodial guardianship over digital assets, as well as the right to engage in crypto trading and staking for their esteemed clientele. The application, lodged through the auspiciously named Morgan Stanley Digital Trust, was officially recorded on the 18th of February, as the Office of the Comptroller of the Currency duly noted.