It appears our dear Bitcoin doth linger coyly just beneath its recent summit, having mounted a spirited ascent that carried it to the very zenith of this week’s dealings. Such persistence in price and bustling trade volume bespeak a heart stout and bullish, though the formidable barrier at $95,500 doth remain a most crucial sentinel to be observed.

Bitcoin

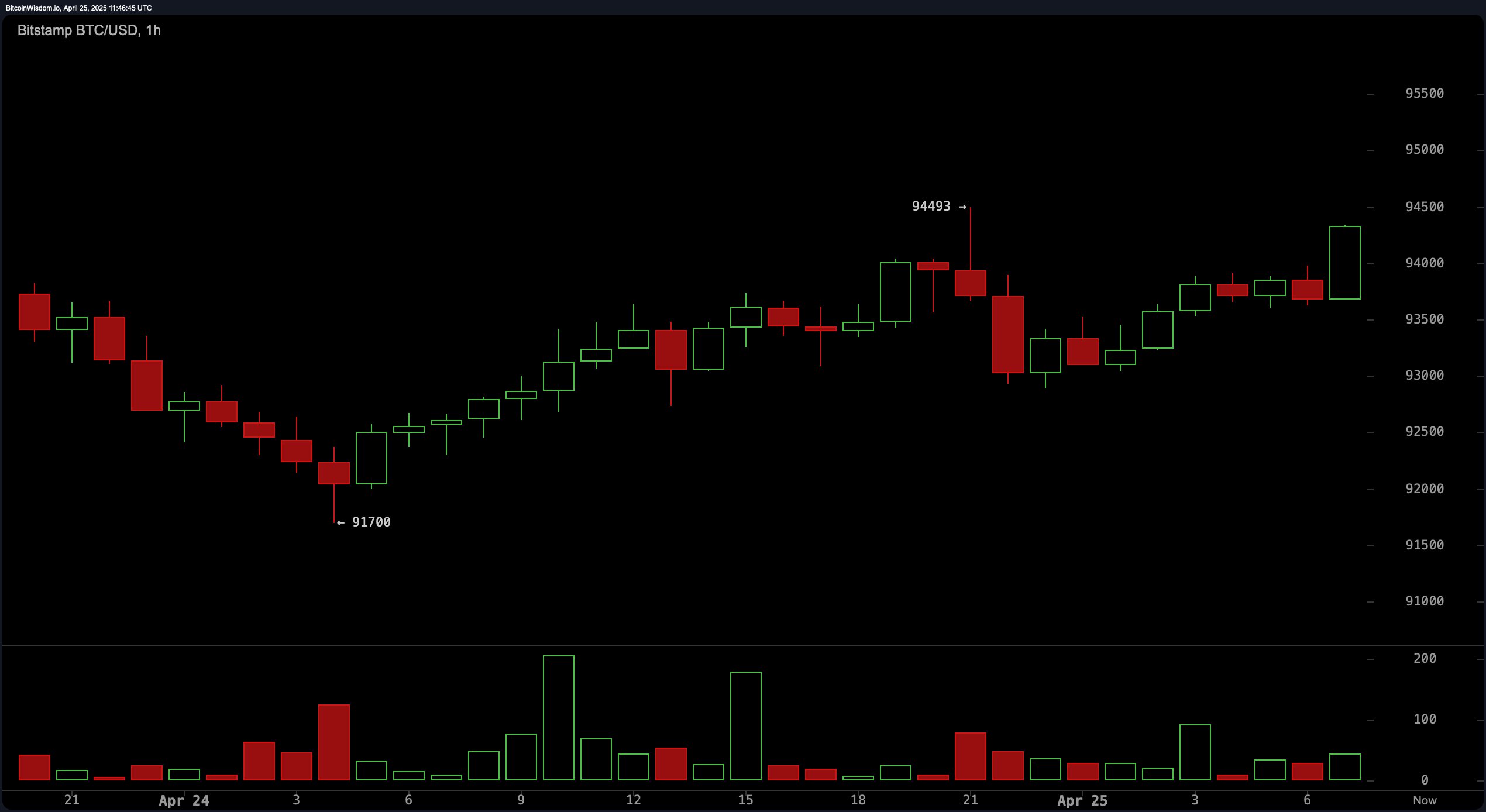

Upon the swift-moving hour’s ledger, Bitcoin exhibits a modest dalliance betwixt the bounds of $93,000 and $94,900, with a slight inclination towards optimism. The latest candle of the hour, bold and bullish, did close after rebounding from the humble threshold of $91,700. Should Bitcoin breach and happily close above $94,500, one might expect a fresh ascent, a most delightful upward leg. Yet, should it falter and meet refusal in the narrow realms of $95,000 to $95,500, a sell-off might ensue like a jilted suitor hastening away. Traders of daring temperament may seek perilous entry just above this boundary, eyes keenly alight on the ebb and flow of volume. Conversely, signs of frailty might beckon a retreat to gentler pastures below.

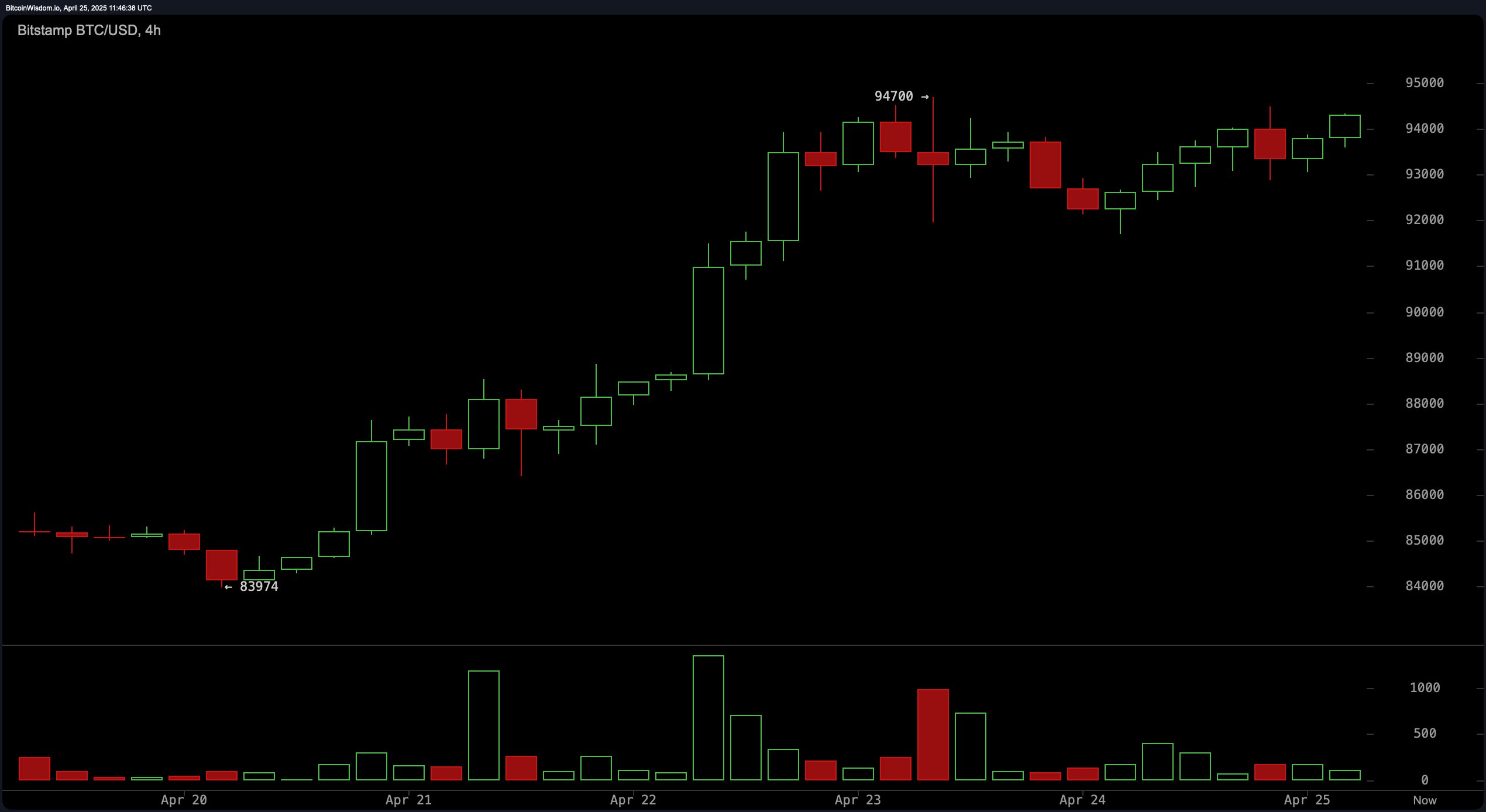

The fourfold hour, dear reader, presents a tale as old as time—a gradual ascension by stair and step, price’s modest retracements but shallow protests. From the triumphant day of April 22, a surge in volume set hearts aflame, tempered only as Bitcoin approached the lofty $94,000 plateau. Beneath this eminence lies firm support around $83,974, the very bedrock of this hopeful climb. The dips near $92,000 to $92,500 offer invitations for the prudent (or the daring) to seize a bargain entry. Still, without renewed vigor and an eventual triumph beyond $95,500, weariness might settle upon this ascent, prompting some to hedge their bets and retreat with pockets slightly fuller—profit-taking, or as I call it, a genteel exit.

When one views the daily chronicle, a splendid breakout from a long and languid pause beneath $86,000 doth reveal itself. Our spirited Bitcoin has made a gallant charge toward $95,000, buoyed by the hearty clamor of volume—a genuine thrust upward. Yet the tightening daily candles intimate a subtle slowing of pace, as if the steed tires just as the finish line looms. A respectful retest in the $90,000 to $91,000 domain might present a second chance for entry, should prior opposition transform into staunch support. Nevertheless, a flickering momentum that cannot surpass the $95,500 bastion warns one to proceed with measured caution.

Oscillator readings present quite the mixed company, revealing a market both hopeful and wary. The momentum and MACD, those trusted friends, call for purchase with a nod, declaring the strength of the recent advances. Yet, the CCI—a bit of a party pooper—warns of an overindulgence with a selling hint. Meanwhile, RSI and Stochastic adopt a neutral stance, much like a chaperone unsure if a dance will continue or conclude abruptly. Such a merry muddle underscores the necessity of vigilant observation of resistance and daily patterns lest a sudden reversal catch one unawares or a breakout surprise the crowd with rapture.

Fortifying the bullish tale, all moving averages—be they simple or exponential over spans from 10 to 200—signal the auspicious note of “buy.” The 10-period averages, both lively and slow, trail Bitcoin’s current lofty price by several thousands, affirming a robust momentum. The grander moving averages such as the 200-period EMA at $85,380 and SMA at $88,858 secure this upward journey’s long-term legitimacy. Yet until Bitcoin dashes boldly above $95,500 and remains steadfast, one might expect a teasing range-bound dalliance, calling for patience befitting a lady or gentleman in a delicate courtship.

Verdict of the Bulls:

Bitcoin persists in a posture most bullish, upheld by a sturdy framework of rising averages and encouraging oscillator signals like momentum and the MACD (12, 26). The gentle consolidation just shy of $94,500 might serve as a mighty springboard, for a confirmed breakthrough above $95,500 could ignite a swift campaign toward the splendid unknown peaks. As long as supports at $91,700 and $90,000 hold their ground, the bullish notion remains firmly entangled in hope.

Verdict of the Bears:

However, and there is ever a however, the industrious Bitcoin’s journey is shadowed by overbought chatter from the CCI and a timid conviction near the summit, portending potential fatigue. The confined range at the apex may well foreshadow a corrective interlude, especially if the price crumbles beneath support zones of $92,000 to $91,700. Should volume languish and rejection at $95,500 endure, a brief retreat to mid-$80,000s is a prospect not without precedent nor likelihood—prudence, therefore, should be the candle lit in this unfolding drama. 🎭

Secure your internet browsing with a NordVPN subscription. [Learn more](https://pollinations.ai/redirect/432264)

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-04-25 16:00