As the midweek sun casts its pallid light upon the crypto markets, a palpable tension hangs in the air, thicker than a winter fog. The macroeconomic compass, once guided by the twin beacons of regulation and interest rates, now spins erratically, its needle trembling at the altar of capital exhaustion. Institutional investors, those titans of the financial realm, have slowed their gallop, their ETF flows now exhibiting a five-day streak of crimson hues. Bitcoin, that enigmatic phoenix, has descended beneath the fabled “Black Friday” price, its once-cherished $100,000 threshold now a ghostly memory, haunting the digital ether. 📉💸

TL;DR

- Bitcoin and Ethereum ETFs, those venerable vessels of digital wealth, have shed a staggering $797 million in a single day, their sails furled after five consecutive days of red ink. 🚩💸

- Bitwise’s Matt Hougan, that sage of crypto prophecy, whispers of $125,000-$150,000 BTC before the year’s curtain falls. A vision as audacious as it is tantalizing. 🧠📈

- The Amplify XRP 3% ETF, a marvel of financial engineering, has secured its spot on the DTCC, a triumph as rare as a unicorn in a stockroom. 🦄💼

- Charles Edwards, the Cassandra of crypto, warns that when institutions stop buying, the exit signs flicker ominously. 🔥🚫

$150,000 for Bitcoin in 2025? Bitwise says yes

While the masses wail about a “crypto winter,” Bitwise’s Matt Hougan offers a different narrative: retail investors, those harried souls, are “in maximum despair mode,” selling into every dip like a child tossing toys into a tantrum. 🤯💸

According to Bitwise’s internal flow data, this is the prelude to a grand reversal, a dance of forced liquidations and profit exits. Yet, institutional desks, those stoic giants, remain steadfast, buying Bitcoin like it’s the last slice of pizza. 🍕🧠

IBIT, FBTC, and GBTC continue to draw capital, even as the market wails. The Solana ETF, a beacon of resilience, raised $400 million in its first week-a testament to capital rotation, not flight. 🚀📉

Hougan’s targets are clear: a “realistic” $125,000-$130,000 BTC by year’s end, or a “Saylor-level” $150,000 if institutions regain their composure. A repeat of 2020’s consolidation, he claims, before the next leg higher. 📈🌌

Unique 3% XRP ETF achieves key DTCC listing

The Amplify XRP 3% ETF, that paragon of financial innovation, has been officially listed on the DTCC, marking the final step in its journey from conception to market. Without this, brokers and market makers would be as useful as a chocolate teapot. 🍫🔐

This listing paves the way for the first XRP-based income-generating product on U.S. markets, a feat as thrilling as a magician pulling a rabbit from a hat. 🎩🐇

The debut of spot $XRP ETFs appears to be just around the corner in the US

– U.Today (@Utoday_en) November 5, 2025

The ETF, a 3% monthly yield machine, mimics equity income ETFs, offering passive income to digital asset enthusiasts. A revolution, or just a cleverly wrapped candy? 🍬💡

The XRP fund will trade on Cboe BZX, redeeming shares only in institutional “creation units.” A world where even XRP has its own elite club. 🎩💼

If all goes according to plan, XRP will join Bitcoin and Ethereum in the U.S. ETF pantheon, a trio as iconic as the Three Musketeers. 🎩⚔️

Bitcoin and Ethereum lose $800 million in one day

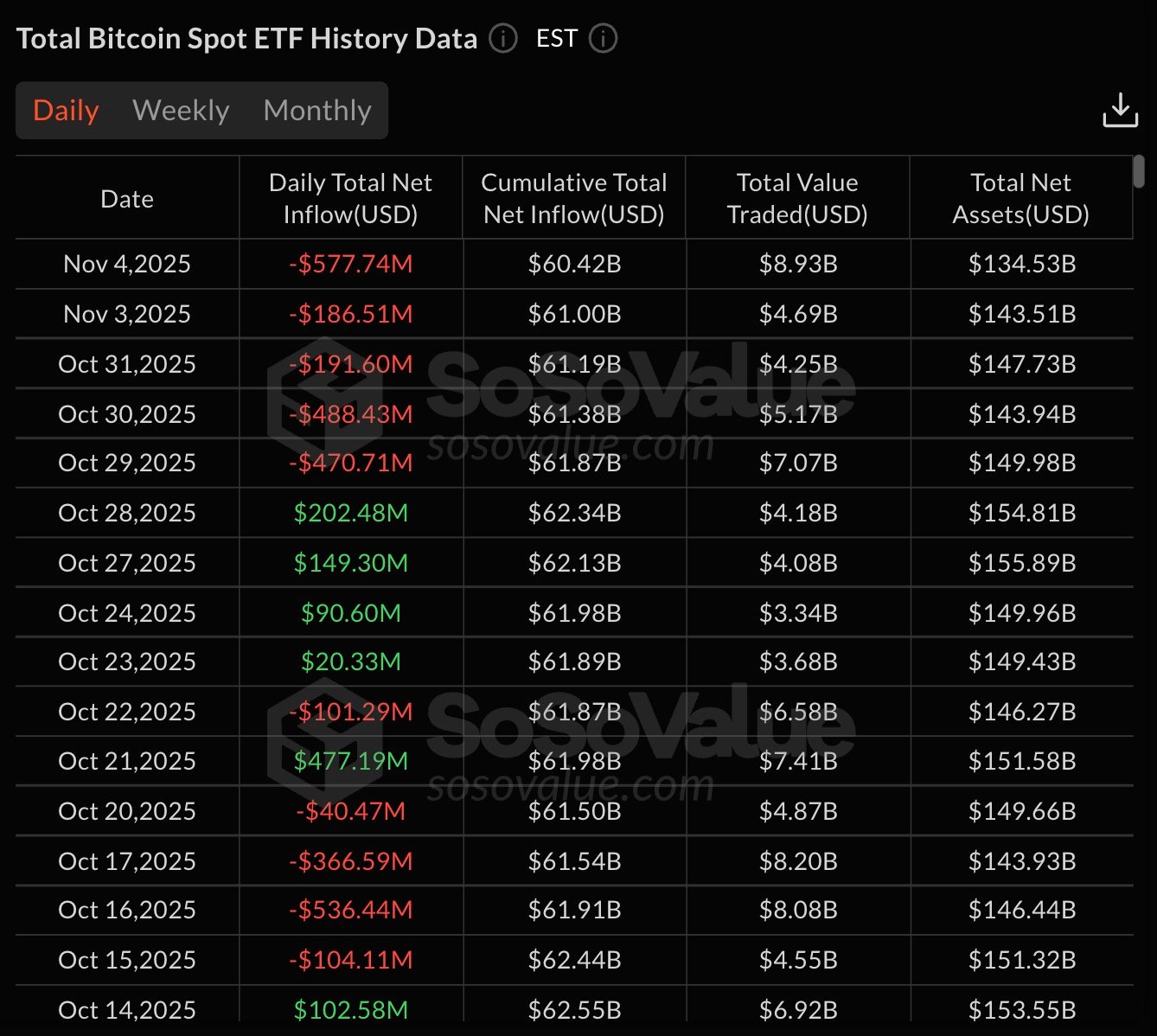

The ETF data for Nov. 4, 2025, is a masterclass in despair. Spot Bitcoin ETFs lost $577.7 million, while Ethereum ETFs shed $219.3 million. A combined $797 million in 24 hours-more than a cryptocurrency’s weekly allowance. 💸📉

- Spot Bitcoin ETFs: $577.7 million in net outflows. A hemorrhage worse than a broken faucet. 🚰💸

- Spot Ethereum ETFs: – $219.3 million in net outflows. A fiscal nightmare in a bottle. 🍶📉

Over five days, both BTC and ETH funds have seen consecutive withdrawals, their cumulative inflows now a shadow of their former selves. The previous week had already shown stress, with BTC down $798.95 million and ETH barely positive. A tale of two cryptocurrencies, both weeping into their keyboards. 🖱️😭

Market reaction was immediate. Bitcoin traded below $100,000 overnight, a fall so dramatic it could make a stock market chart weep. Ethereum lingered near $2,900, a ghost of its former $3,200 self. 🌫️📉

Analyst Charles Edwards from Capriole Investments warned that for the first time in seven months, net institutional buying has fallen below daily mined supply-a sign that distribution is outpacing accumulation. “When institutions stop buying, run,” he cautioned. A warning as chilling as a snowstorm in July. ❄️🏃♂️

SoSoValue data confirms the trend: Bitcoin’s weekly net inflow fell $764.25 million, while Ethereum lost $355.13 million. A Q4 decline so severe, it could make a bear market blush. 🐻📉

Evening outlook

For now, the crypto market looks fragile, a tightrope walker balancing on a thread. The next few sessions may decide whether this correction matures into a full reversal or deepens into a real crypto winter. 🕰️⚖️

- Bitcoin (BTC): Bulls must defend the $100,000 point to prevent cascade selling into $93,000. Holding that range could set up a rebound to $112,000, where major resistance now sits. A battle for the soul of crypto. 🏹💰

- Ethereum (ETH): Pressure builds under $3,300. If it holds, a short-term recovery to $3,700 is still in play. But failure there shifts focus to the $2,500 support and a colder Q4 outlook. A game of high-stakes chess. 🏰♟️

- XRP: Trades in a fragile consolidation near $2.2, but support above $2 keeps ETF-driven optimism alive. A close over $2.50 would confirm trend revival, while a drop under $1.90 would cancel it. A cliffhanger in digital form. 🕷️💸

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-11-05 14:48