Dear Reader, it is with a most distressing state of affairs that we must report the recent fluctuations of Bitcoin (BTC) and Ethereum (ETH), which have found themselves in a state of considerable fluctuation on this fateful Friday, September 26. Alas, both assets have dared to breach their key support levels, $110,000 for BTC and $4,000 for ETH, before, with a most unseemly haste, reclaiming them. A most curious spectacle, to be sure.

Indeed, in the past 24 hours, Ethereum (ETH) has managed a modest ascent of 3.82%, climbing to $4,050, while Bitcoin (BTC) has inched upward by 0.39% to $109,983. Yet, despite these minor triumphs, trading volumes have dwindled, a clear sign that the broader market remains as cautious as a debutante at a ball. A most prudent course of action, one might say, though rather dull for the adventurous.

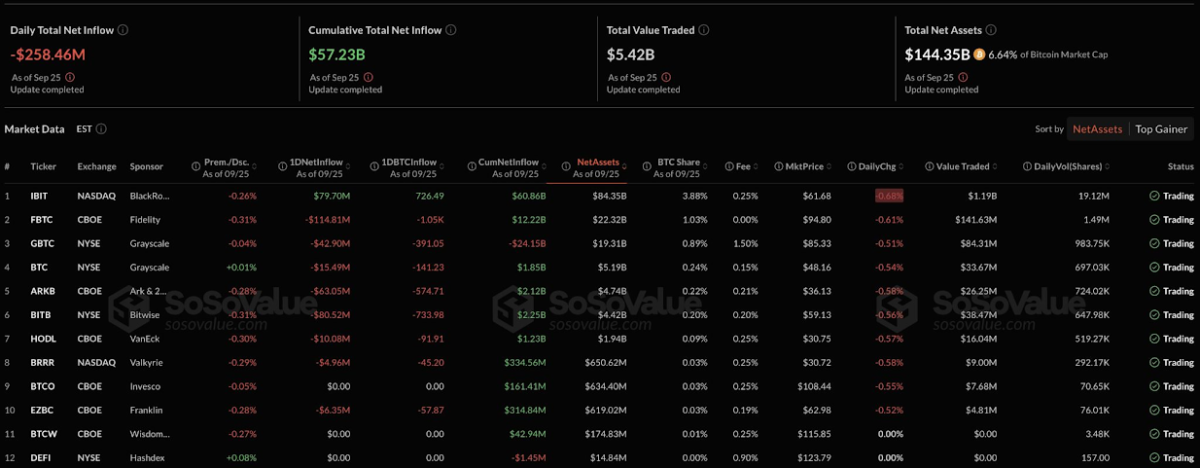

Bitcoin ETF outflows

The recent price correction for Bitcoin has accelerated with alarming speed, as the asset has plummeted below the esteemed $110,000 threshold. This movement coincides with a most unseemly display of selling pressure from institutional investors, who seem to have abandoned their posts with the haste of a frightened mouse. According to the analytics platform SoSoValue, the US Spot Bitcoin ETFs have recorded outflows of $258 million on Thursday, a most disheartening figure for the faithful.

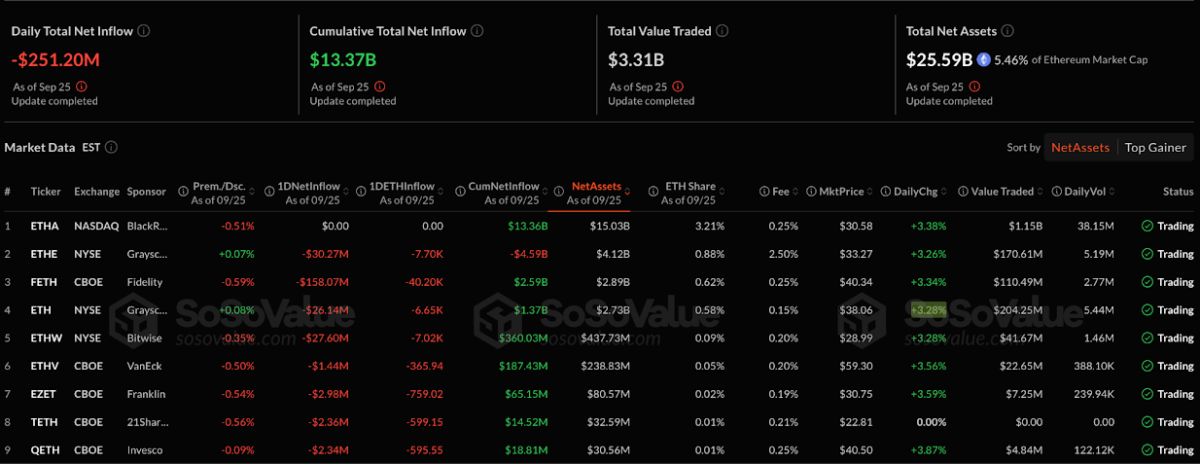

Ethereum follows suit

Ethereum, ever the dutiful companion, has mirrored Bitcoin’s downturn with a most unflattering lack of grace. The market for the second-largest cryptocurrency has witnessed investor withdrawals totaling $251 million from its own spot ETF products. A most lamentable turn of events, one might say, for those who place their trust in such ventures.

The combined outflow of over $500 million signals a widespread “risk-off” sentiment among institutional players, who seem to have adopted the caution of a mouse in a room full of cats. One might wonder if they anticipate further volatility, or if they simply prefer the comfort of traditional assets, which, while less exciting, are far less likely to cause a heart palpitation.

This trend suggests that large-scale investors are actively reducing their exposure to digital assets in anticipation of further market volatility. The current downturn follows a period of instability where Bitcoin recently lost key support levels, while ETH’s supply on centralized exchanges has hit its lowest point since 2016. A most unenviable position for any asset to occupy.

The Crypto Fear and Greed Index has plummeted to 32 (Fear), a most dismal figure, down from a neutral 41 yesterday. This shift reflects growing investor anxiety after weeks of ETF outflows and weak technical signals, marking one of the lowest sentiment levels since March’s “extreme fear” reading. A most sobering reminder that even the most ardent optimists can be swayed by the whims of the market.

The substantial outflows from institutional investment products mark a clear shift in market sentiment, acting as the primary driver for the current weakness in Bitcoin and Ethereum prices. Continued withdrawals could lead to further price declines in the short term unless there is a significant improvement in overall market confidence. For now, investor caution appears to be shaping the immediate future of the digital asset market, a most unyielding force indeed. 💰📉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- M7 Pass Event Guide: All you need to know

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

2025-09-26 23:34