Ethereum‘s had a week worse than my first audition, dropping nearly 6.2% over the past seven days. Analysts were quicker to predict a correction than I am to tell a joke, but guess what? The token managed to steady itself, like a stand-up comedian finding their groove. Over the past 24 hours, Ethereum’s price is up a tiny 0.1%, trading in neutral territory. It’s like the calm before the storm, or in my case, the punchline.

Now, this alone doesn’t change much, but a mix of on-chain and chart signals suggests something more interesting might be brewing. It’s like finding a hidden treasure map in a used comedy script!

Short-Term Holders Step Back In

One sign of renewed strength comes from short-term wallets. These are addresses that typically hold ETH for a few days or weeks before selling, like a hot potato. After weeks of trimming exposure, this group has started buying again. It’s like they’re saying, “Hey, maybe this Ethereum thing isn’t a dud after all!”

Data shows that 1-week to 1-month holders grew their share of ETH supply from 6.9% on July 22 to 9.19% on August 21. At the same time, 1-day to 1-week holders rose from 1.64% on August 8 to 2.74% on August 21. That’s a 67% increase in just two weeks, a clear indication that fresh buying pressure is returning. It’s like a sudden surge of laughter in a comedy club!

HODL Waves show the share of coins held across different time bands, from a few days to several years. It helps reveal whether short-term traders or long-term holders are driving market activity. Think of it as the difference between a one-night stand and a lifelong marriage.

Why does this matter? These short-term cohorts are often the first to react when they see an opportunity. Their renewed activity suggests confidence that the ETH price may have found a local floor and could be gearing up for the next move higher. It’s like the audience is warming up, and the big laugh is just around the corner.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. It’s like getting a front-row seat to the best comedy show in town!

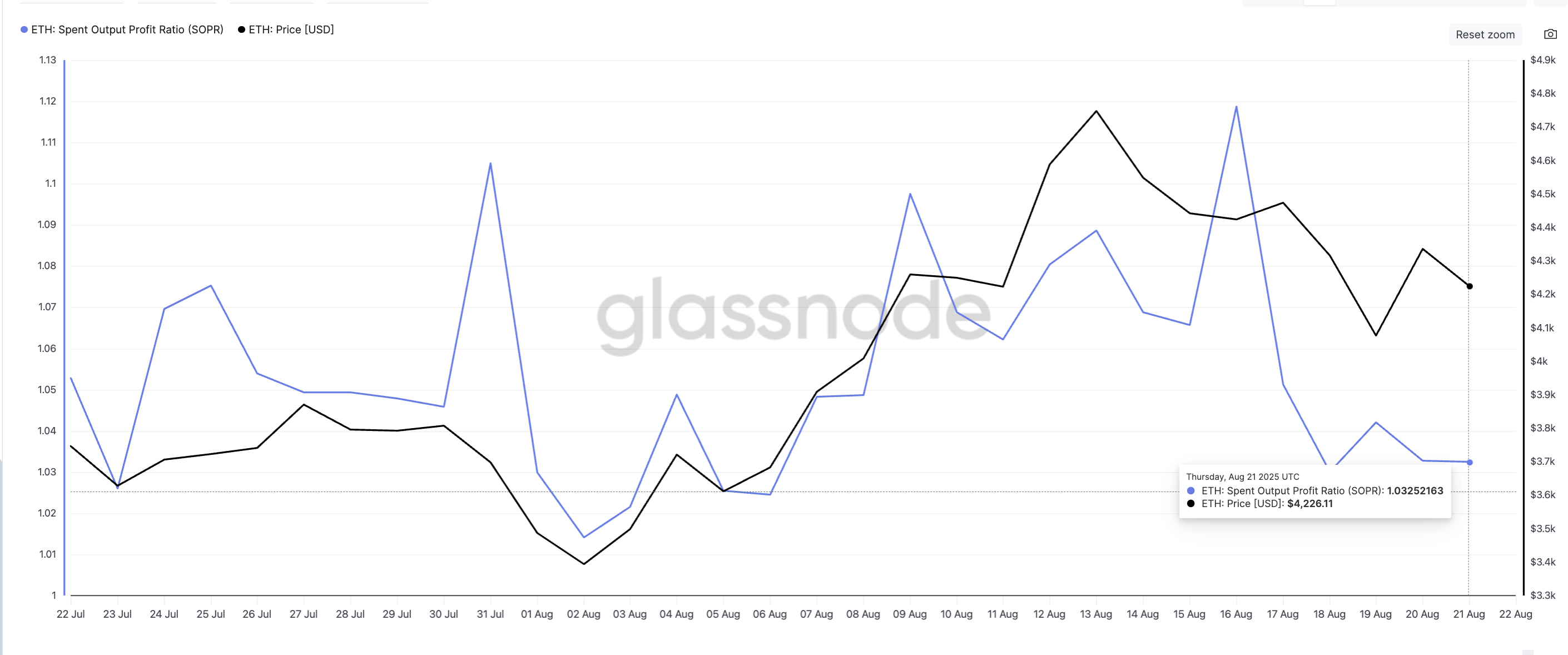

SOPR Hints at Market Bottom

Another piece of the puzzle comes from the Spent Output Profit Ratio (SOPR), a metric that tracks whether coins moving on-chain are being sold at a profit or a loss. When SOPR is high, it means holders are cashing out in profit. When it drops closer to 1 or below, more so with the prices correcting, it shows sellers are taking fewer profits, often near local bottoms. It’s like when the laughter dies down, and you know the next joke is about to land.

Over the past week, ETH’s SOPR dropped from 1.11 to 1.03. A similar move was last observed on July 31, when the ratio decreased from 1.10 to 1.01. At the time, the drop marked a market bottom. ETH bounced from $3,612 to $4,748 in the following days – a 31% rally. It’s like a comeback so good, even the critics are laughing.

A similar setup may be forming now. The SOPR decline suggests profit-taking is drying up while sellers weaken, creating the conditions for buyers to step back in. If history repeats, this could be the early signal of another Ethereum price rally. It’s like the audience is on the edge of their seats, waiting for the big finish.

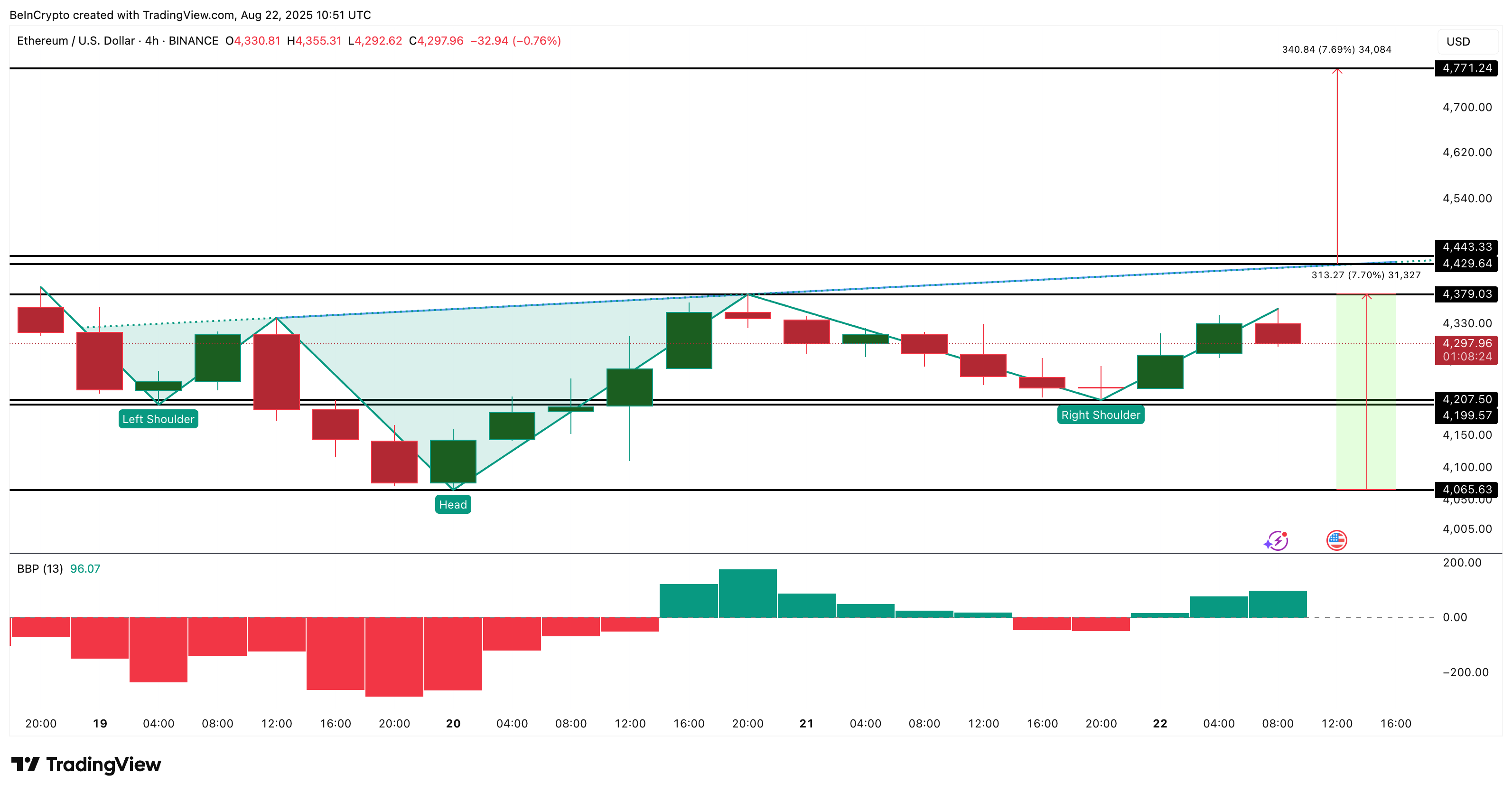

Inverse Head And Shoulders Ethereum Price Pattern in Play

Beyond on-chain signals, the price chart itself is flashing a strong setup. On the 4-hour chart, ETH is forming an inverse head and shoulders pattern, a classic bullish reversal signal. The neckline of this pattern sits near $4,379 and is slightly sloping upward, which often strengthens the breakout case. It’s like the final setup for the punchline.

For confirmation, the ETH price needs to clear $4,443. If that happens, the technical target points toward $4,770, calculated from the distance between the neckline and the head. This lines up with the broader bullish signals from short-term buyers and SOPR. Even the increase in the bullish momentum, while the Ethereum price flirts with a breakout pattern, strengthens the bullish case. It’s like the comedian is hitting all the right notes, and the audience is ready to explode with laughter.

The increase in bullish momentum can be exhibited by the rising green bars in the Bull Bear Power indicator, which measures the gap between the highest price and a moving average to show whether buyers or sellers are in control. It’s like the tension building up, and you know the punchline is coming.

Still, traders should watch the invalidation level. If ETH slips below $4,207 (the base of the right shoulder), the pattern fails and the bullish thesis weakens. It’s like the comedian bombing on stage; the audience starts to leave, and the show is over. But let’s hope for the best and keep our fingers crossed! 🤞

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-22 17:52