The rise of institutional RWAs has escalated to a staggering $2 billion, propelled by stablecoins and network enhancements, all while DeFi takes a charming little nap.

Ah, dear reader, how the winds of fortune have blown through the hallowed halls of BNB Chain in the fourth quarter of 2025! Institutional capital has donned its finest attire and reshaped the very fabric of this digital realm, even as token prices fluttered like a delicate butterfly in a tempest. Real-world assets (RWAs) have flourished at an unprecedented pace, catapulting BNB Chain to the illustrious second position among blockchains by RWA value. Meanwhile, stablecoin supplies and infrastructure upgrades have fortified the network’s vital role in the grand masquerade of payments and trading.

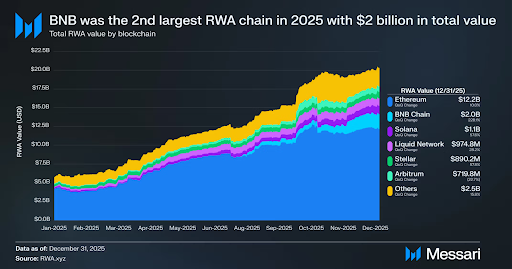

BNB Chain RWA Growth Hits $2B as Network Activity Climbs

According to the esteemed sages at Messari, BNB’s market cap took a slight dip of 15.3% quarter over quarter, landing at a still-impressive $118.9 billion by the end of Q4. An industry-wide liquidation event on October 11 served as a rather rude awakening for crypto enthusiasts. BNB had danced to a record high of $1,370 on October 13 before embarking on its steady descent back to reality.

Yet, lo and behold! Despite this minor setback, BNB gracefully finished the quarter as the third-largest cryptocurrency by market cap, trailing behind the ever-mighty Bitcoin and Ethereum. The report giddily noted that BNB experienced a veritable flourish of network activity during this tumultuous quarter.

Average daily transactions soared by 30.4%, rising to a delightful 17.3 million from a mere 13.3 million in the previous quarter. Daily active addresses waltzed up 13.3% to reach 2.6 million. The early October volatility, though a frightful affair, caused a brief spike in activity. Even when excluding that whimsical surge, usage remained well above Q3 levels, suggesting a steady parade of new users joining the BNB Chain extravaganza.

Image Source: Messari

In addition, the protocol witnessed a vigorous outbreak of tokenized real-world assets during Q4. The total RWA value skyrocketed to $2 billion-an exhilarating leap from Q3 and a far cry from the previous year. By quarter’s end, BNB Chain frolicked into the second spot in total RWA value, outpacing Solana while still trailing behind the ever-esteemed Ethereum.

Institutional Deals Push BNB Chain RWA Value

What, you may ask, sparked this remarkable expansion? The answer lies in the embrace of institutional partnerships. On October 10, BNB Chain joined forces with CMB International to launch a rather impressive $3.8 billion tokenized money market fund-one of the largest single RWA launches ever witnessed on a public blockchain stage.

Not long after, Ondo Global Markets sprinkled their magic by adding over 100 tokenized U.S. stocks and ETFs to BNB Chain, thereby expanding their offerings beyond the realm of money market funds and into the exciting world of equities. And let us not forget November 14, when BlackRock’s BUIDL fund, issued through the fine folks at Securitize, also opted for a delightful dalliance with BNB Chain.

However, it must be noted that the bulk of RWA values are cozying up in just a handful of products. USYC leads the pack with $1.4 billion, claiming over 70% of the total pie. BUIDL follows closely with approximately $503 million-or about a quarter of all RWA value. Other assets, including Matrixdock Gold and VanEck’s Treasury Fund, are merely sipping tea on the sidelines with much smaller amounts. Tokenized shares of Circle and Alphabet, meanwhile, contribute only a whisper to the overall discourse.

TVL Slides in Q4 While Stablecoins Record Steady Growth

Alas, DeFi activity chose to take a leisurely stroll during Q4, with total value locked sliding down by 15.2% to a respectable $6.6 billion from Q3 levels. Nevertheless, TVL remains comfortably above its stature from a year prior. Despite this little dip, BNB Chain retains its position as the third-largest network by total value locked.

Image Source: Messari

Our beloved PancakeSwap continues to reign supreme as the largest DeFi platform on the network, cradling $2.2 billion in TVL and commanding about one-third of the market. Its TVL has only dipped by a modest 1%, indicating that it has managed to retain most of its users and funds-a feat worthy of applause! Meanwhile, Lista DAO has elegantly descended to $1.5 billion after some vault liquidations pruned liquidity, while Venus Finance has slipped to $1.4 billion as borrowing demand took a quiet nap. Aster, poor thing, suffered the sharpest decline, plummeting to $598 million after earlier incentive-driven deposits were withdrawn. Smaller protocols like Aave and Avalon Labs also recorded declines, as traders prudently reduced risk across the market.

However, the silver lining is that stablecoin supply grew during the quarter, with the total stablecoin value on BNB Chain rising by 9.2% to $15.2 billion. Tether (USDT) remains the belle of the ball, reaching $9.0 billion after a delightful 12.4% increase. USD Coin (USDC) too enjoyed a robust growth spurt, now at $1.3 billion, bolstered by payment use and gas-fee discounts.

Stablecoin Payments Expand Through New Network Partnerships

New partnerships have sprouted like daisies, helping to expand the use of payments on BNB Chain. The Better Payment Network added support for various stablecoins to facilitate cross-border transfers on-chain, while AWS customers were soon allowed to pay for services using BNB through that delightful system.

Additionally, United Stables unveiled a charming new stablecoin, $U, on December 18, permitting users to mint the token using Tether (USDT), USD Coin (USDC), and USD1 as collateral.

Moreover, BNB Chain rolled out several upgrades in 2025, featuring Pascal, Lorentz, Maxwell, and the ongoing Fermi hard fork. These enhancements have rendered the network faster and more economical, with block times dipping from 3 seconds to a mere 0.45 seconds, while transaction finality improved to a delightful 1.1 seconds.

Image Source: Messari

Network capacity has more than doubled to a jaw-dropping 133 million gas per second, and gas fees have plummeted from 1 gwei to a mere 0.05 gwei. As we gaze into the crystal ball for 2026, the protocol’s aspirations focus on high-performance trading and stability. Target throughput stands at an ambitious 20,000 transactions per second with sub-second finality. The team also plans to seamlessly integrate off-chain computing with on-chain verification, ensuring a delightful flow of transactions without the risk of performance degradation. Fear not, for in the long run, BNB Chain is crafting a trading-focused chain designed for near-instant confirmation-a digital utopia awaits!

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Gold Rate Forecast

- Star Wars Fans Should Have “Total Faith” In Tradition-Breaking 2027 Movie, Says Star

- KAS PREDICTION. KAS cryptocurrency

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Christopher Nolan’s Highest-Grossing Movies, Ranked by Box Office Earnings

- Jujutsu Kaisen Season 3 Episode 8 Release Date, Time, Where to Watch

- Jason Statham’s Action Movie Flop Becomes Instant Netflix Hit In The United States

- Jessie Buckley unveils new blonde bombshell look for latest shoot with W Magazine as she reveals Hamnet role has made her ‘braver’

- How to watch Marty Supreme right now – is Marty Supreme streaming?

2026-02-12 11:37