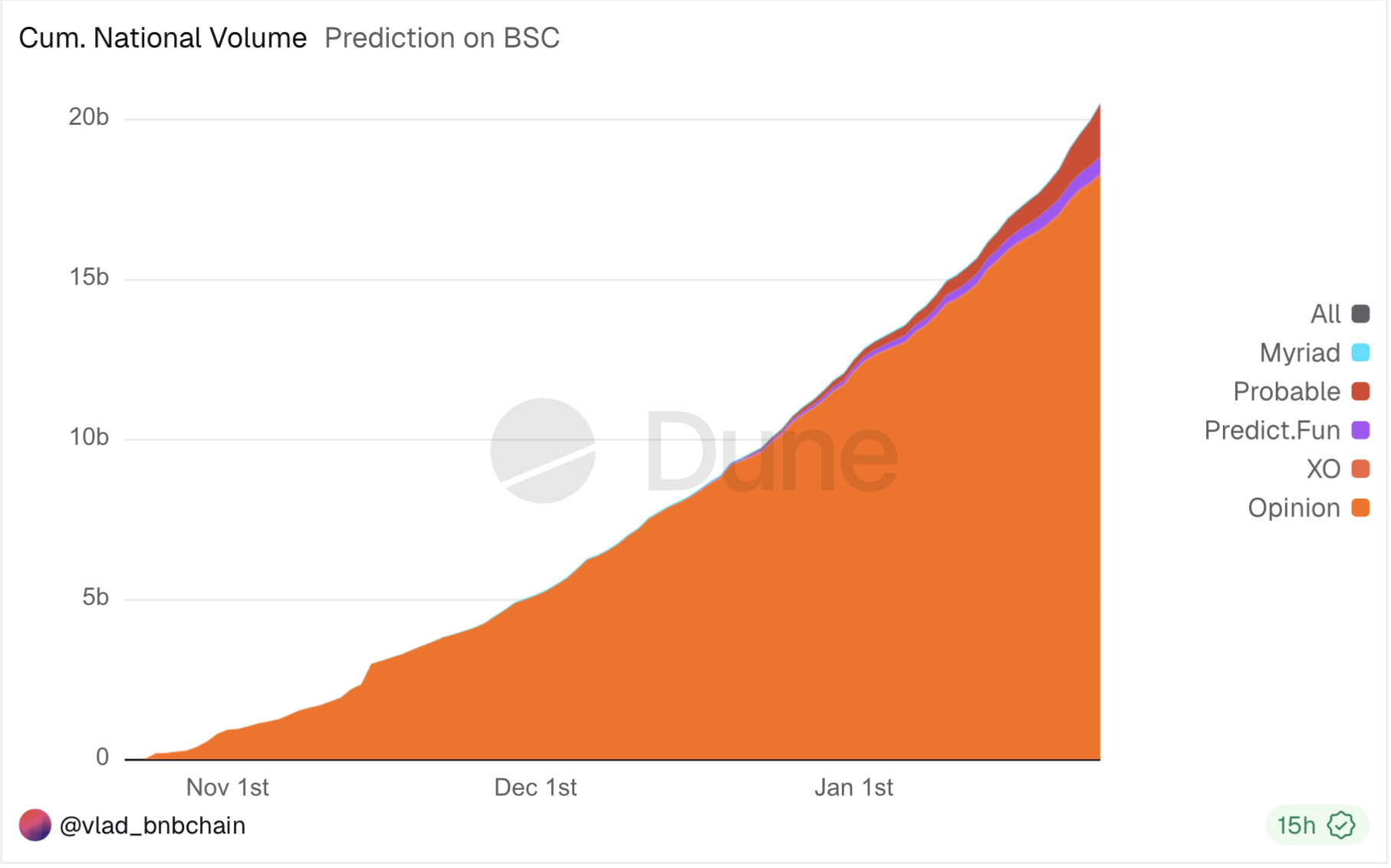

Well, bless my soul! If it ain’t the BNB Chain, strutting its stuff like a rooster in a henhouse. Over the past few months, these prediction markets have boomed like popcorn in a hot skillet, with trading volumes ballooning to astonishing heights. I reckon they’ve crossed the $20 billion mark-yes, you heard right, folks-like a runaway mule!

BNB Chain’s Prediction Markets Go Bananas

Just the other day on Monday, BNB Chain spilled the beans that their prediction markets hit a new high, topping a staggering $20.91 billion in cumulative trading over the weekend. I tell ya, that’s more dough than a baker sees on pie day!

This chain has been expanding its horizons faster than a jackrabbit on a date, bringing in big players like Opinion Labs and Probable, not to mention a few others that sound like they sprouted from a top hat. If that ain’t diversifying, I don’t know what is!

According to the fine folks at BNB Chain, these prediction markets are akin to crystal balls for forecasting events and managing risks on a grand scale. They say these tools can help folks make smarter decisions in finance and governance-a claim that’s as ambitious as a cat trying to catch a laser pointer!

From political elections to sports games, and even the latest happenings in the world of AI, these markets are turning all sorts of scattered knowledge into something resembling wisdom. Just take a gander at Polymarket, which raked in over $2 billion in volume last October-now that’s what I call a successful gamble!

According to the Dune data (a name that sounds suspiciously like a desert), these prediction markets within the ecosystem have surged by nearly 89% in the last month alone. It appears that BNB Chain has taken the lead in weekly trading volume, leaving competitors like Polygon and Solana in the dust since the dawn of 2026.

On top of that, DeFiLlama’s intel suggests three platforms in the BNB universe have made it into the top five prediction markets-just behind Kalshi and Polymarket, proving that folks are hopping on this bandwagon faster than a squirrel on a power line.

Opinion Labs is sitting pretty at third place, boasting trading volumes of $725.56 million in just a week and over $3.35 billion in the last thirty days. Meanwhile, the open interest has shot past $144 million-who would have thought betting could pay off so handsomely?

Probable, meanwhile, has seen $558 million in volume over the past week and $1.05 billion in the last month. That’s some serious moolah for a platform that only just rolled out the welcome mat a month ago!

ETF Buzz and Price Bouncing Back

Now, here’s where it gets interesting: this milestone comes as some heavyweight institutional players show interest in the BNB token. Just last week, Grayscale filed an S-1 form with the SEC to launch a spot Exchange-Traded Fund (ETF) based on our friend BNB.

If the bureaucratic gods grant approval, the Grayscale BNB Trust (GBNB) will reflect the value of BNB as held by the Trust. That means investors might get to dip their toes in the water without actually having to hold the slippery fish in their own hands.

As we speak, BNB’s price is making a comeback from a little hiccup it had on Sunday, trying to turn a key spot back into a cozy home base. Market watcher Rose Premium Signals pointed out that BNB bounced back from a robust demand zone-$860, to be precise-like a catapulted frog!

Moreover, it held its ground in the key Fibonacci retracement area, which, according to the analysts, bumps up the chances of a bullish reaction. If this altcoin can reclaim the $900 territory as its fortress, we might just see a revisit to those lofty targets of $937 and $980. Now wouldn’t that be a sight for sore eyes!

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Overwatch Domina counters

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- 1xBet declared bankrupt in Dutch court

- Clash of Clans March 2026 update is bringing a new Hero, Village Helper, major changes to Gold Pass, and more

- Gold Rate Forecast

2026-01-27 23:50