Well, look who’s been busy in the crypto playground! BlackRock’s fund, the one that’s got its eyes glued to the top cryptocurrency, has just done the unthinkable. It’s surpassed Strategy’s holdings and is now second in the world for Bitcoin reserves. Who’s number one, you ask? Only a mysterious figure named Satoshi Nakamoto, of course.

It’s a big deal, sure, but let’s not throw confetti just yet. Centralization was *never* supposed to be the plan for crypto. I mean, that whole “decentralized revolution” thing? Yeah, remember that?

History, or Just Another Day in Crypto?

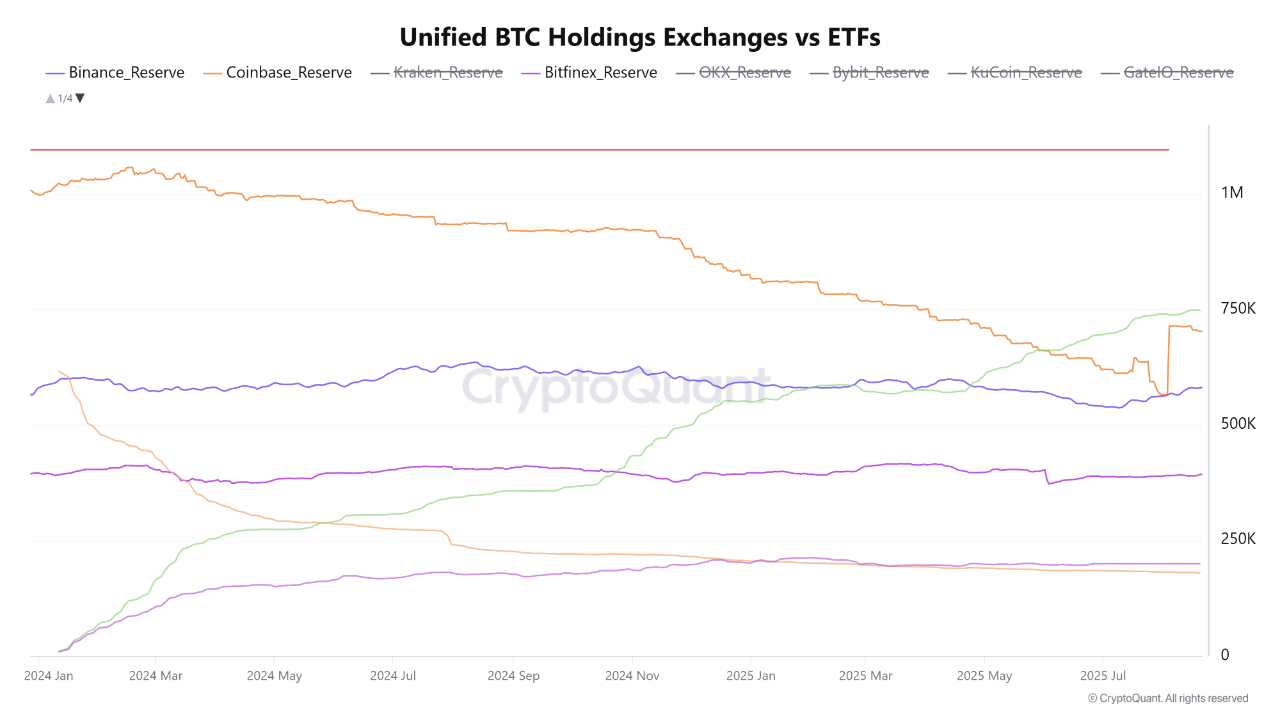

According to the ever-reliable on-chain analysis platform CryptoQuant, BlackRock’s iShares Bitcoin Trust (IBIT) ETF is really making waves. Launched just last January, this fund has amassed a jaw-dropping 781,000 bitcoins. That’s over $88 billion if you’re keeping score at home. 🤑

The ETF has been leading the charge since May 2025, when it passed Coinbase’s holdings. By August, BlackRock had solidified its spot as the largest known Bitcoin holder, only Satoshi’s wallet stands in its way. 😎

The fund’s lead is undeniable, leaving Coinbase and Binance trailing behind. Coinbase owns 703,000 bitcoins, and Binance? They’ve got 558,000. Pfft, amateurs.

BlackRock has even overtaken Strategy’s massive Bitcoin stash. That’s right, a company that spent five years accumulating Bitcoin is now second fiddle to BlackRock, which did it in a mere year and a half. 🚀

What Does This All Mean?

In case you missed it, things are changing. No longer are we just talking about retail exchanges and hobbyist investors. The big boys are coming. Institutions are flocking to regulated financial products like IBIT, which is just pumping out Bitcoin like there’s no tomorrow.

This has created a massive supply shock, as the ETF is basically hoarding Bitcoin, taking it off the market while exchanges keep trading. So, as fewer and fewer bitcoins are available, the price is, predictably, looking pretty darn solid. 💰

Meanwhile, traditional investors are finding themselves more comfortable with these compliant, institutional funds. The usual crypto exchanges? Well, they’re no longer the go-to for holding assets, as the demand for institutional-grade products increases.

Now, for all you crypto purists out there, here’s the kicker: while this marks a new chapter for Bitcoin, it’s a chapter that’s veering away from everything it was supposed to stand for. Will this shift affect the future? Who knows. We’ll just have to sit back, popcorn in hand, and see where it all goes. 🍿

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-08-22 21:26