If Arthur Dent ever woke up on a Thursday and wondered what all the fuss was about on planet Earth, he’d probably be as puzzled by crypto ETFs as he was by digital watches — except, these ones come with numbers so big you need a towel just to dry your forehead after reading them. So, get ready to hitchhike through the galaxy of finance where Blackrock is waving around wads of cash and the rest are struggling to keep their towels dry. 🚀🦑

Bitcoin ETFs Have a 7-Day Inflow Streak (Presumably for the Exercise)

Bitcoin ETFs, never ones to shy away from drama, extended their streak of “look at me, I can still attract money!” for seven solid days, defying the sort of outflow that would send most mutual funds sobbing to their auditors. Just another Tuesday in 2025 — if you’re a carbon-based life form who fancies neural synapses, you should probably sit down.

Blackrock — a galactic entity reportedly run by Vogons — parked an astonishing $639.19 million into its IBIT fund, singlehandedly counter-balancing what Fidelity and Ark 21shares yanked out. Fidelity’s FBTC tried a sneaky $208.46 million exit stage left, while Ark’s ARKB was only marginally less dramatic, misplacing $191.40 million along the way. But Blackrock, like a determined interstellar barista, kept topping everyone’s cup whether they liked it or not.

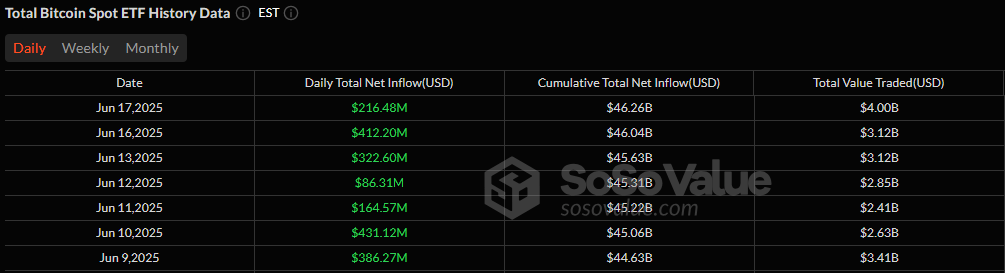

Even Bitwise’s BITB, in a clear bid for attention, flung $22.84 million out the airlock, but the universe kept its balance: the day closed with an epic $216.48 million net inflow. Overall trading swelled to a gravitational $4 billion — enough zeros to make Zaphod Beeblebrox jealous. Bitcoin ETF net assets now cling stubbornly to $128.18 billion, which is probably enough to buy decent tea, even in deep space.

Ether ETFs wanted in on the cosmic excitement, too. Here, Fidelity’s FETH had a $20.22 million wobble and Grayscale’s ETHE took a $9.02 million joyride out the window. But Blackrock’s ETHA, not to be upstaged, hoovered up $36.71 million in new loot, while Bitwise’s BITB scraped up a polite $3.62 million (every little bit counts on Betelgeuse). All told, Ether ETFs managed an $11.09 million net inflow, and trading hit $528.36 million — enough to keep even Marvin the Paranoid Android half-interested. Total net assets: $10.05 billion, in case you were counting in Triganic Pu’s.

Despite all these ups and downs — and sideways, and possibly through a small black hole — the market remains in “accumulation mode,” a very technical term meaning humans are still throwing money at crypto in ways that would make a Babel fish frown. Or smile. It’s really hard to tell with Babel fish.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-06-18 21:29